Average price tag on a home dips by just £21 in June

The average price tag on a home dipped by just £21 in June, following a record high in May, according to a property website.

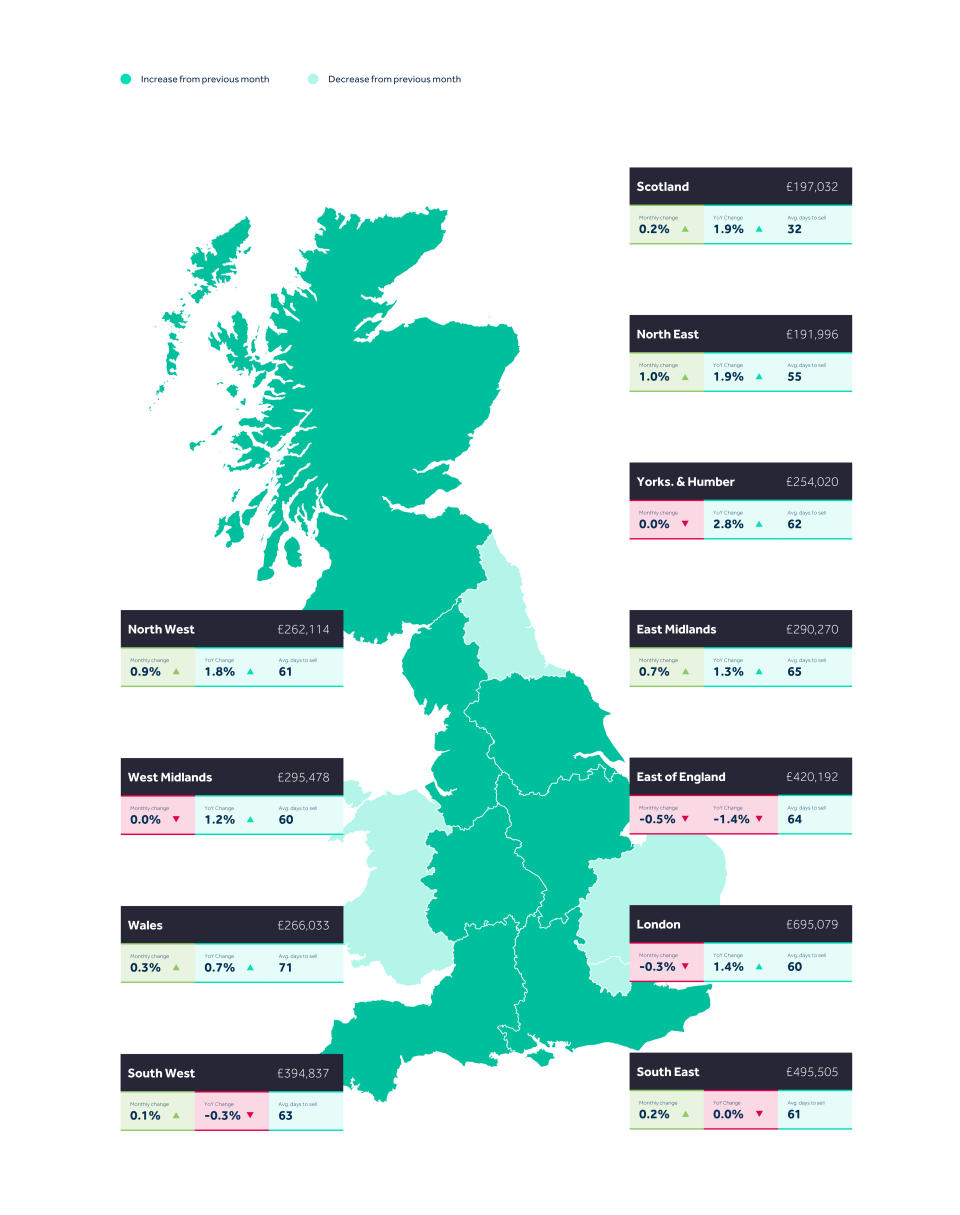

Across Britain, the average price of a home coming fresh on the market in June is £375,110, slightly down compared with May’s record of £375,131, Rightmove said.

The number of sales being agreed has remained steady in recent weeks and the volume of buyer inquiries to agents has also been stable, Rightmove’s report said.

However, it did highlight some “possible election caution” among some would-be sellers, particularly at the top end of the market, some of whom appear to be pausing their plans to see how the weeks ahead unfold.

Tim Bannister, Rightmove’s director of property science said: “It’s always difficult to predict how home movers will react to sudden uncertainty, but looking back through our data, we can see that during previous election campaigns, market activity has remained largely steady.

“This election has followed a similar pattern so far.”

He added: “However, some potential sellers appear to be watching and waiting rather than taking action, evidenced by a dip in the number of new sellers coming to market, particularly at the top end. This is understandable when many of these sellers have more flexibility over when they act, but overall, it appears to be business as usual for the mass market.”

Ian Preston, group chief executive at Yorkshire-based estate agent Preston Baker said: “Whichever government is chosen, the priority must be increasing the supply of new homes.

“Investment in the local authority planning system, to speed up applications, is the priority. The rental price growth has been extraordinary over the past few years, and landlord-friendly policies will be required to attract landlords back into the market.”

Rightmove’s report was released as property firm Hamptons said the cost to tenants of a newly-let home in Britain rose to an average of £1,337 per month in May, which was 6.3% or £79 per month higher compared with the same period in 2023.

Aneisha Beveridge, head of research at Hamptons, said: “High mortgage rates have squeezed buyers with small deposits out of the market, forcing more households to rent for longer.”

She said that despite political parties’ General Election pledges around low deposit mortgage deals “their effectiveness will probably be determined by Threadneedle Street rather than Downing Street.

“The extent to which the Bank of England reduces rates will shape the numbers of would-be buyers with small deposits more than the best-designed government policy.”

Yahoo Finance

Yahoo Finance