Baker Hughes (BHGE) to Report Q1 Earnings: What's in Store?

Baker Hughes, a GE company BHGE is set to release first-quarter 2019 results before the market opens on Apr 30. Based in Houston, TX, Baker Hughes is one of the world’s largest oilfield service providers. The company’s integrated oilfield products and digital solutions help customers to acquire, refine, and transport hydrocarbons efficiently and cost effectively, with low environmental concerns.

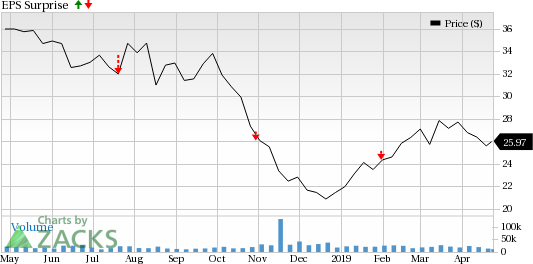

In the last reported quarter, the company’s earnings of 26 cents per share missed the Zacks Consensus Estimate by a penny due to lower contributions from Bently Nevada and Controls businesses. In the trailing four quarters, the company delivered a positive earnings surprise of 3.4%, beating estimates just once. In the to-be-reported quarter, it is expected to report earnings of 14 cents per share.

Baker Hughes, a GE company Price and EPS Surprise

Baker Hughes, a GE company Price and EPS Surprise | Baker Hughes, a GE company Quote

Let’s see how things are shaping up for this announcement.

Which Way are Estimates Trending?

Let’s take a look at estimate revisions to get a clear picture of what analysts are thinking about the company before the earnings release.

The Zacks Consensus Estimate for first-quarter earnings of 14 cents has witnessed no upward revisions and three downward revisions by firms in the past 30 days. This is indicative of an improvement from the reported earnings of 9 cents in the year-ago quarter.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $5.6 billion, suggesting an improvement of 4% from the year-ago reported figure.

Factors at Play

Explorers are focusing more on shale oil and gas rather than conventional production. The growing need for advanced and complex techniques for extracting hydrocarbons from shale and offshore deep-water regions is expected to be reflected in Baker Hughes’ first-quarter earnings.

The Zacks Consensus Estimate for first-quarter operating income from the Digital Solutions unit is pegged at $73 million. This estimated figure is flat with the year-ago reported number but lower than $115 million in the last reported quarter.

The Oilfield Equipment segment is expected to generate an operating income of around $2 million compared with the year-ago period’s reported loss of $6. The expected figure, however, is lower than $12 million profit recorded in fourth-quarter 2018.

The Zacks Consensus Estimate for first-quarter operating income from the Oilfield Services segment is pegged at $178 million, implying a rise from the year-ago reported figure of $141 million but a decline from the last reported quarter’s $224 million.

The Zacks Consensus Estimate for operating income from the Turbomachinery & Process Solutions is pegged at $114 million, indicating a decrease from $257 million in fourth-quarter 2018 and $119 million in the year-ago period.

Total orders from all the segments for the first quarter is expected to be almost $7 billion, suggesting an increase from the year-ago figure of $5.2 billion and the last reported-quarter’s $6.9 billion.

Increase in total orders and rising profit levels from Oilfield Equipment and Oilfield Services units will definitely boost the company’s first-quarter earnings. However, lower profit levels in Turbomachinery & Process Solutions can affect earnings growth in the to-be-reported quarter.

What Our Model Unveils

Our proven model does not conclusively show that Baker Hughes is likely to beat the Zacks Consensus Estimate in the quarter to be reported. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, this is not the case here as elaborated below.

Earnings ESP: Earnings ESP represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate. Baker Hughes has an Earnings ESP of -4.02% as the Most Accurate Estimate stands below the Zacks Consensus Estimate of 14 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Baker Hughes currently carries a Zacks Rank #3. Though a Zacks Rank of 3 increases the predictive power of ESP, a negative ESP makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

We caution against Sell-rated stocks (Zacks Ranks #4 and 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Energy Stocks With Favorable Combination

Here are some companies from the energy space which, according to our model, have the right combination of elements to post an earnings beat in the upcoming quarterly reports.

Houston, TX-based Apache Corporation APA has a Zacks Rank #2 and an Earnings ESP of +28.93%. The company is scheduled to report quarterly earnings on May 1.

Oklahoma City, OK-based Continental Resources, Inc. CLR has a Zacks Rank #3 and an Earnings ESP of +0.42%. The company is slated to report first-quarter earnings on Apr 29.

Denver, CO-based Antero Resources Corporation AR has a Zacks Rank #3 and an Earnings ESP of +0.59%. The company is set to report first-quarter earnings on May 1.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Apache Corporation (APA) : Free Stock Analysis Report

Antero Resources Corporation (AR) : Free Stock Analysis Report

Baker Hughes, a GE company (BHGE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance