Bénéteau And Two More Euronext Paris Dividend Stocks To Consider

Amidst a backdrop of general market recovery in Europe, with France's CAC 40 Index experiencing notable gains, investors are increasingly attentive to opportunities within the dividend stock arena. Given the current economic climate and market dynamics, stocks that offer consistent dividend payouts are particularly appealing for those seeking potential income alongside capital appreciation.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Samse (ENXTPA:SAMS) | 9.47% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 7.27% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.74% | ★★★★★★ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.08% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.29% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.17% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.82% | ★★★★★☆ |

Carrefour (ENXTPA:CA) | 6.32% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.53% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.13% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bénéteau

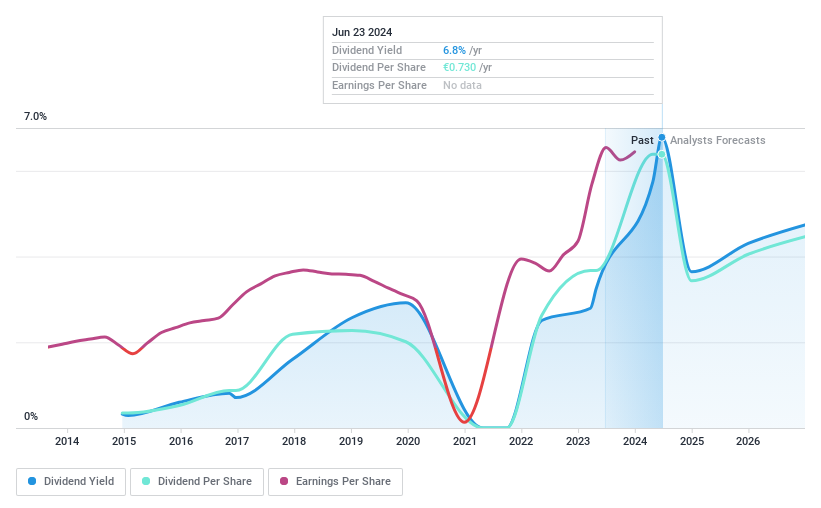

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bénéteau S.A. is a company based in France that designs, manufactures, and sells boats and leisure homes globally, with a market capitalization of approximately €0.87 billion.

Operations: Bénéteau S.A. generates €1.47 billion in revenue primarily from its boat manufacturing segment.

Dividend Yield: 6.8%

Bénéteau maintains a low payout ratio of 37.2%, suggesting dividends are well-covered by earnings, despite some inconsistencies in dividend reliability and coverage by cash flows over the past decade. The stock trades at a significant discount, valued 62% below estimated fair value, and offers a high yield of 6.78%, ranking in the top quartile among French dividend payers. However, analysts anticipate an average earnings decline of 7% annually over the next three years, raising concerns about future dividend sustainability and growth.

Vinci

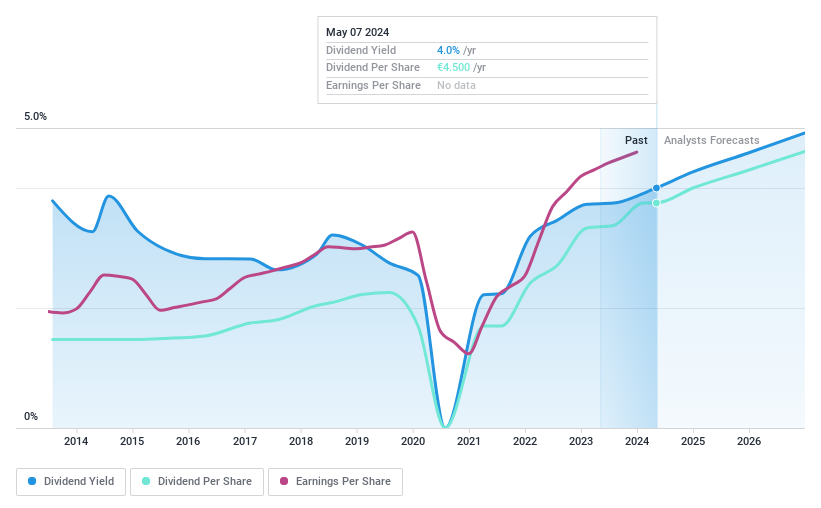

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA operates in the concessions, energy, and construction sectors both in France and globally, with a market capitalization of approximately €58.30 billion.

Operations: Vinci SA generates revenue through several key segments: VINCI Energies (€19.33 billion), VINCI Construction including Eurovia (€31.46 billion), Concessions - VINCI Autoroutes (€6.88 billion), Concessions - VINCI Airports (€4.23 billion), Cobra IS (€6.50 billion), Other Concessions (€0.73 billion), and VINCI Immobilier and Holding Companies (€1.23 billion).

Dividend Yield: 4.4%

Vinci's dividend profile shows a mix of strengths and concerns. Its dividends, growing over the past decade, are supported by earnings with a payout ratio of 54.4% and cash flows at 35.8%. However, Vinci's dividend yield stands at 4.42%, below the top quartile of French dividend stocks at 5.55%. Recent financial performance includes a slight decline in Autoroutes traffic but an increase in Airport passenger numbers, indicating varied sectoral dynamics within the company as of May 2024.

TotalEnergies

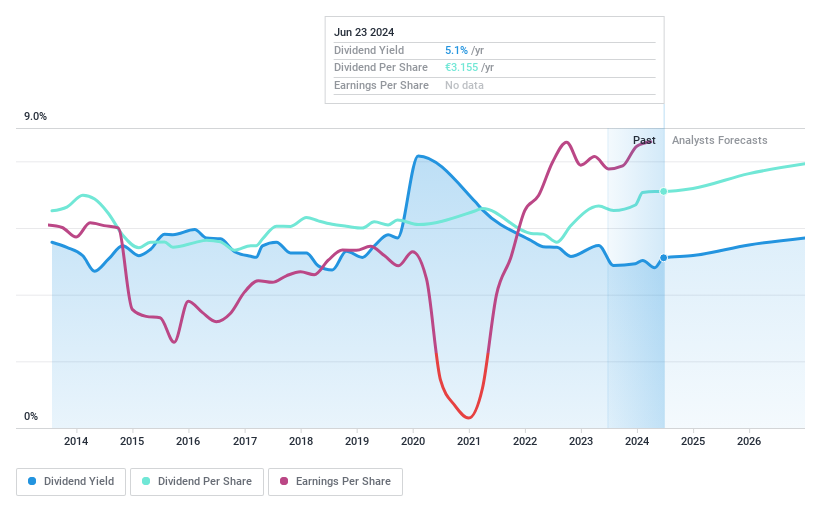

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TotalEnergies SE is a diversified energy company engaged in the production and marketing of oil, biofuels, natural gas, green gases, renewables, and electricity across various regions including France, the rest of Europe, North America, Africa, and internationally; it has a market capitalization of approximately €142.97 billion.

Operations: TotalEnergies SE generates revenue from several key segments: Integrated LNG at $22.16 billion, Integrated Power at $29.10 billion, Marketing & Services at $71.62 billion, Refining & Chemicals at $135.72 billion, and Exploration & Production at $47.53 billion.

Dividend Yield: 5.1%

TotalEnergies has a mixed dividend profile. Its dividends are well-supported by both earnings and cash flows, with payout ratios of 37.4% and 36.2%, respectively, indicating sustainability. However, its dividend payments have shown volatility over the past decade and its current yield of 5.11% is below the French market's top quartile for dividend stocks at 5.55%. Despite these challenges, TotalEnergies trades at a discount to fair value and analysts expect its stock price to rise significantly in the near term. Recent strategic alliances and expansions into new energy projects underline its ongoing transformation and commitment to sustainable energy solutions.

Click here to discover the nuances of TotalEnergies with our detailed analytical dividend report.

Upon reviewing our latest valuation report, TotalEnergies' share price might be too pessimistic.

Summing It All Up

Investigate our full lineup of 32 Top Euronext Paris Dividend Stocks right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:BEN ENXTPA:DG and ENXTPA:TTE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance