Bank savings going nowhere? Here's how to take some control back

Something very strange is happening in the Australian economy: interest rates are low. Really low.

In 1981, the average interest rate was roughly 17 per cent. Today, the cash rate is under 1 per cent.

The reason for the ‘extreme’ monetary policy is to stimulate the economy.

At home economic growth is so sluggish there’s a greater likelihood your boss will tap you on the shoulder and show you the door.

And even if you keep your job, it’s unlikely you’ll be able to bag a pay rise.

More from Dave Taylor: Worried about a recession? You could be in the wrong job

More from Dave Taylor: Global recession storm clouds are now overhead: Here's how it affects you

More from Dave Taylor: 3 reasons you don't want a recession

And overseas risks? Take your pick: the US-China trade war; Brexit; the European debt debacle and Hong Kong’s economy (hostage to recent protests).

There’s a lot threatening Australians households and investors.

That’s why in recent months we’ve seen such big swings on the stock market, and it’s precisely why so many people choose to stash their hard-earned money in the bank.

However, with interest rates so low, what is a saver to do? Stay the course and hunker down, or look elsewhere?

Here are some options.

Best savings accounts?

Based on data from finder, U Bank, AMP, HSBC and Suncorp all have competitive savings accounts.

All their deposit rates are between 2 and 3 per cent.

The problem I have with all of these products is in the fine print. For example, all of these financial institutions require the saver to deposit hundreds of dollars each month, and even if you can do that, the bank could drop the interest rate down significantly after the “introductory” rate period ends.

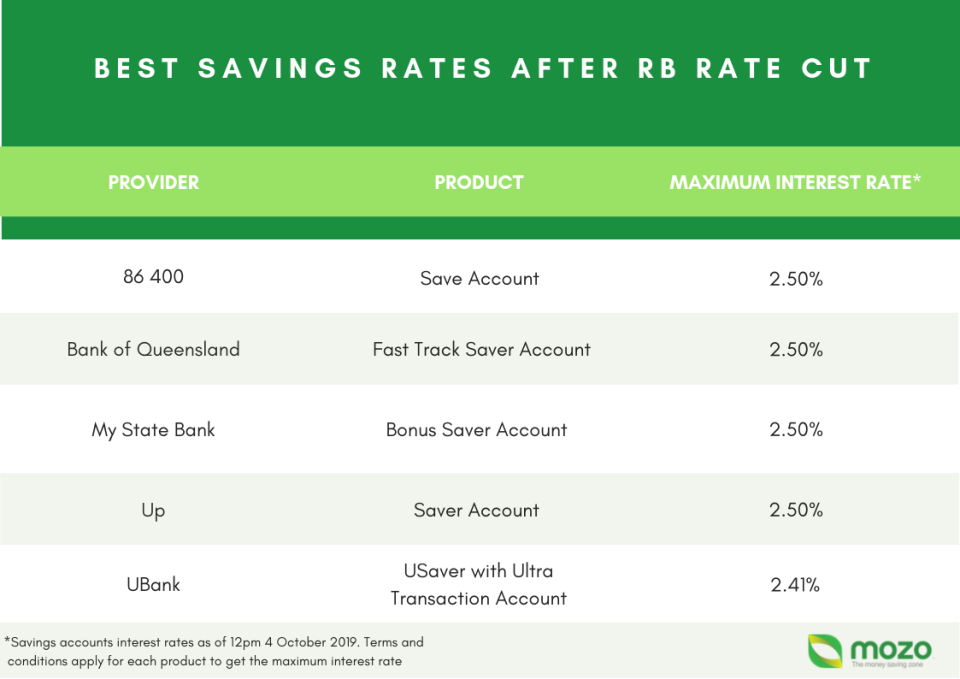

Mozo also has some data on savings comparisons.

It’s a harsh reality but saving in Australia right now is tough.

Banking analyst Brett Le Mesurier from Shaw & Partners pulls no punches, describing savers as “collateral damage” in the broader fight to support the Australian economy.

The expectation too is that interest rates will fall further still.

That leaves savers with two options: suck it up and accept you’ll earn next to nothing by putting your money in the bank; or look for alternatives.

Alternatives to bank deposits

I really believe everyone should know what their investing options are. Broadly there are three. They’re called “asset classes”. They are fixed interest (savings), stocks (share market), and property.

We know you earn very little on savings, and property, for younger Australians is virtually impossible to break into, which leaves shares.

Now, here’s the thing, share investing doesn’t need to be reserved for the rich. It all depends on how you approach it.

I want to explain something very simple to you. You need at least $500 in your bank account to get a foot hold in the stock market.

It’s known as the ‘minimum marketable parcel of shares’. Beyond that, all bets are off! You can basically top up your holdings as you like within reason.

So, right now, the stock market looks like an obvious place to save money. The reason why many people still shy away from it is because it’s stressful.

Last week, for example, global stock markets fell dramatically overnight. That basically means that as Australian shareholders go to bed at night, there’s the chance when they wake up in the morning, their shareholdings stand to fall a lot at the open of trade.

This is where I want to make a crucial point. If you’re a saver, there’s no reason to treat the share market any differently to a bank account – you stick with it over an investment ‘time horizon’, stay unemotional and disciplined about it, and you hope for the best.

There’s every expectation the stock market could correct (fall heavily) in the next 12 months, but if you’re keen to earn more than 1 to 2 per cent on your cash, it’s potentially worth the risk. Why? Well because you could arguably invest the minimum amount now, then top up following a correction.

You’re effectively ‘saving’ via the sharemarket.

The hard fact remains: over the longer term, you will make more money on the share market than with cash in the bank.

How to save money without being a hermit

The only obvious problem remaining is how incredibly difficult it is to save.

Even if you’re on an average income, after you’ve paid rent, your monthly mortgage repayment, gas and utility bills, the car rego and insurance… chances are you’re actually going backwards.

However, consider this: set up a separate account with your bank – designated for saving. Each month put a small amount into it: say $20 or $50. Then, if that all goes ok, put more and more in each month.

You may find that, after a year, you’re comfortable putting a couple of hundred dollars away each month.

If you can’t, see where you can find some savings – get a better deal on your car insurance, or switch utility providers.

If you can find the extra cash, and put that into a higher returning investment, like shares, you’ll avoid being ‘collateral damage’.

There are no easy solutions to this savings business, but you do have options.

@DaveTaylorNews

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance