AxoGen's (AXGN) New Launch to Aid Peripheral Nerve Protection

AxoGen AXGN recently announced the full launch of its latest product, Avive+ Soft Tissue Matrix. Avive+ is a resorbable, multi-layer amniotic membrane allograft designed for use as a soft tissue barrier. It offers temporary tissue separation and protection during the crucial stage of peripheral nerve recovery.

With the introduction of Avive+ Soft Tissue Matrix, Axogen is likely to enhance its comprehensive solutions for nerve protection and address a significant need for patients with compression or non-transected nerve injuries.

More on the Launch

Nerve protection, which includes crush injuries, various non-transected traumatic nerve injuries, carpal and cubital tunnel syndromes, and other traumas, accounts for around $800 million of the total nerve repair market. Given the market potential, Axogen’s latest launch is likely to boost the company’s business and generate additional revenues.

With its specialized array of solutions, Axogen is dedicated to enhancing outcomes for patients by addressing the specific needs of each injury type and the healing process. The company's current line of nerve protection products, which also includes Axoguard Nerve Protector and Axoguard HA+ Nerve Protector, is enhanced with the addition of Avive+ Soft Tissue Matrix.

The multi-layer design of the Avive+ Soft Tissue Matrix is likely to provide ideal handling and a robust barrier that retains the inherent properties of an amniotic membrane and the opportunity to improve patient outcomes after acute traumatic injury.

More on Axogen’s Product Portfolio

Axogen's platform for peripheral nerve repair features a comprehensive portfolio of products used across various applications and surgical specialties, including traumatic injuries, oral and maxillofacial surgery, breast reconstruction, and the surgical treatment of pain. These applications encompass both scheduled and emergent procedures.

The company’s other products include Axoguard Nerve Connector, a porcine (pig) submucosa extracellular matrix (ECM) coaptation used for tensionless repair of severed peripheral nerves.

AxoGen’s porcine submucosa ECM product, Axoguard Nerve Protector, is used for wrapping and protecting damaged peripheral nerves and reinforcing nerve reconstruction while preventing soft tissue attachments.

AxoGen’s Axoguard Nerve Cap, a porcine submucosa ECM product, is used to protect a peripheral nerve end and separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma.

The company’s Avive+ Soft Tissue Matrix, a multi-layer amniotic membrane allograft, is intended to protect and separate tissues in the surgical bed during the critical phase of tissue repair.

AxoGen’s Axotouch Two-Point Discriminator is used to measure the innervation density of any surface area of the skin.

Industry Prospects

Per a report by Grand View Research, the global peripheral nerve injury market, which was valued at $1.5 billion in 2023, is expected to witness a growth rate of 7.7% from 2024 to 2030.

The market growth is attributed to the increasing aging population and the rising prevalence of peripheral nerve injuries globally. Moreover, increasing government initiatives and reimbursement policies are expected to further boost market growth. The market is expected to expand due to the high number of orthognathic surgeries, third-molar surgeries, dental implants, anesthetic injections, and mandibular resection procedures.

Notable Developments

In April 2024, AxoGen announced the first surgical implantations of its newest product, Avive+ Soft Tissue Matrix. Avive+ Soft Tissue Matrix is a resorbable, multi-layer, placenta-based allograft that provides temporary protection and tissue separation during the critical phase of healing for nerves.

Price Performance

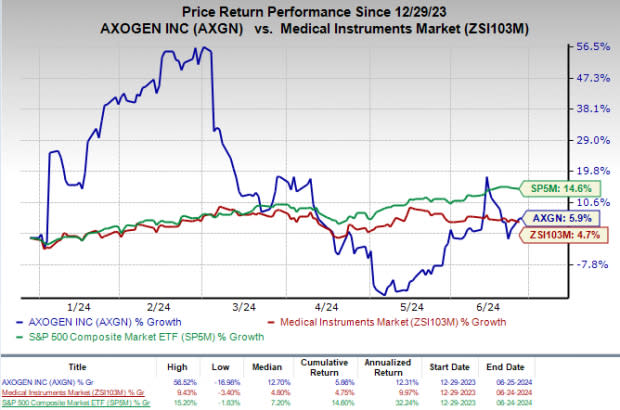

In the year-to-date period, AXGN’s shares have gained 5.9% compared with the industry’s growth of 4.7%. The S&P 500 increased 14.6% in the same time frame.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

AXGN carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are DaVita Inc. DVA, Universal Health Services UHS and Elevance Health, Inc. ELV.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 46.6% compared with the industry’s 15.6% rise in the past year.

Universal Health Services has an Earnings ESP of +2.91% and a Zacks Rank #2 at present. UHS has an estimated earnings growth rate of 30.5% for 2024.

UHS’ earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 8.12%.

Elevance Health’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 2.77%. The consensus estimate for ELV’s 2024 earnings indicates a rise of 12.4% from the year-ago figure. The consensus mark for revenues implies an improvement of 1.1% from the year-ago reported figure.

ELV carries a Zacks Rank #2 at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

AxoGen, Inc. (AXGN) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance