Bitcoin Pullback to $66K Triggers $250M in Crypto Liquidations as Traders Brace for 'Wild Wednesday' of FOMC, CPI Report

Cryptocurrencies tumbled deeper into correction on Tuesday with bitcoin {{BTC}} dipping to near $66,000 as traders brace for Wednesday's key U.S. inflation report and Federal Reserve meeting.

Bitcoin {{BTC}} started the day trading near $70,000 before hitting a three-week low price at $66,170 during the U.S. session. It slightly rebounded to near $66,500, but was still down nearly 5% over the past 24 hours.

Altcoins saw even deeper pullbacks during the same period, with the broad-market crypto market benchmark CoinDesk 20 Index declining over 6% with all twenty constituents being in the red. Ethereum's ether {{ETH}} broke below $3,500 and was down 6.5%, while solana {{SOL}}, dogecoin {{DOGE}}, Cardano's ADA and Chainlink's LINK endured 6%-9% losses.

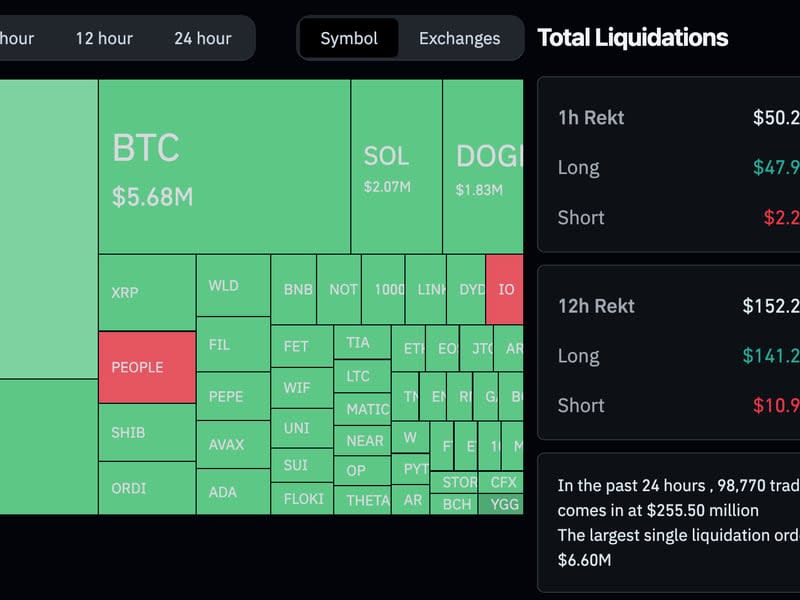

The sudden pullback incurred over $250 million in liquidations of leveraged derivatives trading positions across all crypto assets, CoinGlass data shows, marking the second significant leverage flush in a week after Friday's $400 million liquidations.

Liquidations occur when an exchange closes a leveraged position due to a partial or total loss of the trader’s initial money down, or "margin," because the user fails to meet the margin requirements or doesn't have enough funds to keep the position open.

One reason behind the pullback is investors “de-risking” from crypto assets ahead of tomorrow's May Consumer Price Index (CPI) report and Fed meeting, hedge fund QCP said in an update.

Bitcoin could see a volatile session Wednesday as it has been "highly responsive" to economic data recently and its 30-day correlation with U.S. equities climbing to highest since 2022, K33 Research noted in a Tuesday market update.

"The stage is set for a frantic macro-Wednesday, with both May CPI data and the FEDs interest rate decision poised to move the market," K33 analysts said.

Investors will monitor the Federal Open Market Committee (FOMC) members' interest rate outlook – so-called "dot plot" – to see how many rate cuts policymakers are projecting for this year in light of recent sticky inflation readings and softer economic data.

"The FOMC dot plot, alongside forward guidance during Jerome Powell’s press conference, is likely to be the most material price movers, as BTC has resumed its attentiveness to the market's interest rate expectations."

Market observers noted some positive signs during the sell-off that could point to a quick recovery.

Bitcoin saw multiple pullbacks this year before FOMC meetings only to reverse the move soon after, pseudonymous crypto analyst Gumshoe pointed out in an X post.

this is a scam dump.

there have been 4 FOMC's in 2024

every single one of them had the same scam dump

BTC dumped 10% in the 48 hours before all of them

on FOMC day it recovered the entire move

the market always prices in overly bearish statements, then reverses pic.twitter.com/oFa801csND— gumshoe (@0xGumshoe) June 11, 2024

Bitcoin futures open interest on crypto exchanges BitMEX and Binance deviated earlier today, crypto analytics platform CryptoQuant posted citing pseudonymous trader BQYoutube. "Often this kind of phenomenon is seen when whales [on] BitMEX start to accumulate positions while Binance retail gets washed out,” the post added.

"Despite short-term headwinds, we think this might be a good opportunity to accumulate coin," QCP said.

Yahoo Finance

Yahoo Finance