B. Riley Financial (NASDAQ:RILY) Is Paying Out A Dividend Of $1.00

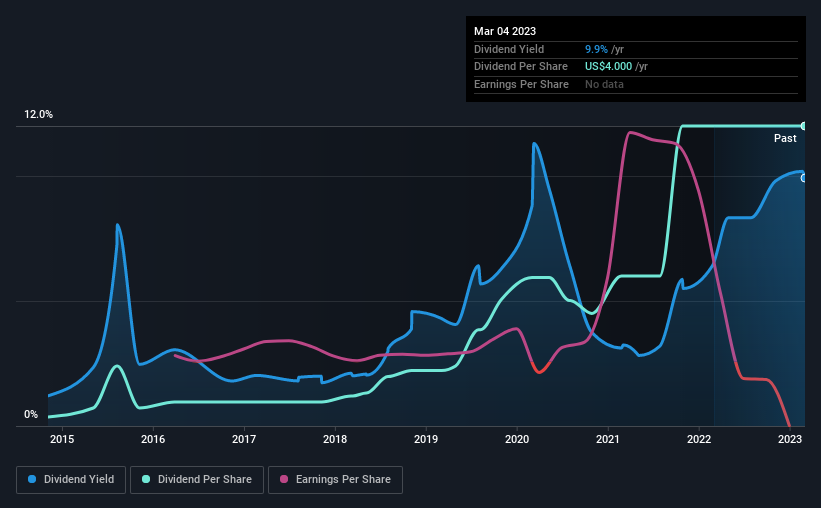

B. Riley Financial, Inc. (NASDAQ:RILY) will pay a dividend of $1.00 on the 23rd of March. This makes the dividend yield 9.9%, which will augment investor returns quite nicely.

View our latest analysis for B. Riley Financial

B. Riley Financial Might Find It Hard To Continue The Dividend

If the payments aren't sustainable, a high yield for a few years won't matter that much. Even while not generating a profit, B. Riley Financial is paying out most of its free cash flows as a dividend. Paying a dividend while unprofitable is generally considered an aggressive policy, and with limited funds retained for reinvestment, growth may be slow.

Looking forward, earnings per share could rise by 26.6% over the next year if the trend from the last few years continues. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

B. Riley Financial's Dividend Has Lacked Consistency

Looking back, B. Riley Financial's dividend hasn't been particularly consistent. This suggests that the dividend might not be the most reliable. Since 2015, the dividend has gone from $0.12 total annually to $4.00. This implies that the company grew its distributions at a yearly rate of about 55% over that duration. B. Riley Financial has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. We are encouraged to see that B. Riley Financial has grown earnings per share at 27% per year over the past five years. The company hasn't been turning a profit, but it running in the right direction. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about B. Riley Financial's payments, as there could be some issues with sustaining them into the future. Strong earnings growth means B. Riley Financial has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, B. Riley Financial has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance