Bear Of The Day: NetEase (NTES)

NetEase (NTES) is a Zacks Rank #5 (Strong Sell) despite beating the Zacks Consensus Estimate in the most recent quarter. Stocks that miss the number don’t always fall to a Zacks Rank #5 (Strong Sell) so let’s take a look at why that is the case in this Bear of the Day article.

Description

NetEase, Inc. is an Internet technology company engaged in the development of applications, services and other technologies for the Internet in China. It provides online gaming services that include in-house developed massively multi-player online role-playing games and licensed titles. NetEase, Inc.is based in Beijing, the People's Republic of China.

Earnings History

When I look at a stock, the first thing I do is look to see if the company is beating the number. This tells me right away where the market’s expectations have been for the company and how management has communicated to the market. A stock that consistently beats has management communicating expectations to Wall Street that can be achieved. That is what you want to see.

In the case of NTES, I see one miss and three beats of the Zacks Consensus Estimate over the last year. This alone does not make the stock a Zacks Rank #1 (Strong Buy) and it doesn’t make it a Zacks Rank #5 (Strong Sell) either.

The Zacks Rank does care about the earnings history, but it is much more heavily influenced by the movement of earnings estimates.

Earnings Estimates

The Zacks Rank tells us which stocks are seeing earnings estimates move higher or in this case lower. For NTES I see estimates fluctuating.

This quarter has dipped from $0.74 to $0.73.

Next quarter has moved from $1.01 to $1.00 over the last 60 days.

The Zacks Rank is more heavily influenced by the move in the annual numbers, and the movement is negative for those numbers.

The 2021 consensus number has decreased from $3.58 to $3.36.

The 2022 number has moved from $4.56 to $3.98 over the last 60 days.

Negative movement in earnings estimates like that is why this stock is a Zacks Rank #5 (Strong Sell).

It should be noted that a majority of stocks in the Zacks universe are seeing positive earnings estimate revisions. That means that the stocks that are seeing small but negative earnings estimate revisions are falling to a Zacks Rank #5 (Strong Sell).

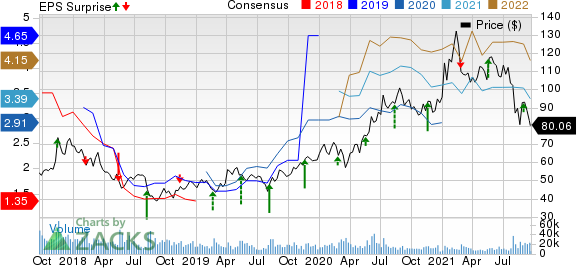

Chart

NetEase, Inc. Price, Consensus and EPS Surprise

NetEase, Inc. price-consensus-eps-surprise-chart | NetEase, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetEase, Inc. (NTES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance