Bicycle Therapeutics (BCYC) Up as PIPE Funding Set to Make $555M

Bicycle Therapeutics BCYC shares rallied 9.6% in the last trading session on May 23 after the company announced entering into a funding agreement with multiple institutional investors, new and existing, to issue and sell an aggregate of 25,933,706 American Depositary Shares (ADS) at $21.42 per share. Such impending transaction will be accomplished via a private investment in public equity (PIPE) financing.

Please note that one ADS of Bicycle Therapeutics represents one ordinary share of the company.

The company expects to generate gross proceeds of approximately $555 million from the PIPE financing agreement. The transaction is expected to close on May 28, 2024, which is contingent upon the fulfillment of certain customary closing conditions.

The PIPE financing is set to significantly strengthen Bicycle Therapeutics’ cash position. Following the closing of the transaction, the company expects its pro forma cash and cash equivalents to be approximately $1 billion, which is expected to extend its financial runway into the second half of 2027.

However, BCYC has clarified that the expected cash balance stated is merely an estimate based on currently available information that is subject to change.

Excluding transaction expenses, Bicycle Therapeutics plans to use net proceeds from the PIPE funding to support ongoing development activities of its pipeline comprising multiple clinical-stage precision-guided therapeutics.

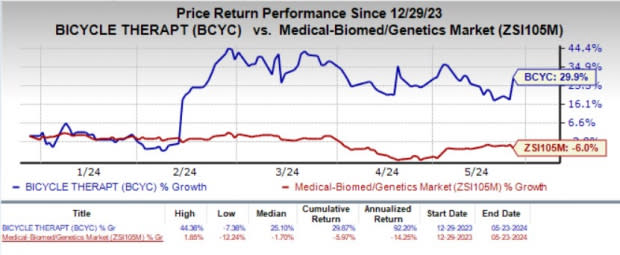

Year to date, shares of BCYC have soared 29.9% against the industry’s 6% decline.

Image Source: Zacks Investment Research

Bicycle Therapeutics’ lead candidate is BT8009, a BTC molecule, which is being studied in two ongoing company-sponsored clinical studies for different cancer indications. The phase I/II Duravelo-1 study is evaluating BT8009 in several Nectin-4-driven tumors, while the phase II/III Duravelo-2 registrational study is evaluating the candidate as a treatment for metastatic bladder (urothelial) cancer. Both studies are currently enrolling patients.

Last year, the company aligned with the FDA on the design of the registrational Duravelo-2 study which can provide the basis for an accelerated approval in untreated (first-line) and previously treated (second-line plus) metastatic bladder cancer. The late-stage study was subsequently initiated in the first quarter of 2024.

Bicycle Therapeutics’ clinical-stage pipeline contains three other product candidates, namely BT5528, BT1718 and BT7480, which are undergoing development in separate early to mid-stage studies across a variety of tumor types.

In the first-quarter earnings release, the company stated that it expects to share numerous clinical data readouts and program updates on its pipeline candidates in the second half of 2024.

Bicycle Therapeutics PLC Sponsored ADR Price and Consensus

Bicycle Therapeutics PLC Sponsored ADR price-consensus-chart | Bicycle Therapeutics PLC Sponsored ADR Quote

Zacks Rank and Other Stocks to Consider

Bicycle Therapeutics currently has a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the drug/biotech industry worth mentioning are ALX Oncology Holdings ALXO, Annovis Bio ANVS and Entera Bio Ltd. ENTX. Each stock presently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology’s 2024 loss per share has narrowed from $3.33 to $2.89. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.85 to $2.73. Year to date, shares of ALXO have lost 1.3%.

ALX Oncology beat estimates in two of the trailing four quarters, missing the mark on the other two occasions, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.35 to $2.46. During the same period, the consensus estimate for 2025 loss per share has narrowed from $2.82 to $1.95. Year to date, shares of ANVS have plunged 62.1%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

In the past 30 days, Zacks Consensus Estimate for Entera Bio’s 2024 loss per share has remained constant at 25 cents. During the same period, the consensus estimate for 2025 loss per share has remained constant at 54 cents. Year to date, shares of ENTX have surged 285%.

ENTX’s earnings beat estimates in three of the trailing four quarters and missed the same once, the average surprise being 6.50%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Entera Bio Ltd. (ENTX) : Free Stock Analysis Report

Bicycle Therapeutics PLC Sponsored ADR (BCYC) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

ALX Oncology Holdings Inc. (ALXO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance