Barclays (BCS) Plans to Close Another 15 Banking Branches

Barclays BCS is planning to shut 15 more branches in the coming months. Of the total, 12 are located in England, two in Scotland and one in Wales.

In England, most of the branch closures will occur in August, while a few are expected to close in September. The Scotland branches will shut in August, while the Wales branch is still waiting to get any confirmation.

In 2022, BCS announced its plans to shut down 132 branches in the region, with several of those already closed.

The primary reason behind the branch closures is the changing habit of consumers while doing banking transactions. Since the pandemic, the number of customers using their local branch has reduced significantly, with the usage of online banking services gaining traction.

Our Take

Over the past years, Barclays has been undertaking several restructuring actions to maintain profitability. Last year, the company signed an agreement to acquire Kensington Mortgage, which will support its mortgage business in the UK.

BCS intends to undertake further cost-saving efforts to improve operating efficiency, including divesting less profitable units and focusing on the core business to generate revenues. Overall expenses are expected to remain manageable as business restructuring initiatives continue to offer some support.

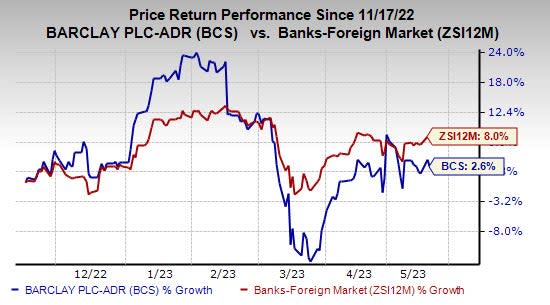

Over the past six months, shares of Barclays have gained 2.6% compared to the 8% upside of the industry.

Image Source: Zacks Investment Research

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Restructuring Efforts by Other Banks

Truist Financial TFC announced the completion of a 20% stake sale in its subsidiary Truist Insurance Holdings ("TIH") to Stone Point Capital, in partnership with co-investors, including Mubadala Investment Company, for $1.95 billion. The cash deal, which values TIH at $14.75 billion in aggregate, was announced in February.

TFC now holds 80% of TIH (currently the sixth-largest insurance brokerage in the country). Also, a five-person board has been constituted to oversee TIH (continued to be led by the present chairman and CEO, John Howard), with four members appointed by Truist and one by Stone Point. The deal doesn’t include TIH’s premium finance business.

Citigroup Inc. C announced the completion of the sale of its India consumer business to Axis Bank Limited. The sale was announced in March 2022. The sale includes retail banking, credit cards, wealth management and consumer loans, as well as the transfer of around 3,200 Citi employees.

The transaction is anticipated to result in a regulatory capital release of $1.4 billion. When the deal was announced, it was expected that Axis Bank would pay Citigroup $1.6 billion to acquire the consumer business, subject to customary closing adjustments.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance