Biomea (BMEA) Doses First Patient in Leukemia Study, Stock Up

Biomea Fusion, Inc. BMEA, a clinical-stage company, announced dosing the first patient in its early-stage study of BMF-500 in the treatment of adult patients with relapsed or refractory acute leukemia.

BMF-500 is the company’s investigational covalent FLT3 inhibitor developed using the proprietary FUSION System.

The phase I COVALENT-103 study is evaluating the safety and efficacy of twice-daily oral BMF-500 as a monotherapy in adult patients with relapsed or refractory acute leukemia with FLT3 wild-type and FLT3 mutations.

Biomea’s stock climbed 6.7% on Tuesday, in response to the encouraging news. Year to date, shares of BMEA have gained 35.6% against the industry’s 18.4% fall.

Image Source: Zacks Investment Research

The company also reported that the preclinical studies of BMF-500 have previously demonstrated promising activity against all known FLT3 activating and resistance-conferring mutations.

Per management, there are several late-stage and approved therapies targeting FLT3 mutations at present. However, most patients with acute leukemia harboring FLT3 mutations have not achieved durable remissions upon treatment with these available therapy options. This represents a significant unmet medical need.

Management believes that BMF-500 has the potential to fully extinguish FLT3-driven diseases and can combine with other targeted therapies and standard-of-care agents.

Apart from BMF-500, Biomea has another clinical-stage candidate, BMF-219, which is also being developed leveraging the company’s proprietary FUSION System. BMF-291 is an orally bioavailable, potent and selective covalent inhibitor of menin.

BMF-219 is currently being evaluated in several different early-stage studies in the treatment of solid tumors (COVALENT-102), liquid tumors (COVALENT-101) and type II diabetes (COVALENT-111).

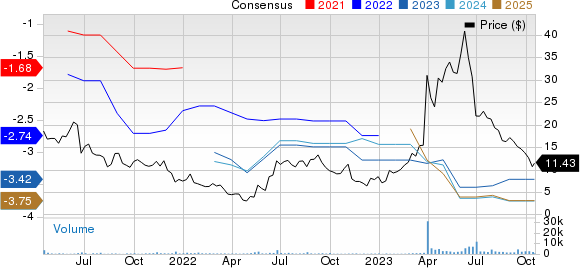

Biomea Fusion, Inc. Price and Consensus

Biomea Fusion, Inc. price-consensus-chart | Biomea Fusion, Inc. Quote

Zacks Rank and Stocks to Consider

Biomea currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same industry are Dynavax Technologies DVAX, Anixa Biosciences ANIX and Adicet Bio, Inc. ACET. DVAX sports a Zacks Rank #1 (Strong Buy), and ANIX and ACET carry a Zacks Rank #2 (Buy) each at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Dynavax’s 2023 loss per share has narrowed from 24 cents to 22 cents. The estimate for Dynavax’s 2024 earnings per share is currently pegged at 8 cents. Year to date, shares of DVAX have gained 35.5%.

DVAX’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 25.78%.

In the past 30 days, the Zacks Consensus Estimate for Anixa Biosciences’ 2023 loss per share has narrowed from 33 cents to 32 cents. The estimate for Anixa Biosciences’ 2024 loss per share has narrowed from 38 cents to 37 cents. Year to date, shares of ANIX have lost 19.3%.

ANIX beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 26.29%.

In the past 30 days, the estimate for Adicet Bio’s 2023 loss per share has remained constant at $2.93. The estimate for Adicet’s 2024 loss per share has remained constant at $2.40. In the past year, shares of ACET have decreased by 83.2%.

ACET’s earnings beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 7.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Adicet Bio, Inc. (ACET) : Free Stock Analysis Report

ANIXA BIOSCIENCES INC (ANIX) : Free Stock Analysis Report

Biomea Fusion, Inc. (BMEA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance