Meet the stock market's winners & losers under president-elect Trump

“President Trump” has transformed the markets—literally overnight—and investment themes that will likely dominate for several months are already apparent. Here are the expected winners and losers.

The S&P 500 (^GSPC) notched a 3.8% gain alst week, defying nearly all expectations of a severe market selloff following Trump’s election victory. But underneath the market’s hood, trillions of dollars are being shifted from projected losers to expected winners. Investors are taking note.

Rarely does this type of money reallocation, or sector rotation, occur so abruptly when the long-term trend is already bullish. Typically, these thematic changes happen after a steep and protracted market correction—and only become apparent weeks after the actual market bottom.

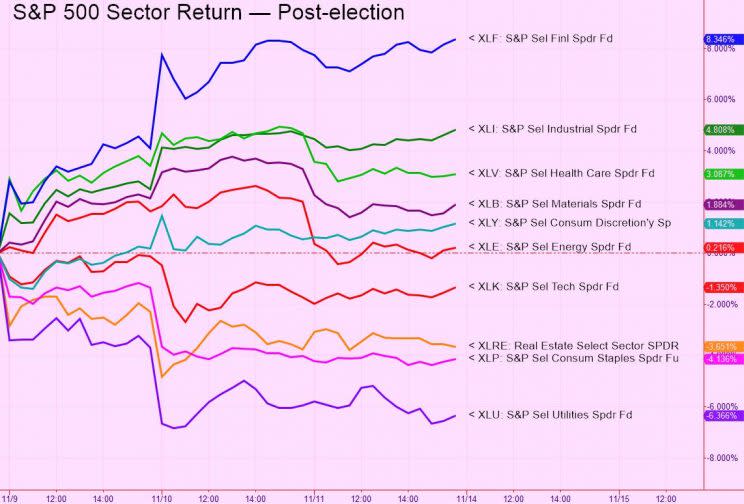

Here is how the major S&P 500 sectors have fared since Tuesday’s market close on election day.

Big banks are leading

The financial sector (XLF) is the clear winner. The top gainers among large cap stocks are dominated by the big banks based on two assumptions. First, Trump has made waves about rolling back Dodd-Frank, which, de facto, makes banks more interesting again instead of boring (how this is reconciled with claims to reinstate Glass-Steagall is yet to be determined).

Second, the bond market is signalling both economic growth and price inflation ahead, which bodes well for the traditional bank model of borrowing low and lending high, while minimizing defaults. (Plus, Senator Elizabeth Warren will be “contained.”)

Rebuilding roads and bridges-to-somewhere

Second up are the industrials (XLI) — and to a slightly lesser extent, materials (XLB). Trump promises massive infrastructure spending. This is exactly the type of fiscal stimulus the IMF, World Bank, other NGOs, and the Federal Reserve itself have been pleading over the last two years for developed nations to deliver. They’ve given up on monetary policy and are pleading for help on the fiscal side. Regardless of whether or not you agree with this, construction and engineering are banking on this news.

The witch hunt in pharmaceuticals is over

At least, that’s what the market is pricing in. Big Pharma has been hammered over fears that its business model would be functionally eviscerated by another Clinton presidency. This is a typical junk-off-the-bottom rally. That which had been sold the most this year is rebounding—not unlike the big bank stocks in mid-2009.

Non-pharma biotech already had a nice growth story and is poised to ride the coattails of the sector strength.

Energy is not so much Trump-driven

Whatever you think about the veracity of any OPEC claim, it’s still driving the energy sector (XLE), as are the weekly supply and demand estimates. Trump’s anti-globalization rhetoric tends not to cross hairs with oil and gas. That might be in part because the US has become a net exporter of crude oil. Energy names at the bottom of the list tend to suffer from idiosyncratic risk.

Nevertheless—on a very rough basis—oil above $50 a barrel is constructive for energy names, while oil below $40 becomes a severe problem.

Trump’s war on tech

It might not be an all-out “war,” but Trump has been openly hostile toward the sector (XLK), calling its recent stock price ascendancy a “bubble.” He’s called out Apple (AAPL) and Amazon (AMZN) by name and is openly against the H-1B visa program that Silicon Valley relies on.

Some of the big cap names like Apple, Microsoft (MSFT), Cisco (CSCO) and Alphabet (GOOGL) would benefit enormously from a cash repatriation tax holiday. But nonetheless, tech remains underwater post-election.

Real Estate

This is an interest rate play, pure and simple. Mortgage rates are going up, and REITs (XLRE) are going down.

Why is Coca-Cola down?

…and Kraft Heinz (KHC), Colgate-Palmolive (CL) and Pepsico (PEP)?

Investors are not expecting big, international consumer staples (XLP) to benefit from Trump’s anti-globalization plans, which threatens extant trade agreements. In addition, these dividend darlings are not as attractive when the US 10-year Treasury yield (^TNX) is quickly approaching the S&P 500 dividend yield of 2.15%.

Mark this on your calendar: The search for yield is officially over.

Utilities

Risk on.

The much-anticipated stock-by-stock ranking

Here’s how the largest 100 US public companies by market capitalization have performed—from Tuesday, just before the votes were counted, to the close Friday afternoon.

Rank | Ticker | Company | Sector | Return since election | Return year-to-date |

|---|---|---|---|---|---|

1 | Wells Fargo | Financial | 13.57% | -4.86% | |

2 | Morgan Stanley | Financial | 12.84% | 20.97% | |

3 | Metlife Inc | Financial | 12.13% | 11.37% | |

4 | Goldman Sachs Grp | Financial | 12.10% | 13.16% | |

5 | Bank of America Corporation | Financial | 11.88% | 13.01% | |

6 | Celgene Corp | Healthcare | 10.14% | -0.26% | |

7 | Caterpillar Inc | Capital Goods | 9.84% | 36.86% | |

8 | PNC Finl Svcs Grp | Financial | 9.60% | 11.13% | |

9 | General Dynamics Corp | Capital Goods | 9.60% | 22.71% | |

10 | JPMorgan Chase & Co | Financial | 9.51% | 16.14% | |

11 | Pfizer Inc | Healthcare | 8.63% | 0.96% | |

12 | Lockheed Martin Corp | Capital Goods | 8.35% | 19.35% | |

13 | Biogen Inc | Healthcare | 8.05% | 4.26% | |

14 | Amgen Inc | Healthcare | 7.65% | -8.19% | |

15 | AbbVie Inc | Healthcare | 7.29% | 6.52% | |

16 | General Motors Co | Consumer Cyclical | 7.22% | 0.03% | |

17 | Union Pacific Corp | Transportation | 6.90% | 23.85% | |

18 | US Bancorp | Financial | 6.49% | 12.26% | |

19 | Bank of New York Mellon Corp | Financial | 6.49% | 13.37% | |

20 | Amer Intl Grp | Financial | 6.42% | 2.18% | |

21 | Comcast Cl A | Services | 6.30% | 17.77% | |

22 | Bristol-Myers SQUIBB | Healthcare | 6.04% | -18.05% | |

23 | Allergan plc | Healthcare | 6.01% | -33.58% | |

24 | Citigrp Inc | Financial | 5.83% | 2.07% | |

25 | Merck & Co | Healthcare | 5.69% | 21.07% | |

26 | United Technologies | Capital Goods | 5.30% | 13.30% | |

27 | American Express Co | Financial | 5.11% | 1.37% | |

28 | Blackrock Inc’A’ | Financial | 5.01% | 9.01% | |

29 | Lilly (Eli) | Healthcare | 4.93% | -7.82% | |

30 | Home Depot Inc | Services | 4.51% | -1.81% | |

31 | Boeing Co | Capital Goods | 4.44% | 2.72% | |

32 | Lowe’s Cos | Services | 4.39% | -8.29% | |

33 | General Electric Co | Capital Goods | 4.38% | -1.41% | |

34 | Intl Business Machines Corp | Technology | 3.93% | 17.19% | |

35 | Charter Communications Inc | Services | 3.90% | 48.83% | |

36 | Disney (Walt) Co | Services | 3.50% | -7.04% | |

37 | Gilead Sciences | Healthcare | 3.24% | -24.46% | |

38 | TJX Companies | Services | 2.95% | 6.32% | |

39 | Danaher Corp | Technology | 2.55% | 14.97% | |

40 | UnitedHealth Grp Inc | Financial | 2.46% | 24.46% | |

41 | Honeywell Intl | Capital Goods | 2.38% | 9.97% | |

42 | 3M Co | Capital Goods | 2.37% | 16.22% | |

43 | Costco Wholesale Corp | Services | 2.24% | -7.52% | |

44 | CVS Health Corp | Services | 2.12% | -23.20% | |

45 | Wal-Mart Stores | Services | 2.06% | 16.20% | |

46 | United Parcel’B’ | Transportation | 1.96% | 18.71% | |

47 | FedEx Corp | Transportation | 1.25% | 23.22% | |

48 | Johnson & Johnson | Healthcare | 1.21% | 15.33% | |

49 | Walgreen Boots Alliance Inc | Services | 1.20% | -4.82% | |

50 | Kinder Morgan Inc | Utilities | 1.18% | 38.40% | |

51 | The Chubb Corp | Financial | 1.17% | 8.56% | |

52 | Cisco Systems | Technology | 1.16% | 15.46% | |

53 | Oracle Corp | Technology | 0.82% | 7.99% | |

54 | Abbott Laboratories | Healthcare | 0.78% | -10.62% | |

55 | Dow Chemical | Basic Materials | 0.41% | 4.22% | |

56 | Exxon Mobil | Energy | 0.39% | 9.87% | |

57 | Twenty-First Century Fox Inc A | Services | 0.18% | -0.07% | |

58 | Texas Instruments | Technology | 0.14% | 27.59% | |

59 | McDonald’s Corp | Services | 0.10% | -3.32% | |

60 | Dupont(E.I.)Denemours | Basic Materials | -0.07% | 3.92% | |

61 | Simon Ppty Grp | Services | -0.35% | -6.08% | |

62 | Intel Corp | Technology | -0.37% | 0.46% | |

63 | Accenture PLC (Ireland) NEW | Technology | -0.53% | 14.05% | |

64 | Nike Inc Cl B | Consumer Cyclical | -0.61% | -18.77% | |

65 | Chevron Corporation | Energy | -0.62% | 18.53% | |

66 | Thermo Fisher Scientific Inc | Healthcare | -0.87% | 6.61% | |

67 | ConocoPhillips | Energy | -0.88% | -5.89% | |

68 | Mastercard Inc | Financial | -1.02% | 7.46% | |

69 | Visa Inc | Services | -1.21% | 5.58% | |

70 | Time Warner | Services | -1.24% | 34.19% | |

71 | AT&T Inc | Services | -1.30% | 6.10% | |

72 | Starbucks Corp | Services | -1.30% | -10.19% | |

73 | Schlumberger Ltd | Energy | -1.48% | 12.77% | |

74 | Qualcomm Inc | Technology | -2.04% | 33.79% | |

75 | Verizon Communications | Services | -2.06% | 0.97% | |

76 | EOG Resources | Energy | -2.09% | 29.13% | |

77 | Apple Inc | Technology | -2.37% | 3.01% | |

78 | The Priceline Grp Inc | Services | -2.37% | 20.84% | |

79 | Microsoft Corp | Technology | -2.40% | 6.38% | |

80 | salesforce.com Inc | Technology | -2.56% | -4.86% | |

81 | Medtronic plc | Healthcare | -2.69% | 6.70% | |

82 | Occidental Petro | Energy | -2.90% | -3.93% | |

83 | Reynolds American Inc | Consumer/Non-Cyclical | -3.32% | 16.08% | |

84 | PayPal Hldgs Inc | Financial | -3.61% | 10.72% | |

85 | Facebook Inc | Technology | -4.17% | 13.74% | |

86 | Adobe Systems | Technology | -4.26% | 10.46% | |

87 | Coca-Cola Co | Consumer/Non-Cyclical | -4.31% | -4.49% | |

88 | Procter & Gamble Cc | Consumer/Non-Cyclical | -4.44% | 5.25% | |

89 | Alphabet Inc Cl A | Technology | -4.98% | -0.83% | |

90 | Pepsico Inc | Consumer/Non-Cyclical | -5.09% | 3.27% | |

91 | Broadcom Ltd | Technology | -5.28% | 15.51% | |

92 | Duke Energy Corporation | Utilities | -5.54% | 5.39% | |

93 | Colgate-Palmolive Co | Consumer/Non-Cyclical | -5.82% | 1.20% | |

94 | Amazon.com Inc | Services | -6.16% | 9.37% | |

95 | Altria Grp | Consumer/Non-Cyclical | -6.20% | 6.10% | |

96 | Netflix Inc | Services | -7.69% | 0.35% | |

97 | The Kraft Heinz Company | Consumer/Non-Cyclical | -8.07% | 11.61% | |

98 | Philip Morris Intl Inc | Consumer/Non-Cyclical | -9.10% | 1.18% | |

99 | NextEra Energy Inc | Utilities | -9.32% | 9.26% | |

100 | Mondelez Int’l Inc Cl A | Consumer/Non-Cyclical | -10.54% | -8.21% |

Yahoo Finance

Yahoo Finance