BHP Sells Smallest Copper Mine in Chile for $320 Million

BHP Billiton Limited BHP has agreed to sell its smallest copper mine — Cerro Colorado in Chile to private equity manager, EMR Capital for as much as $320 million. Cerro Colorado is one of two copper mining operations of BHP’s Pampa Norte division and is located in the Atacama Desert in northern Chile. BHP Billiton had been searching for a buyer for the mine for almost a year.

The sale is expected to close during the fourth quarter of calendar year 2018, pursuant to fulfillment of customary closing conditions. On closure, the company will receive a total cash consideration of $230 million plus around $40 million from the sale of certain Cerro Colorado copper inventory. It will also receive a contingent payment of up to $50 million in the future, depending upon copper price performance.

The booming market for electric vehicles will significantly impact demand for copper over the next decade. Going forward, copper prices are likely to be influenced by demand from China, India and emerging markets, as well as economic activity in the United States and other industrialized countries. BHP Billiton along with other miners like Rio Tinto plc RIO, are consequently keen to invest in copper assets to capitalize on the long-term fundamentals of the metal. The sale of the Cerro Colorado is in sync with BHP Billiton’s plans to focus in large-scale projects.

Notably, the Cerro Colorado mine produced 65,000 ton of copper cathode in fiscal 2017. It is a much smaller operation given that BHP Billiton’s flagship Escondida operation also located in Chine produced 232,000 tons of copper cathode and 539,600 tons of payable copper in fiscal 2017 and the Spence mine produced 189,600 tons of copper cathode.

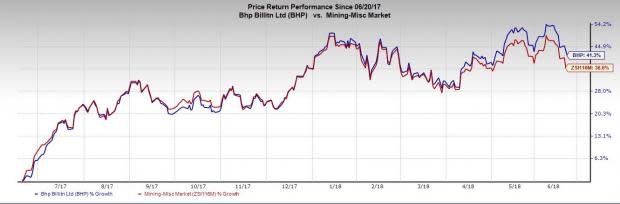

Over the last year, BHP Billiton’s shares yielded a return of 41.3%, outperforming 36.6% gain recorded by the industry . The company is gaining competency on the back of sturdier productivity and remains on track to deleverage balance sheet over time. It is making operations more efficient driven by smarter technology adoption across the entire value chain along with reducing capital and exploration expenses.

BHP Billiton currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the same industry are listed below:

Ternium S.A. TX delivered an average positive earnings surprise of 50.23% in the last four quarters. Its shares have appreciated 40% in a year’s time. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity Corporation NGVT carries a Zacks Rank of #2 (Buy). The company recorded an average positive earnings surprise of 20.15% in the trailing four quarters. Its shares have surged 46% over the past year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

BHP Billiton Limited (BHP) : Free Stock Analysis Report

Rio Tinto PLC (RIO) : Free Stock Analysis Report

Ternium S.A. (TX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance