Autodesk (ADSK) Q3 Earnings Beat Estimates, Revenues Up Y/Y

Autodesk ADSK reported third-quarter fiscal 2020 non-GAAP earnings of 78 cents per share that beat the Zacks Consensus Estimate by 6.9%. Moreover, the figure was much better than earnings of 29 cents posted in the year-ago quarter.

The earnings figure also surpassed management’s non-GAAP earnings guidance of 70-74 cents per share.

Revenues of $842.7 million comfortably surpassed the consensus mark of $824 million and grew 27.5% year over year. At constant currency (cc), revenues were up 28%. Acquisitions contributed 4% to revenue growth.

The figure beat the management’s guided range of $820-$830 million.

Recurring revenues represented 96% of Autodesk’s third-quarter fiscal 2020 revenues, flat year over year.

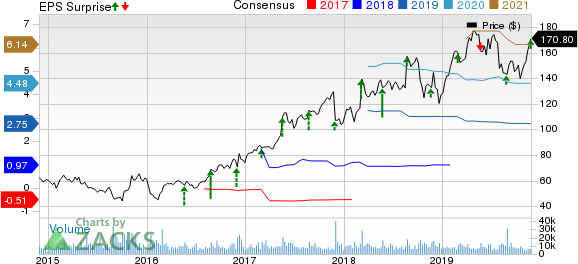

Autodesk, Inc. Price, Consensus and EPS Surprise

Autodesk, Inc. price-consensus-eps-surprise-chart | Autodesk, Inc. Quote

Top-Line Details

Subscription revenues (84.8% of revenues) soared 48.6% year over year to $715 million. However, maintenance revenues (10.8% of revenues) slumped 39.2% to $91.2 million.

Revenues were also positively impacted by a 23.7% year-over-year increase in other revenues (4.3% of revenues), which totaled $36.5 million in the reported quarter.

Geographically, revenues from the Americas (41.5% of revenues) increased 30.1% from the year-ago quarter to $349.3 million. Europe, Middle East and Africa (EMEA) revenues (39.1% of revenues) increased 23.7% to $329.6 million. Revenues from Asia-Pacific (19.4% of revenues) grew 30.1% to $163.8 million.

Autodesk’s top line improved slightly in the United Kingdom and central Europe. The commercial business in China continued to perform well despite a slowdown in state owned enterprises.

Billings of $1.01 billion surged 55% year over year in the reported quarter.

Product-Wise Top-Line Details

Autodesk offers primarily four product families, Architecture, Engineering and Construction (AEC), AutoCAD and AutoCAD LT, Manufacturing (MFG), and Media and Entertainment (M&E).

AEC (42.5% of revenues) revenues surged 35.7% year over year to $358 million. AutoCAD and AutoCAD LT (29.1% of revenues) revenues rose 28.8% to $245.4 million. MFG (21.6% of revenues) revenues increased 15% to $182.2 million. M&E (6% of revenues) grew 16.1% to $50.6 million. Moreover, other revenues (0.8% of revenues) jumped 47.7% to $6.5 million.

Annualized Recurring Revenues in Detail

Annualized Recurring Revenues (ARR) were $3.22 billion, up 28% year over year. Acquisitions (completed over the trailing 12 months) contributed $113 million to ARR. Notably, BIM 360 ARR growth accelerated in the reported quarter.

Subscription plan ARR of $2.86 billion surged 49% (50% at cc). The figure includes $597 million related to the maintenance-to-subscription (M2S) program.

M2S conversion rate increased to an all-time high of 40%. The growth in conversion rate was primarily due to 20% increase in maintenance renewal prices, making it more cost effective for customers to shift subscription based pricing.

However, maintenance plan ARR of $365 million declined 39% (40% at cc) from the year-ago quarter.

Core ARR rose 23% year over year to $2.99 billion. Cloud ARR skyrocketed 164% to $232 million, driven by strong performance in construction. Organic Cloud ARR, which primarily comprises BIM 360 and Fusion 360, soared 35%.

Net revenue retention rate was within the fiscal 2019 range of 110-120%.

Autodesk also signed 19 license compliance deals worth more than $500K. Three of these deals were worth more than $1 million. This reflected that the company is successfully monetizing its non-paying user base.

Operating Results

Non-GAAP gross margin expanded 180 basis points (bps) from the year-ago quarter to 92.2%.

Research & development, marketing & sales and general & administrative expenses as a percentage of revenues declined 290 bps, 620 bps and 190 bps year over year, respectively.

As a result, non-GAAP operating expenses, as a percentage of revenues, declined to 65.4% from 76.4% reported in the year-ago quarter.

The lower operating expenses reflected disciplined cost management in the reported quarter.

Autodesk reported non-GAAP operating income of $225.3 million compared with the year-ago quarter’s figure of $92.2 million.

Key Q3 Details

During the quarter, the company announced Autodesk Construction Cloud.

Moreover, Autodesk announced a partnership with ANSYS, which allows its customers to use simulation solutions of the latter while running generative design workflows in Fusion 360.

The company also launched design-through-make electronics workflow in Fusion 360 to take advantage of the expanding market for smart products.

Balance Sheet & Cash Flow

As of Oct 31, 2019, Autodesk had cash and cash equivalents (including marketable securities) of $1.02 billion compared with $991.3 million as of Jul 31, 2019.

Deferred revenues increased 35% to $2.42 billion. Unbilled deferred revenues at the end of the third quarter were $549 million.

Remaining performance obligations (RPO) totaled $2.97 billion, up 32%. Current RPO totaled $2.05 billion, up 23%.

During the third quarter, Autodesk paid down another $100 million on the term loan associated with the fourth quarter of fiscal 2019 acquisitions.

Moreover, the company repurchased shares worth $124 million. Year to date, Autodesk has repurchased 1.7 million shares for $264 million.

Cash flow from operating activities was $276 million, compared with $219 million posted in the previous quarter. Free cash flow was $267 million, compared with the previous quarter’s figure of $205 million.

Guidance

For fourth-quarter fiscal 2020, Autodesk expects revenues between $880 million and $895 million. The Zacks Consensus Estimate for revenues is pegged at $896.9 million, indicating growth of 21.7% from the figure reported in the year-ago quarter.

Non-GAAP earnings are anticipated to be 86-91 cents per share. The consensus mark for earnings is pegged at 92 cents, indicating 100% growth from the figure reported in the year-ago quarter.

For fiscal 2020, Autodesk expects revenues between $3.26 billion and $3.27 billion, indicating growth of 27% year over year. The Zacks Consensus Estimate for revenues is pegged at $3.25 billion.

Billings are projected to be $4.05-$4.09 billion, implying growth of 50-51% year over year.

Total ARR is expected between $3.405 billion and $3.445 billion, indicating year-over-year growth of 24-25%.

Non-GAAP spend is expected to increase roughly 9%.

Non-GAAP earnings are expected between $2.74 and $2.79 per share. The consensus mark for earnings is pegged at $2.75 per share.

Autodesk expects to retire remaining term loan ($150 million) associated with fourth-quarter fiscal 2019 acquisitions by end of fiscal 2020.

Free cash flow is expected between $1.30 billion and $1.34 billion.

Moreover, long-term deferred revenues are expected in the mid-20% range of total deferred revenues at the end of fiscal 2020.

For fiscal 2021, Autodesk expects revenue and free cash flow growth in the low 20% range.

Zacks Rank & Stocks to Consider

Autodesk currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same industry include CommVault Systems CVLT, Cadence Design System CDNS, and Microsoft MSFT. While CommVault sports a Zacks Rank #1 (Strong Buy), both Cadence and Microsoft carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for CommVault, Cadence and Microsoft is projected to be 10%, 10.5% and 11.9%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CommVault Systems, Inc. (CVLT) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Autodesk, Inc. (ADSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance