Best Value Stocks to Buy for May 14th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, May 14th:

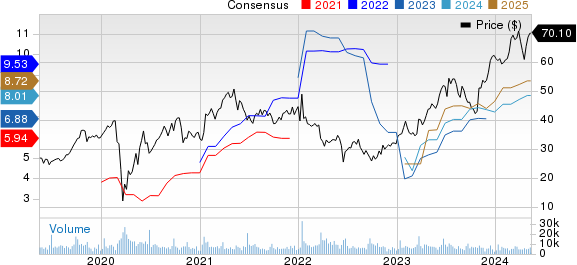

Tsakos Energy Navigation TNP: This company which is a leading provider of international seaborne crude oil and petroleum product transportation services, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 18.1% over the last 60 days.

Tsakos Energy Navigation Ltd Price and Consensus

Tsakos Energy Navigation Ltd price-consensus-chart | Tsakos Energy Navigation Ltd Quote

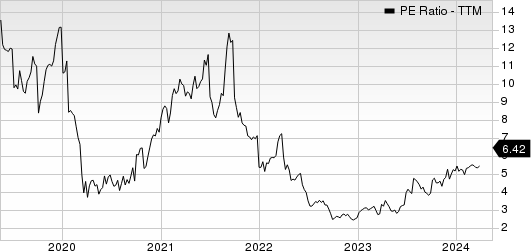

Tsakos Energy Navigation has a price-to-earnings ratio (P/E) of 3.12 compared with 11.80 for the industry. The company possesses a Value Score of A.

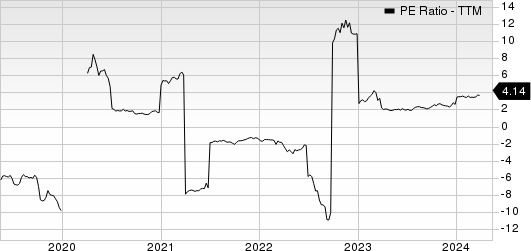

Tsakos Energy Navigation Ltd PE Ratio (TTM)

Tsakos Energy Navigation Ltd pe-ratio-ttm | Tsakos Energy Navigation Ltd Quote

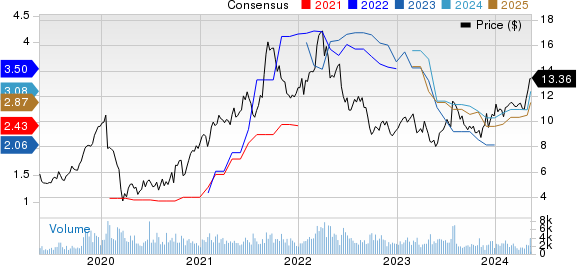

Costamare CMRE: This company which operates as a containership owner chartering its vessels to liner companies, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 12.0% over the last 60 days.

Costamare Inc. Price and Consensus

Costamare Inc. price-consensus-chart | Costamare Inc. Quote

Costamare has a price-to-earnings ratio (P/E) of 4.3 compared with 11.80 for industry. The company possesses a Value Score of A.

Costamare Inc. PE Ratio (TTM)

Costamare Inc. pe-ratio-ttm | Costamare Inc. Quote

KB Home KBH: This company which is a well-known homebuilder in the United States and one of the largest in the state, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.5% over the last 60 days.

KB Home Price and Consensus

KB Home price-consensus-chart | KB Home Quote

KB Home has a price-to-earnings ratio (P/E) of 8.75 compared with 10.20 for industry. The company possesses a Value Score of A.

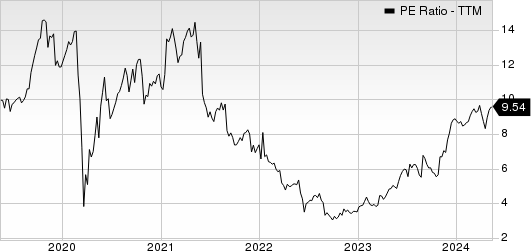

KB Home PE Ratio (TTM)

KB Home pe-ratio-ttm | KB Home Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KB Home (KBH) : Free Stock Analysis Report

Tsakos Energy Navigation Ltd (TNP) : Free Stock Analysis Report

Costamare Inc. (CMRE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance