Baidu (BIDU) to Report Q4 Earnings: What's in the Cards?

Baidu, Inc. BIDU is scheduled to report fourth-quarter 2019 results on Feb 27.

For fourth-quarter 2019, the company expects revenues between $3.78 billion and $4.02 billion. The Zacks Consensus Estimate for revenues is pegged at $3.96 billion, indicating growth of 0.2% from the year-ago quarter.

Further, the Zacks Consensus Estimate for earnings is pegged at $2.68 per share, suggesting an improvement of 39.6% from the prior-year reported figure.

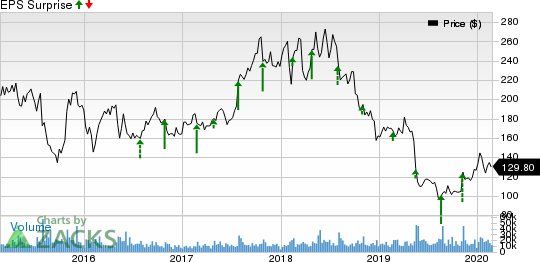

The company has beaten estimates in three of the trailing four quarters, while matching once. It has a trailing four-quarter positive earnings surprise of 27.7%, on average.

Baidu, Inc. Price and EPS Surprise

Baidu, Inc. price-eps-surprise | Baidu, Inc. Quote

Factors at Play

Baidu’s sustained efforts to strengthen mobile search engine and AI tools are likely to have contributed to the fourth-quarter performance.

Moreover, deepening focus toward bolstering its AI business remained a tailwind. Its robust DuerOS voice assistant and Baidu Cloud are expected to have benefited the performance of this business during the to-be-reported quarter.

Notably, monthly voice queries on DuerOS exceeded the mark of 4.2 billion in September 2019, which increased more than 4.5-fold year over year. This trend is likely to have continued in the quarter under review on the back of expanding DuerOS skills store, which offers more than 3,200 skills across various genres.

We believe enhanced AI skills and DuerOS supported smart devices portfolio that includes Xiaodu smart speakers are expected to have bolstered Baidu’s user base in the fourth quarter.

Apart from this, the company’s strengthening presence in the autonomous driving space has been acting as a key catalyst. Baidu’s autonomous driving licenses, which currently total 150, are expected to have aided performance of its open-source autonomous vehicle technology platform, Apollo, in the to-be-reported quarter.

Further, strengthening Baidu's mobile ecosystem is expected to have contributed to growth in average daily active user base of Baidu App during the fourth quarter. Moreover, hosted solutions on Baidu App such as BJH account, smart mini program and Managed Page are expected to have driven the Baidu Core segment’s fourth-quarter performance.

Additionally, the company’s strong iQIYI segment, which offers online entertainment service, is expected to have contributed to the to-be-reported quarter performance.

However, mounting investment costs might have hurt the company’s margin expansion in the fourth quarter. Further, increasing competition from players like Alibaba BABA and Tencent’s TCEHY WeChat is likely to get reflected in the fourth-quarter results.

What Our Model Says

Our proven model conclusively predicts an earnings beat for Baidu this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Baidu has an Earnings ESP of +38.81% and a Zacks Rank #3.

Another Stock to Consider

Here is another stock that you may consider, as our proven model shows that this too has the right combination of elements to post an earnings beat this quarter.

Benefitfocus, Inc BNFT has an Earnings ESP of +35.48% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance