BankUnited Inc. Reports First Quarter 2024 Earnings: Exceeds EPS Estimates

Net Income: Reported at $48.0 million, surpassing the estimated $45.04 million.

Earnings Per Share (EPS): Achieved $0.64 per diluted share, outperforming the analyst estimate of $0.60.

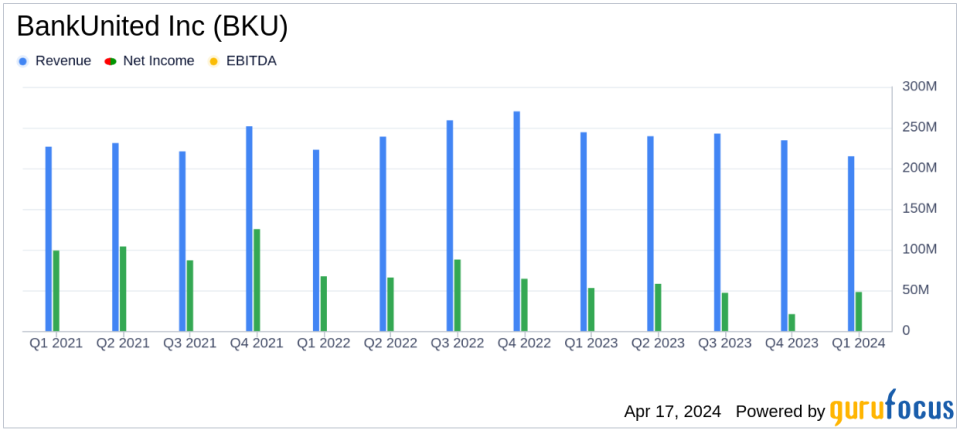

Revenue: Details on revenue were not disclosed in the summary, comparison with the estimate of $239.96 million remains unaddressed.

Dividend Increase: Announced a dividend increase to $0.29 per share, marking a 7% rise.

Loan Portfolio: Total loans saw a reduction, influenced by strategic decisions and market conditions.

Asset Quality: Improved with a lower non-performing assets ratio and a robust increase in the ACL to loans ratio.

Liquidity and Capital: Maintained strong liquidity and a robust capital position, with CET1 at 11.6%.

BankUnited Inc (NYSE:BKU) released its 8-K filing on April 17, 2024, detailing its financial results for the first quarter ended March 31, 2024. The Miami Lakes-based bank holding company reported a net income of $48.0 million or $0.64 per diluted share, showing a significant improvement from the previous quarter's $20.8 million, or $0.27 per diluted share, and a slight decrease from $52.9 million, or $0.70 per diluted share, year-over-year.

BankUnited is a key player in the regional banking sector, primarily serving Florida and New York City, with a focus on small to middle-market businesses. The bank's strategic initiatives this quarter included enhancing its funding mix and maintaining a stable net interest margin, which stood at 2.57%. Notably, the bank has successfully increased its non-interest bearing demand deposits by $404 million and reduced its reliance on wholesale funding by $1.4 billion compared to the previous quarter.

The bank's loan portfolio experienced a strategic reduction of $407 million, primarily in residential loans and certain commercial real estate and industrial loans. This was part of a broader balance sheet strategy aimed at optimizing the bank's asset mix in response to market conditions and specific client paydowns.

Asset quality has shown favorable trends with a decrease in the non-performing assets (NPA) ratio to 0.34% and a significant bolstering of the allowance for credit losses (ACL) to 0.90% of total loans, reflecting prudent risk management and credit performance. The bank's capital position remains robust, with a CET1 ratio of 11.6%, reinforcing its financial stability and capacity to support growth.

Despite challenges in the banking sector, BankUnited's management has demonstrated adeptness in navigating market fluctuations, achieving a stable funding structure, and maintaining strong credit quality. The increase in dividends also reflects confidence in the bank's ongoing financial health and its commitment to delivering shareholder value.

For further insights and detailed financial metrics, stakeholders and interested parties are encouraged to view the full earnings report and join the upcoming earnings call scheduled for April 17, 2024, as detailed in BankUnited's Investor Relations announcements.

Explore the complete 8-K earnings release (here) from BankUnited Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance