Bear of the Day: Dropbox, Inc. (DBX)

Dropbox, Inc. (DBX) is a cloud storage firm that has struggled to sustain a strong run ever since its 2018 IPO.

Dropbox stock tumbled following its Q4 2023 release in mid-February as its outlook in a changing industry failed to inspire confidence.

Dropbox 101

Dropbox offers a cloud-based platform that enables businesses and individuals to create, access, and share digital content. Dropbox serves more than 700 million registered users across approximately 180 countries. DBX closed last year with 18.12 million paying users.

Dropbox faces huge competition in the content collaboration platform and cloud storage spaces from some of the biggest companies in the world, including Microsoft and Alphabet. Dropbox announced last year it was streamlining its business and trimming staff to adapt to the artificial intelligence revolution.

Image Source: Zacks Investment Research

Wall Street was always worried about much larger companies eating Dropbox’s lunch. Now the firm appears behind the curve on AI, further threatening its near term and long run growth prospects.

Dropbox posted around 8% revenue growth in FY23 and FY22, following a 13% expansion in 2021. The firm is projected to post just 2% sales growth in 2024 and 2.7% higher revenue next year to reach $2.62 billion.

The company’s adjusted earnings are projected to pop 1.5% this year. But its consensus estimate for FY25 has fallen by 7% since its Q4 report to help it land a Zacks Rank #5 (Strong Sell).

Bottom Line

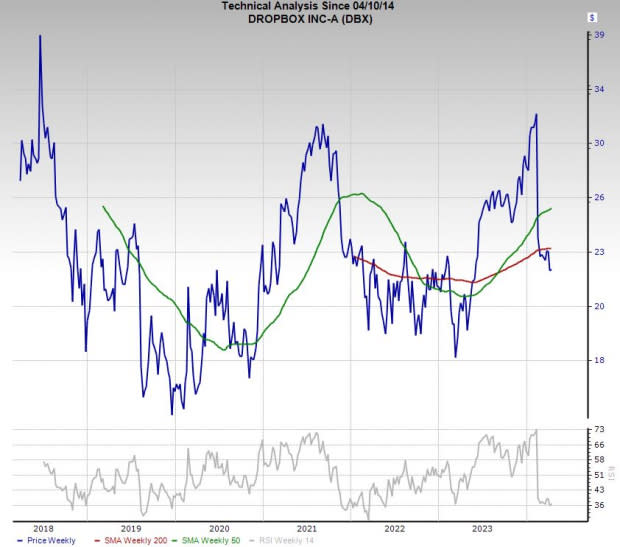

Dropbox stock is up 5% in the last five years, including some large peaks and valleys. During this time, the Zacks Tech sector has soared 123%.

DBX tumbled after its Q4 release, washing away its recent stretch of success. Dropbox now trades below its 50-week and 200-week moving averages.

On top of that, Dropbox’s balance sheet is hardly robust and not what most tech investors are looking for, with total liabilities outstripping total assets.

It might be best for investors to look elsewhere at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance