Berry Global (BERY) to Buy Back $50M Shares in Accelerated Program

Berry Global Group, Inc. BERY yesterday announced that it plans to buy back common shares worth $50 million. This plan will be executed through an accelerated share repurchase (ASR) program and funded using the company’s available cash.

Such buyback actions reflect Berry Global’s flexible capital allocation policy and strong cash position.

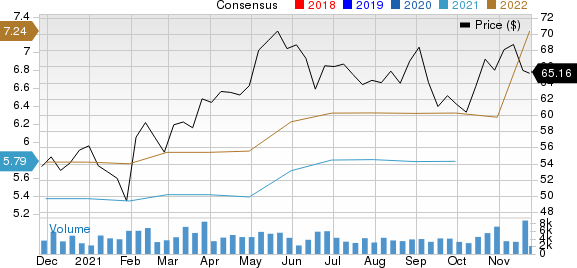

Yesterday, shares of BERY lost 0.70%, ending the trading session at $65.16.

Inside the Headlines

Per the ASR program, Berry Global will be buying as many shares as possible, using the average share price (volume-weighed) for the buyback period, for $50 million. Adjustments and discounts will be deducted from the applicable price.

The ASR program is expected to be completed in the first quarter of fiscal 2022 (ending December 2021). Notably, this program comes under the ambit of Berry Global’s existing authorized share buyback program. No share buybacks were made in fiscal 2021 and fiscal 2022 while $74 million worth of buyback was done in fiscal 2019 (ended September 2019).

Exiting fiscal 2021, Berry Global was left to repurchase $393 million worth of shares. Its shares outstanding were 138.3 million at the end of fiscal 2021. Also, its cash and cash equivalents were $1,091 million exiting the year, reflecting an increase from $750 million at the end of fiscal 2020. Net cash generated from operating activities totaled $1,580 million in the year and its free cash flow was $904 million.

Further improvement in Berry Global’s cash position and financial performance in the quarters ahead will enable the company to reward its shareholders handsomely. For fiscal 2022 (ending September 2022), the company expects free cash flow to be $900-$1,000 million and cash flow from operations to be $1,700-$1,800 million.

Zacks Rank, Price Performance & Earnings Estimates

With a market capitalization of $8.9 billion, Berry Global currently sports a Zacks Rank #1 (Strong Buy). Strengthening end-market businesses, investments in growth opportunities and efficient capital-allocation strategies are beneficial for the company.

In the past three months, Berry Global’s shares have decreased 2.2% compared with the industry’s decline of 1.2%.

Image Source: Zacks Investment Research

Berry Global’s earnings estimates for first-quarter fiscal 2022 (ending December 2021) are pegged at $1.37 per share, reflecting growth of 26.9% from the 30-day-ago figure. Also, the consensus estimate is pegged at $7.24 for fiscal 2022 (ending September 2022) and $7.66 for fiscal 2023 (ending September 2023), reflecting increases of 15.3% and 12% from the respective 30-day-ago figures.

Berry Global Group, Inc. Price and Consensus

Berry Global Group, Inc. price-consensus-chart | Berry Global Group, Inc. Quote

Other Stocks to Consider

Some other top-ranked stocks in the Zacks Industrial Products sector are discussed below.

A. O. Smith Corporation AOS presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. AOS repurchased $212 million worth of shares in the first nine months of 2021. It intends to repurchase in total $400 million worth of shares in 2021.

In the past 30 days, A. O. Smith’s earnings estimates have increased 6.6% for 2021 and 9% for 2022. Its shares have gained 14.8% in the past three months.

Emerson Electric Co. EMR bought back shares worth $500 million in fiscal 2021 (ended Sep 30, 2021). EMR expects its share buybacks to be $250-$500 million in fiscal 2022 (ending September 2022). The company presently carries a Zacks Rank #2.

Emerson’s earnings estimates have increased 5.5% for fiscal 2022 and 5.8% for fiscal 2023 (ending September 2023) in the past 30 days. Its shares have lost 9.5% in the past three months.

Applied Industrial Technologies, Inc. AIT repurchased $6.5 million worth of shares in the first three months of fiscal 2022 (ended Sep 30, 2021). At the end of the fiscal quarter, AIT was left to buy back 388,000 shares.

Applied Industrial’s earnings estimates have increased 1.9% for fiscal 2022 (ending June 2022) and 2.2% for fiscal 2023 (ending June 2023) in the past month. Its shares have gained 18.8% in the past three months. AIT carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance