Bear of the Day: Havertys (HVT)

Havertys HVT continues to face headwinds as the housing market remains slow. This Zacks Rank #5 (Strong Sell) is expected to see earnings decline by the double digits in 2024.

Havertys is a full-service home furnishings retailer with 124 showrooms in 17 Southern and Midwest states. It has been in business since 1885.

Another Earnings Miss in the First Quarter

On May 1, 2024, Havertys reported its first quarter 2024 results and missed on the Zacks Consensus Estimate. It reported $0.14 versus the consensus of $0.33.

That's a miss of $0.19, or 57.6%.

It was the second miss in a row and the third miss out of the last 4 quarters as the furniture industry remains challenging.

Sales fell 18.1% to $184 million from $224.8 million in the first quarter last year. Comparable store sales, a key retail metric, also plunged 18.5%.

Total written sales were down 12.6% and written comp-store sales declined 13%.

"Our sales reflect the challenges from the ongoing weak housing market. The decline in demand requires exceptional customer engagement and operational flexibility," said Clarence H. Smith, CEO.

In some better news, the company's free, in home design service, grew 10.4% year-over-year and was 32.3% of its total written business.

Gross margins also rose to 60.3% from 59.1%.

Havertys is still planning for the future, when sales rebound. It is on track to open 5 new stores this year and 5 more in 2025. One new store in the Memphis, TN market opened at the end of March.

Three stores which were in-fill opportunities in growing areas of Florida, are expected to open in the second and third quarters of this year. It also expects to enter the Houston market later this year.

No Debt Outstanding

Havertys had cash and cash equivalents on hand, as of Mar 31, 2024, of $117.9 million.

It also had no debt outstanding as of Mar 31, 2024.

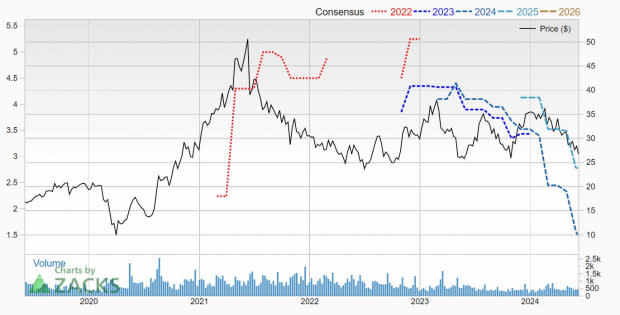

Analysts Cut Full Year Earnings Estimates

Despite some green shoots, including the rise in gross profit margin and the in-house interior design business, it's still a tough market for furniture retailers like Havertys as home sales remain depressed.

It's not a surprise that the analysts have cut 2024 and 2025 earnings estimates again.

1 estimate for 2024 has been cut in the last week, pushing the 2024 Zacks Consensus Estimate down to $1.50 from $2.45 just 60 days ago.

That is a 53.9% decline in earnings as the company made $3.25 last year.

They are bearish on 2025 as well as the Zacks Consensus has fallen to $2.78 from $3.53 in the last 60 days.

Image Source: Zacks Investment Research

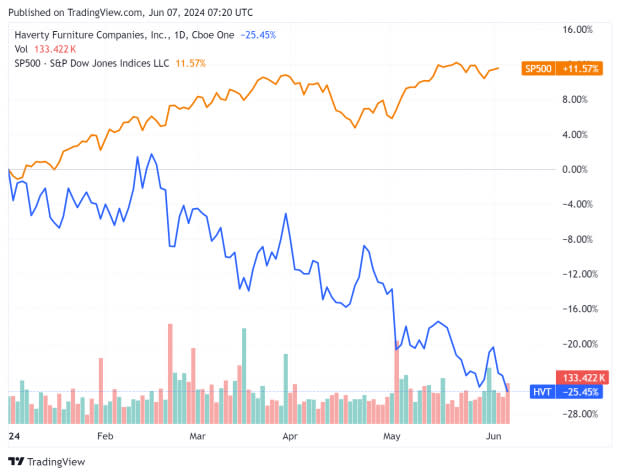

Shares Slide in 2024

Havertys shares have slid in 2024, falling 25.5% year-to-date.

Image Source: Zacks Investment Research

Because the earnings are falling as well, it's not even a cheap stock on a P/E basis. It trades with a forward P/E of 18.3 and a PEG ratio of 1.5. A PEG ratio under 1.0 usually indicates a company has both growth and value.

Havertys takes great pride in being shareholder friendly. It has paid a cash dividend each year since 1935.

On May 1, 2024, it increased its quarterly dividend for the 12th consecutive year. It raised it 6.7% to $0.32 from $0.30 per share.

That's a yield of 4.7% which while it looks juicy, also reflects that the stock has been battered.

Investors might want to wait on the sidelines to try and time the bottom in the earnings and sales decline. With analysts cutting earnings estimates again just this week, it's unclear when that bottom may be hit.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haverty Furniture Companies, Inc. (HVT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance