Bernie Sanders unveils 'Tax on Extreme Wealth' plan

Presidential candidate Bernie Sanders has been a loud critic of the ultra wealthy. Under his newest plan, he is ensuring those in the highest income bracket pay what he sees as their fair share in taxes.

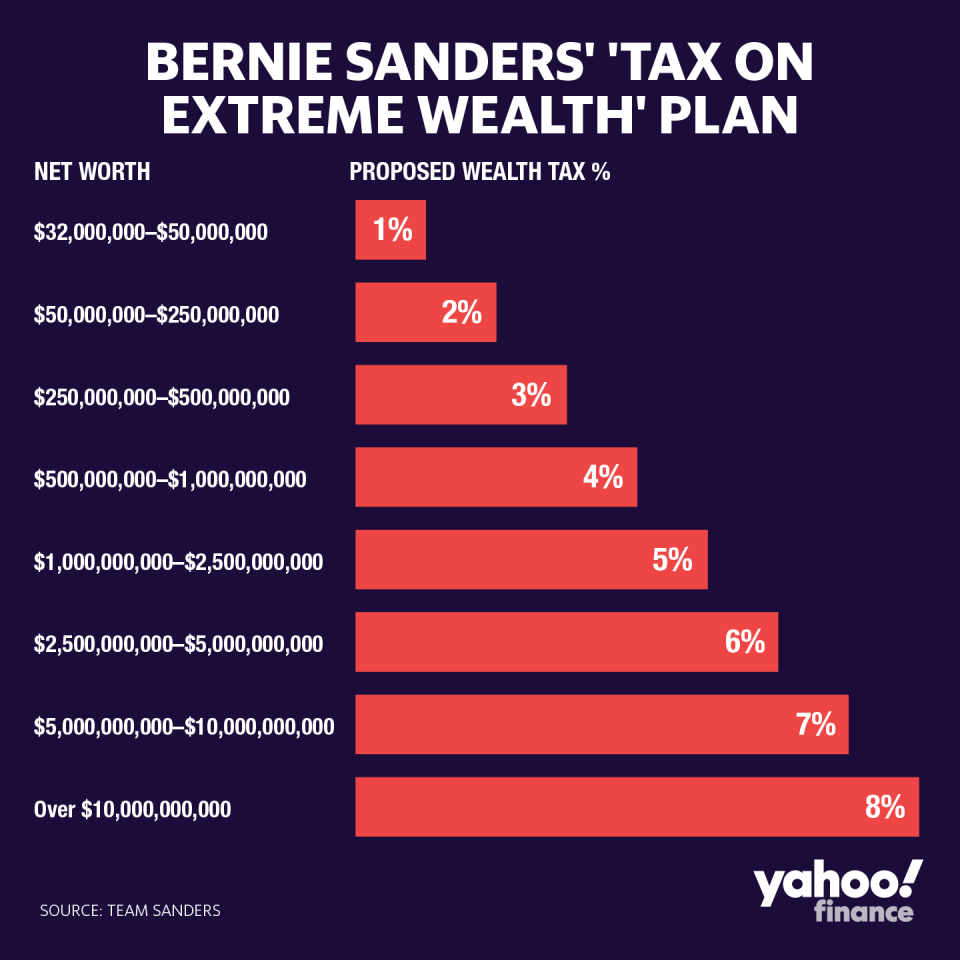

On Tuesday, Sanders released his “Tax on Extreme Wealth” proposal. The plan would place a 1% tax on the top 0.1% of American households. The tax “would start with a 1 percent tax on net worth above $32 million for a married couple,” according to the release. “That means a married couple with $32.5 million would pay a wealth tax of just $5,000.”

The tax rate would increase to 2% on households with new worth between $50 million and $250 million, 3% on net worth up to $500 million, 4% on new worth up to $1 billion, and so on up to a 8% tax on wealth over $10 billion.

“At a time when millions of people are working 2 or 3 jobs to feed their families, the three wealthiest people in this country own more wealth than the bottom half of the American people,” Sanders said. “Enough is enough. We are going to take on the billionaire class, substantially reduce wealth inequality in America, and stop our democracy from turning into a corrupt oligarchy.”

Sanders claims that “the wealth of billionaires would be cut in half over 15 years which would substantially break up the concentration of wealth and power of this small privileged class.”

The revenue generated from this tax on the wealthy would go towards other plans of Sanders, including Medicare for All, universal child care, and affordable housing.

There is growing support for taxing the wealthy. A poll from Politico/Morning Consult found that 76% of registered voters think wealthy Americans should pay more taxes. And, a Fox News survey found that 70% of Americans, including 54% of Republicans, are in support of raising taxes on those who earn more than $10 million.

University of California, Berkeley economists Gabriel Zucman and Emmanuel Saez, who have written extensively about the effects of wealth taxes, analyzed the Sanders proposal and estimates that this would raise $4.35 trillion over the next decade.

Billionaires should not exist. https://t.co/hgR6CeFvLa

— Bernie Sanders (@BernieSanders) September 24, 2019

Zucman and Saez’s $4.35 trillion estimate is higher than the two projected for Sen. Elizabeth Warren’s wealth tax plan released earlier this year. Under her tax proposal, there would be a 2% wealth tax on individuals with a net worth over $50 million and 3% tax on those over $1 billion.

“A progressive wealth tax is the most direct policy tool to curb the growing concentration of wealth in the United States,” the two said in a joint letter. “It can also restore tax progressivity at the very top of the wealth distribution and raise sorely needed tax revenue to fund the public good. Senator Sanders’ very progressive wealth tax on the top 0.1% wealthiest Americans is a crucial step in this direction.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

Stubhub president: 'Universal tax' on the wealthy is not the solution

Mark Cuban: AOC, Sanders, Warren wouldn't complain if they had my 'level of success'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance