Best Income Stocks to Buy for May 14th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, May 14th:

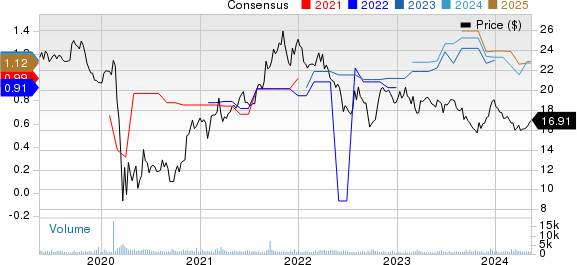

Alexander & Baldwin Holdings ALEX: This real estate investment trust which owns, operates and manages retail, industrial and office space primarily in Hawaii and on the U.S. Mainland, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.6% over the last 60 days.

Alexander & Baldwin Holdings, Inc. Price and Consensus

Alexander & Baldwin Holdings, Inc. price-consensus-chart | Alexander & Baldwin Holdings, Inc. Quote

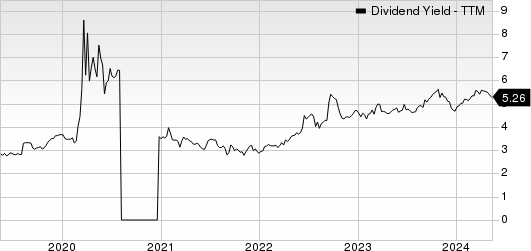

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 5.3%, compared with the industry average of 4.7%.

Alexander & Baldwin Holdings, Inc. Dividend Yield (TTM)

Alexander & Baldwin Holdings, Inc. dividend-yield-ttm | Alexander & Baldwin Holdings, Inc. Quote

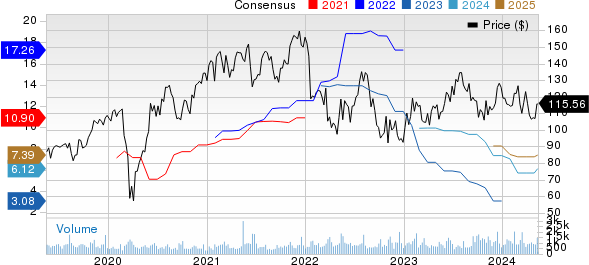

LCI Industries LCII: This company which is a supplier of components to the recreational vehicle and manufactured housing industries as well as adjacent industries including bus, cargo and equestrian trailer, marine and heavy truck, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 7.2% over the last 60 days.

LCI Industries Price and Consensus

LCI Industries price-consensus-chart | LCI Industries Quote

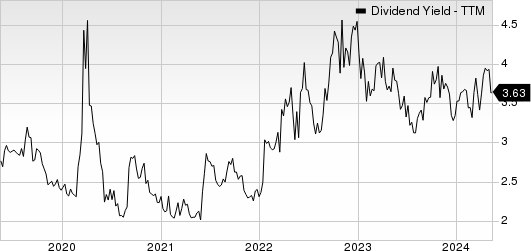

This Zacks Rank #1 company has a dividend yield of 3.6%, compared with the industry average of 0.0%.

LCI Industries Dividend Yield (TTM)

LCI Industries dividend-yield-ttm | LCI Industries Quote

Costamare CMRE: This company which operates as a containership owner chartering its vessels to liner companies, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 12.0% over the last 60 days.

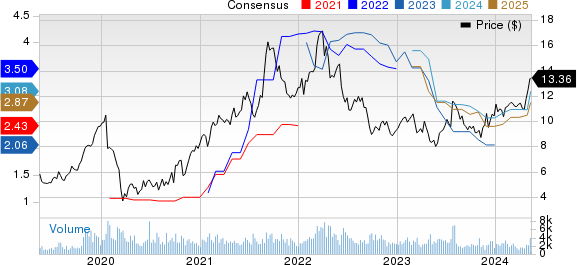

Costamare Inc. Price and Consensus

Costamare Inc. price-consensus-chart | Costamare Inc. Quote

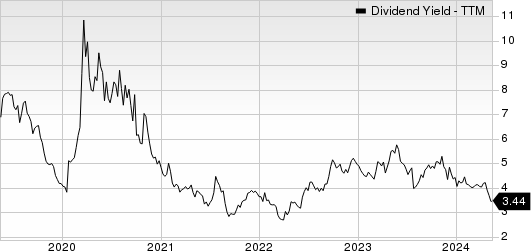

This Zacks Rank #1 company has a dividend yield of 3.4%, compared with the industry average of 2.1%.

Costamare Inc. Dividend Yield (TTM)

Costamare Inc. dividend-yield-ttm | Costamare Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alexander & Baldwin Holdings, Inc. (ALEX) : Free Stock Analysis Report

Costamare Inc. (CMRE) : Free Stock Analysis Report

LCI Industries (LCII) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance