Better Buy: Scotts Miracle-Gro vs. ConocoPhillips

At first blush, it doesn't seem like comparing lawn care company Scotts Miracle-Gro (NYSE: SMG) to oil driller ConocoPhillips (NYSE: COP) would make much sense. But if you step back and look at the bigger picture, the two companies are actually in the middle of big bets on growth. How these plans pan out will have a big impact on each company's future. Here's what you need to understand to compare this pair.

Expanding into marijuana

The core of Scotts' business is lawn care. It's a pretty boring industry, but a reliable one. A few years ago, however, management decided it wanted to jump on the marijuana bandwagon. The pot space is projected to grow enormously in the years ahead as the drug becomes legal in more and more regions. Since Scotts already deals with plants, it was a logical extension for the company to enter the hydroponic space and thus become a supplier to pot growers.

Image source: Getty Images.

That plan sounds great, but there's one caveat: debt. The company's long-term debt load has nearly tripled since 2014 as it spent huge sums to build a hydroponic business through a series of acquisitions. Its debt-to-equity ratio has spiked from around 0.25 to 0.55 over the past five years. To be fair, it covers trailing interest expenses by around five times, which is hardly concerning. But the debt it has taken on will eventually have to be dealt with.

Investors, however, don't seem to care right now. The stock is up 65% so far in 2019 based largely on hype around the marijuana industry. Although the trailing P/E ratio is below its five-year average, that's partly due to one-time charges taken in fiscal 2019 related to acquisitions -- notably a writedown on some marijuana investments that didn't live up to expectations. The company's price-to-cash flow, price-to-book value, and price-to-sales ratios are all above their longer-term averages.

In other words, Scotts is a heavily indebted company that's trading at a premium price based on the marijuana growth story even though most of its business (around 75% or so, using the current revenue run rate in the marijuana business) is tied to the slow-growth lawn care space. If the marijuana hype doesn't pan out, or if Wall Street finds a new story that's more exciting, investors will likely sour on Scotts' shares in a big way.

Booming production

ConocoPhillips is a pure-play oil driller, a volatile business where financial results are highly reliant on commodity prices. That can be both good and bad, since high oil prices will lead to strong results and weak oil prices can mean lots of red ink. So, it is understandable that oil prices, which have been stuck in a relatively low range recently, have left investors less than excited about ConocoPhillips' shares. The stock is down a couple of percentage points so far this year.

But there's a lot of good things going on behind the scenes here. For example, production has been growing strongly as the company's investments in onshore U.S. oil projects have begun to bear fruit. To put some numbers on that, ConocoPhillips' overall production was up 5% year over year in the first quarter, with a massive 30% increase in its U.S. shale operations, an area in which the oil driller is spending heavily.

Meanwhile, management has been working hard to strengthen the company's balance sheet. Debt to equity peaked at around 0.60 in 2016 and has since fallen to around 0.20. Unlike Scotts', ConocoPhillips' debt picture has improved materially, even as it has managed to grow its production. There's little reason to worry about the company's ability to support its continued growth. And while the oil sector was recently abuzz with merger and acquisition speculation, ConocoPhillips has made a point of stating that it plans to remain disciplined and won't chase acquisitions.

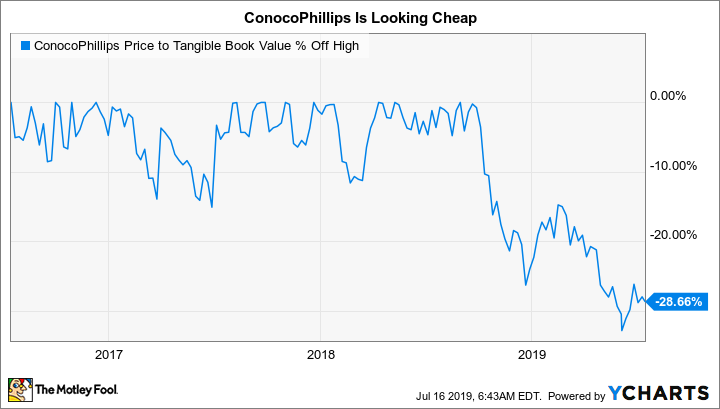

COP price to tangible book value. Data by YCharts.

To be fair, ConocoPhillips isn't for the faint of heart because oil prices will always be a huge wild card. But so far it has proven it has a business model that produces results. Meanwhile, ConocoPhillips' price to tangible book value has fallen nearly 30% since late 2018 despite continued strong drilling results. Add in a solid financial foundation and it looks like a better option than Scotts.

There's a winner, but...

Scotts and ConocoPhillips are both investing for the future. They are taking slightly different paths, notably on the balance sheet. This gives ConocoPhillips the edge here, since it appears to be in a better position to support its long-term goals. And then there's the not-so-subtle fact that investors appear a little too excited about Scotts' pot aspirations today, pushing its valuation up past historic norms, while Conoco's stock has languished despite strong operating results.

That said, with ConocoPhillips focused on just the upstream space, where volatile oil prices are a big uncertainty, it's only appropriate for more aggressive investors. In other words, Conoco has the edge here, but most would probably be better off avoiding both of these stocks.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance