Beyond Meat's (NASDAQ:BYND) Lack of Growth Equals More Short-Term Pain

This article first appeared on Simply Wall St News.

Three years after its IPO debut, Beyond Meat, Inc.'s (NASDAQ: BYND) shares are now trading well below the starting price, with year-to-date loss extending beyond 50%. With looming cash flow burn concerns and geopolitical issues threatening the supply chain, short interest has ballooned over 40%.

Check out our latest analysis for Beyond Meat

First-quarter 2022 results

US$1.58 loss per share (down from US$0.43 loss in 1Q 2021).

Revenue: US$109.5m (up 1.2% from 1Q 2021).

Net loss: US$100.5m (loss widened 268% from 1Q 2021).

Revenue missed analyst estimates by 1.9%. Earnings per share (EPS) also missed analyst estimates by 63%.

Over the next year, revenue is forecast to grow 32%, compared to an 11% growth forecast for the industry in the US. Over the last 3 years, on average, earnings per share have fallen by 16% per year, but its share price has fallen by 30% per year, which means it is performing significantly worse than earnings.

Growth Concerns

Following the 7th consecutive missed earnings report, institutions scrambled to adjust their expectations.

Barclays: Lowered from Overweight to Equal Weight

Mizuho Americas: Dropped price target from US$35 to US$21

Credit Suisse: Reaffirmed Underweight rating, dropped price target from US$40 to US$20

So far, it seems that Beyond Meat's strategy to reduce the prices failed to generate expected topline growth. This is alarming in an environment where food prices have been consistently rising over the last several months. It means that customers aren't willing to consider BYND products as substitutes even at much better relative prices.

Beyond Meat grew its revenue by 12% over the last year. While that may seem decent, it isn't great, considering the company is still making a loss. Even so, you could argue that it's surprising that the share price has tanked 70%. Clearly, the market was expecting better, which may blow out profitability projections.

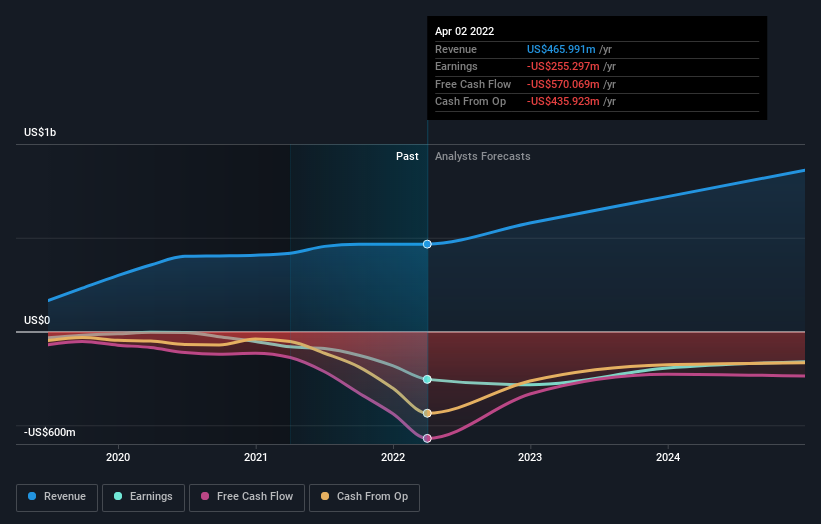

The company's revenue and earnings (over time) are depicted below (click to see the exact numbers).

Beyond Meat is a well-known stock with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

The latest developments do not fare well for Beyond Meat. With food prices ramping up, driven by geopolitical issues, the fact that consumers aren't switching to their meat substitute products at discounted prices is concerning. That is, without factoring in the growing competition. On the other hand, escalating manufacturing costs are depressing the margins - thus, a company valued at US$2b scored only US$200,000 in gross profits.

Finally, while short interest is exceptionally high at 41%, short-squeeze speculators should consider that the company has a relatively modest cash runway. According to our calculations, it could be less than 1 year. Thus, we could expect either taking on more debt (which is already substantial) at a steeper cost due to higher interest rates or share dilution. Neither is a good option for the current shareholders.

While it is well worth considering the different impacts of market conditions on the share price, other factors are even more important. So far, we've spotted3 warning signs for Beyond Meat you should know about.

If you would prefer to check out another company, one with potentially superior financials, then do not miss this free list of companies that have proven they can grow earnings.

Please note that the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Yahoo Finance

Yahoo Finance