This is how banks can win your trust back: Deloitte

Australians’ faith in banks have been bruised by multiple blows from the royal banking commission over the last 11 months, in what a new Deloitte report is calling a “crisis of trust”.

But how can banks move forward? What are the Australian people looking for in their banks?

Also read: The Chaser’s Julian Morrow sounds a warning to consumers

As it turns out, the devil is not in the detail. It’s actually not the technicalities that Aussie bank customers want from the institutions they bank with, according to the Deloitte Trust Index – Banking 2018.

What they want is much more simple: honesty and integrity.

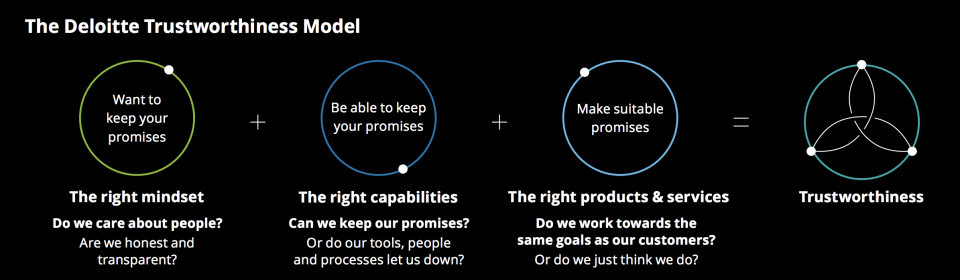

“The Index indicates the greatest driver of perceptions of trustworthiness among bank customers is a mindset of consistently keeping promises,” said Deloitte Trust Index author Willem Punt.

Being upfront about and actively disclosing mistakes is highly correlated with trust, the report said.

This would be key for banks moving forward, Deloitte consulting partner and innovation strategy lead Andy Bateman pointed out.

“The way forward to rebuild reputation and trust in today’s business world is far more about communities and relationships and far less about transactions,” he said.

“The companies that get this, at the deepest level, are exhibiting the kinds of behaviours that genuinely build trust.”

The second-most important thing to consumers is a bank’s ability to be able to deliver what they say they will.

“Customers expect banking products and services to work, and in the current climate limited trust is gained through technical competency,” the report said.

Punt noted that trust was particularly important given that competition in the banking sector was heating up.

“Being trusted becomes even more critical in an open banking environment where banks will have to contend with the possibility of losing customers to more trusted competitors, as the barriers to exit continue to fall and new entrants join the road to open banking,” Punt said.

Lowest down on the list of priorities for banking customers was having the ‘right products and services’, with the Index finding this to have a weak correlation with trustworthiness.

“Customers consider the mindset of the seller far more important in rebuilding trust than the detailed characteristic of what is being sold,” the report said.

Also read: This is why Aussies are shying away from Big 4 banks

Punt noted that customers wanted banks to exhibit the “right mindset” and to be treated with “respect and integrity”.

“This is most important,” he said. “Only then will the right price, technology and product become significant.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance