Biotech Stock Roundup: MRTX Falls on Study Failure, LXRX Drug Wins Approval & More

The biotech sector has been in focus in the past week with key pipeline and regulatory updates. Among these, Mirati Therapeutics, Inc. MRTX was down on failure of a late-stage study. Meanwhile, Bristol Myers Squibb BMY provided some updates.

Recap of the Week’s Most Important Stories:

MRTX Down on Study Failure: Shares of commercial-stage oncology company Mirati were down after the company announced that the late-stage SAPPHIRE study did not meet its primary endpoint of overall survival at the final analysis. This phase III study was evaluating sitravatinib in combination with Opdivo (nivolumab) versus docetaxel in patients with second or third-line advanced non-squamous non-small cell lung cancer (NSQ-NSCLC) who progressed on prior therapy with chemotherapy and immune checkpoint inhibitor therapy.

Mirati plans to disclose the study data at a future date. The results disappointed investors as the company currently has only one marketed drug in its portfolio, Krazati (adagrasib), which was approved by the FDA in December 2022 to treat adult patients with KRASG12C-mutated locally advanced or metastatic NSCLC.

Updates From BMY: Bristol Myers announced that the FDA accepted the new drug application (NDA) for repotrectinib. The NDA is seeking approval for this next-generation tyrosine kinase inhibitor (TKI) to treat patients with ROS1-positive locally advanced or metastatic non-small cell lung cancer (NSCLC). The regulatory body has granted Priority Review to the application and assigned a target action date of Nov 27, 2023.

Last week, Bristol Myers announced that pipeline candidate milvexian has been granted Fast Track Designation by the FDA for all three prospective indications. Milvexian is an investigational oral factor XIa (FXIa) inhibitor (antithrombotic) being studied for the prevention and treatment of major thrombotic conditions as part of the Librexia program in collaboration with Janssen Pharmaceuticals, Inc., one of the Janssen Pharmaceutical Companies of Johnson and Johnson. The Fast Track Designation covers all three indication-seeking studies within the phase III Librexia development program (Librexia STROKE, Librexia ACS and Librexia AF), which are all currently dosing patients.

Bristol-Myers currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lexicon’s Drug Approval: Lexicon Pharmaceuticals, Inc. LXRX announced that the FDA has approved sotagliflozin, a once-daily oral tablet to reduce the risk of cardiovascular death, hospitalization for heart failure and urgent heart failure visit in adults with heart failure or type 2 diabetes mellitus, chronic kidney disease and other cardiovasclar risk factors. The drug has been approved under the brand name Inpefa. The approval boosts Lexicon’s growth prospects.

The drug was granted a broad label across a full range of left ventricular ejection fraction, including heart failure with preserved ejection fraction and heart failure with reduced ejection fraction, and for patients with or without diabetes. The approval is based on two randomized, double-blind, placebo-controlled phase III cardiovascular outcomes studies of Inpefa in patients with or at risk of heart failure. Inpefa reduced the risk of total occurrence of cardiovascular death, hospitalization for heart failure and urgent heart failure visits by 33% compared to placebo in the SOLOIST-WHF study

Iovance Up on Regulatory Update: Iovance Biotherapeutics, Inc. IOVA announced that the FDA accepted its biologics license application (BLA) for lifileucel for patients with advanced melanoma. The FDA granted Priority Review to the BLA and assigned a target action date of Nov 25, 2023. Shares of IOVA were up on the same. The FDA is not currently planning to hold an advisory committee meeting to discuss this application and, after a preliminary review, has not at this time identified any potential review issues.

The BLA submission is supported by positive data from the C-144-01 clinical trial in patients with advanced melanoma who progressed on or after prior anti-PD-1/L1 therapy and targeted therapy, where applicable. Assuming lifileucel receives accelerated approval, the randomized phase III TILVANCE-301 study in frontline advanced melanoma can serve as the confirmatory study to support full approval.

Performance

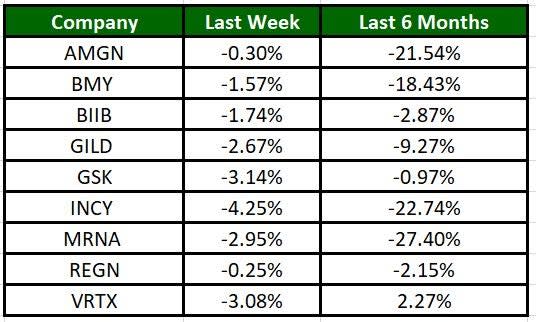

The Nasdaq Biotechnology Index has lost 2.08% in the past four trading sessions. Among the biotech giants, Incyte has lost 4.25% during the period. Over the past six months, shares of MRNA have declined 27.40%. (See the last biotech stock roundup here: Biotech Stock Roundup: IRWD Announces Buyout, ICPT, SRPT & PTCT Fall on Updates )

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for more earnings and pipeline updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Lexicon Pharmaceuticals, Inc. (LXRX) : Free Stock Analysis Report

Mirati Therapeutics, Inc. (MRTX) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance