Biohaven (BHVN) Stock up 8% on Encouraging Pipeline Updates

Shares of Biohaven Ltd BHVN were up 7.6% on May 31, after it provided an overview of clinical progress and regulatory updates on the company’s pipeline candidates at its R&D Day.

As part of its regulatory updates, Biohaven announced that it submitted a new drug application (“NDA”) in second-quarter 2023 for troriluzole, one of its most advanced pipeline candidates. The NDA seeks approval for troriluzole to treat spinocerebellar ataxia type 3 (“SCA3”), an ultra-rare neurodegenerative disease associated with progressive disability.

This NDA is supported by data from a phase III study (BHV4157-206) wherein treatment with troriluzole demonstrated benefits across multiple outcome measures in study participants. Troriluzole has also been granted fast track and orphan drug designations by the FDA in SCA indication. The candidate is also being developed in two late-stage studies for obsessive-compulsive disorder (“OCD”).

The company also announced that it expects to complete enrolment in the global phase III study evaluating taldefgrobep alfa, another candidate, in spinal muscular atrophy (“SMA”) by this year’s end. Management also intends to start a phase II study later this year to evaluate this drug in metabolic disorders.

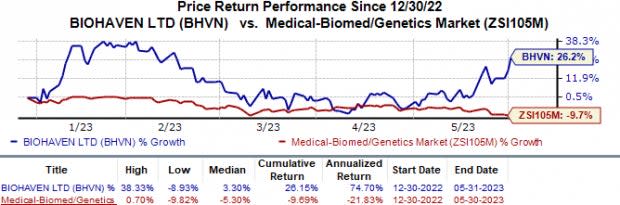

In the year so far, shares of Biohaven have increased 26.2% against the industry’s 9.7% fall.

Biohaven also announced several clinical updates on its pre-clinical/early-stage pipeline candidates. It stated that it has advanced BHV-8000, a TYK-1/JAK1 inhibitor for treating brain disorders, to clinical development. Management recently initiated a phase I study to evaluate BHV-8000 in healthy volunteers. The candidate was acquired in March 2023 from China-based Hangzhou Highlightll Pharmaceutical Co. Ltd.

The firm also revealed its plans to start the phase I EEG study to evaluate BHV-7000, a Kv7.2/3 activator in first-half 2023. Management intends to start pivotal clinical studies evaluating the candidate in focal epilepsy and bipolar disorder indications by this year’s end.

Alongside the above updates, BHVN plans to submit investigational new drug (IND) applications to the FDA to start clinical studies on multiple pipeline candidates. This includes BHV-1300, a novel IgG degrader, whose IND application is on track for submission later this year.

Currently, Biohaven has no marketed drugs in its portfolio and is dependent on its pipeline for growth. The company is a new publicly traded company, which has retained the non-calcitonin gene-related peptide (CGRP) development stage pipeline compounds of legacy Biohaven.

Last year, the company turned to a new direction after it announced that its CGRP business was acquired by Pfizer PFE for $148.50 per share or an aggregate equity value of $11.6 billion. Following this acquisition, the newly-incorporated Biohaven has been focused on advancing its non-CGRP pipeline compounds targeting neurological and neuropsychiatric diseases like SMA, SCA and OCD. The acquisition also resulted in Pfizer adding legacy Biohaven’s sole marketed drug Nurtec ODT to its product portfolio. Pfizer also added Biohaven’s other CGRP programs, including zavegepant nasal spray to its product portfolio. Zavegepant received FDA approval in March for the acute treatment of migraine. Pfizer is marketing this spray under the brand name Zavzpret.

Image Source: Zacks Investment Research

Zacks Rank & Stock to Consider

Biohaven currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector are Arbutus Biopharma ABUS and Ligand Pharmaceuticals LGND. While Ligand Pharmaceuticals sports a Zacks Rank #1 (Strong Buy) at present, Arbutus Biopharma carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the estimate for Ligand’s 2023 earnings per share has increased from $4.16 to $5.25. During the same period, the earnings estimate per share for 2024 has increased from $4.58 to $4.69. In the year so far, the shares of Ligand have risen 4.9%.

Ligand Pharmaceuticals beat earnings estimates in two of the last four quarters, while missing the mark on the other two occasions. On average, the company’s earnings witnessed an earnings surprise of 21.50%. In the last reported quarter, LGND delivered an earnings surprise of 121.36%.

In the past 30 days, estimates for Arbutus Biopharma’s 2023 loss per share have improved from 57 cents to 44 cents. During the same period, the loss estimates per share for 2024 have narrowed from 61 cents to 53 cents. Shares of Arbutus Biopharma are up 6.9% in the year-to-date period.

Earnings of Arbutus Biopharma beat estimates in two of the last four quarters while meeting the mark twice. On average, the company’s earnings witnessed a surprise of 12.91%. In the last reported quarter, Arbutus Biopharma’searnings beat estimates by 28.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Arbutus Biopharma Corporation (ABUS) : Free Stock Analysis Report

Biohaven Ltd. (BHVN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance