Bitcoin Finds Support When It’s Needed The Most

Bitcoin fell by 1.88% on Friday, reversing Thursday’s trend bucking 1.29% gain, to end the day at $7,332.8, leaving Bitcoin up 15.5% for the current week, well ahead of its closest rivals.

While the boarder market was experiencing a reversal through the morning, Bitcoin managed to move within relatively tight ranges, with a morning low $7,341.3 and morning high $7,518.2 steering clear of the first major support level at $7,317.33 and first major resistance level at $7,595.93.

A spike to an intraday high and new swing hi $7,685.2 saw Bitcoin break through the first major resistance level before sliding through the first major support level at $7,317.33 to a late in the day intraday low $7,273.1 before recovering to $7,300 levels by the day’s end.

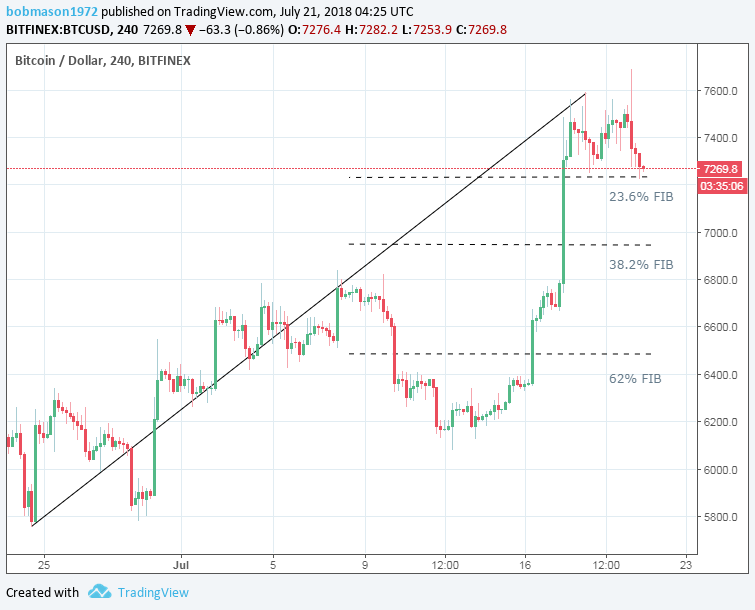

Breaking back through the first major support level was key late in the day, with Bitcoin managing to avoid testing support at the 23.6% FIB Retracement Level of $7,230 to leave the near-term bullish trend intact going into the weekend.

While Bitcoin succumbed to the selling pressure seen across the broader market, bucking the trend, Bitcoin managed to form a near-term bullish trend earlier in the week following a break through to $7,000 levels and has managed to avoid a full reversal to sub-$7,000 levels, which should provide some comfort to the Bitcoin bulls.

Bitcoin has seen its dominance on the rise since a dip in May, supporting the trend bucking moves of late, with some divergence amongst the major cryptocurrencies beginning to form as the market continues to evolve, which can only be a good thing.

Holding above the 23.6% FIB Retracement Level of $7,230 will be key for Bitcoin through the weekend, any pullback likely to test investor resolve, which could ultimately see Bitcoin catch up to the rest of the pack should the negative sentiment persist across the broader market.

Get Into Cryptocurrency Trading Today

At the time of writing, Bitcoin was down 0.86% to $7,269.8, with Bitcoin sliding to a morning low $7,221, to call on support at the 23.6% FIB Retracement Level of $7,230 before a partial recovery, the morning’s $7,333.2 high, struck at the start of the day, falling short of the first major resistance level at $7,587.63.

For the day ahead, a move through $7,430.37 would support a resumption of the bull-run to bring $7,500 levels and the day’s first major resistance level at $7,587.63 into play, while we would expect Bitcoin to fall short of $7,600 levels and Friday’s new swing hi $7,685.2.

Failure to recover the morning’s losses and move through to $7,400 levels could see Bitcoin take a bigger hit later in the day, with the day’s first major support level at $7,175.53 in play should Bitcoin slide through the 23.6% FIB Retracement Level of $7,230 that has provided the much needed support while the broader market went into reverse.

Buy & Sell Cryptocurrency Instantly

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance