Barrick (GOLD) Q1 Earnings In Line With Estimates, Sales Miss

Barrick Gold Corporation GOLD recorded net earnings (on a reported basis) of $400 million or 22 cents per share in first-quarter 2020, up from $111 million or 6 cents in the year-ago quarter.

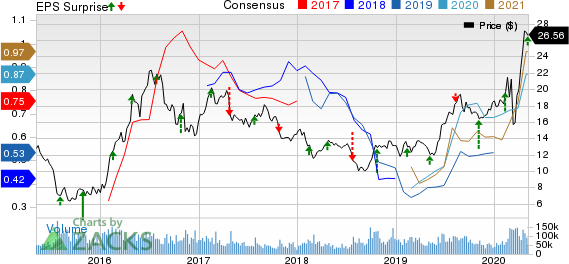

Barring one-time items, adjusted earnings per share increased 45.5% year over year to 16 cents. The figure came in line with the Zacks Consensus Estimate.

Barrick recorded total sales of $2,721 million, up around 30% year over year. The figure missed the Zacks Consensus Estimate of $2,745 million.

Barrick Gold Corporation Price, Consensus and EPS Surprise

Barrick Gold Corporation price-consensus-eps-surprise-chart | Barrick Gold Corporation Quote

Operational Highlights

Total gold production amounted to 1.25 million ounces in the first quarter, down 9% year over year from 1.37 million ounces. Average realized price of gold was $1,589 per ounce in the quarter, up 22% from $1,307 per ounce in the year-ago quarter.

Cost of sales moved up 8% year over year to $1,020 per ounce. All-in sustaining costs (AISC) rose 16% year over year to $954 per ounce in the quarter.

Copper production increased 8% year over year to 115 million pounds. Average realized copper price was $2.23 per pound, down 27% year over year.

Financial Position

At the end of the first quarter, Barrick had cash and cash equivalents of $3,327 million, up 55% year over year. The company’s total debt was around $5.2 billion at the end of the first quarter compared with $5.5 billion as of Dec 31, 2019.

Net cash provided by operating activities rose 71% year over year to $889 million.

Guidance

For 2020, Barrick now anticipates attributable gold production in the range of 4.6-5 million ounces, down from 4.8-5.2 million ounces it expected earlier. AISC is expected in the range of $920-$970 per ounce, unchanged from the prior view. Cost of sales is expected in the range of $980-$1,030 per ounce, unchanged from previous guidance.

The company continues to expect copper production in the range of 440-500 million pounds at AISC of $2.20-$2.50 per pound and at cost of sales of $2.10-$2.40 per pound.

Capital expenditures are projected between $1,600 million and $1,900 million.

Price Performance

Barrick’s shares have gained 111.3% in the past year compared with the industry’s 93% rally.

Zacks Rank & Other Key Picks

Barrick currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Agnico Eagle Mines Limited AEM, Newmont Corporation NEM and Franco-Nevada Corporation FNV, all carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Agnico Eagle has an expected earnings growth rate of 58.8% for 2020. The company’s shares have surged 55.1% in the past year.

Newmont has an expected earnings growth rate of 95.5% for 2020. Its shares have returned 103.2% in the past year.

Franco-Nevada has an expected earnings growth rate of 22% for 2020. The company’s shares have surged 102.3% in the past year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

FrancoNevada Corporation (FNV) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance