‘You’ll be duped’: Warning over big banks’ ‘frustrating’ move

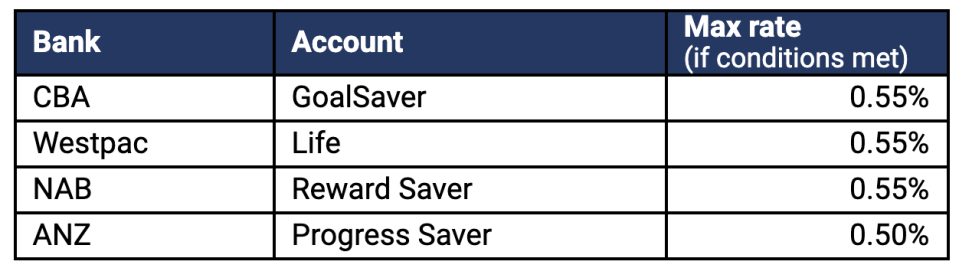

All of Australia’s major banks have cut interest rates on savings accounts in recent weeks, and advocates are calling on savers to seek out a better rate.

Westpac was the last major bank to cut saving rates, taking its savings rates 0.20 per cent lower on Friday

“It’s frustrating to see savings rates tumble despite no move to variable home loan rates. People looking for a competitive rate on their savings account or their home loan have to get up and do something about it,” RateCity.com.au research director Sally Tindall said.

“Do nothing and you’ll be duped.”

And, she added, rates could well slide lower.

“This isn’t necessarily the end of it. The big banks could keep on cutting their rates over the coming months. That’s what they did last time the Reserve Bank of Australia (RBA) cut the cash rate, although it’s becoming hard to see where else there is left to cut.”

The RBA cut rates to a record 0.10 per cent low earlier this month.

Commonwealth Bank, NAB, ANZ and Westpac’s savings cuts mean someone with $50,000 in a savings account earning the average maximum rate at the beginning of the year of 1.53 per cent would have seen their average $64 monthly interest fall to $23 a month.

“It’s abundantly clear from these non-competitive rates, the banks just don’t need or want any more deposits. They’re officially paying peanuts,” Tindall said.

However, Westpac has left its 3 per cent savings rate for customers between 18 and 29 untouched.

“Westpac clearly wants to attract more young Australians on its books in the hope they’ll convert them into long-term customers,” Tindall said.

Young Australians who put $20,000 into Westpac’s account and deposited another $200 a month would earn $644 in interest over the course of a year.

The RBA will meet to discuss interest rates next Tuesday 1 December.

Want to hear Australian influencers reveal their best finance tips? Join the Broke Millennials Club on Facebook, and receive one hot tip per day in December.

And if you want 2021 to be your best (financial) year yet, follow Yahoo Finance on Facebook, LinkedIn, Instagram and Twitter. Subscribe to the free Fully Briefed daily newsletter here.

Yahoo Finance

Yahoo Finance