Auto Stocks' Earnings Roster for May 6: GM, GPC, CNHI & BWA

A host of companies belonging to the Auto-Tires-Trucks sector are slated to release their quarterly numbers this week. So far, six S&P 500 index components have reported quarterly numbers. While many of the companies managed to beat on earnings despite the coronavirus-related setbacks, most of these witnessed year-over-year declines in profits.

Tesla TSLA and Harley-Davidson HOG beat earnings and revenue expectations in the quarter. Ford F, meanwhile, missed earnings projections due to lower automotive sales across all markets served.

In the last reported quarter, the auto sector’s earnings plummeted 57.1% year over year on a 10.3% revenue decline. In the first quarter of 2020, overall earnings and revenues for the auto sector are projected to be down 88.1% and 11.9% year over year, per the latest Earnings Preview. In fact, the auto sector’s earnings are likely to decline the most among all the 16 sectors.

Let’s take a look at the factors that are likely to have impacted auto stocks during the to-be-reported quarter.

Key Factors

Automakers around the globe are likely to have struggled with declining car sales amid the economic-slowdown concerns due to the coronavirus pandemic. Confirmed cases of COVID-19 have exceeded 3.6 million globally, with the death toll crossing 252,000. Notably, vehicle sales from each of the Detroit 3 carmakers — Ford, General Motors and Fiat Chrysler — dropped year over year during the March-end quarter.

The pandemic has crippled the auto industry, with the closure of factories, dealerships witnessing lower footfall and disruptions in the global supply chains. Amid the pandemic-related uncertainties, several auto firms have withdrawn their annual guidance and are resorting to cost-containment measures in a bid to preserve financial flexibility. Dividend cuts, buyback suspensions, employee layoffs, pay cuts and hiring freezes have become commonplace.

The virus outbreak has resulted in unprecedented challenges for the auto sector, having created a demand shock as consumers’ confidence has dropped significantly. The coronavirus crisis is likely to have dented automakers’ earnings and sales in the quarter under review.

Key Releases on May 6

Let’s take a glance at how these four auto players are placed ahead of their quarterly results, slated for a May 6 release.

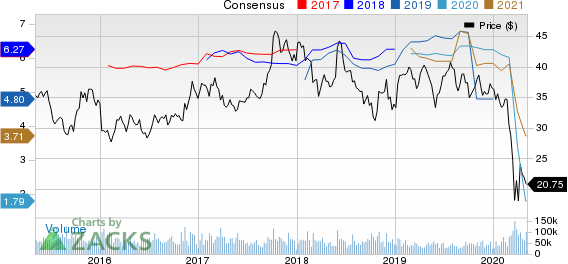

General Motors GM: In the last reported quarter, General Motors delivered solid results on higher-than-anticipated profit in the North American segment. The company beat estimates in each of the trailing four quarters, the average positive surprise being 58.82%.

General Motors Company Price and Consensus

General Motors Company price-consensus-chart | General Motors Company Quote

Our proven model suggests that the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

However, things are not looking up for General Motors as the firm currently carries a Zacks Rank #5 (Strong Sell) and has an Earnings ESP of +42.59%. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 18 cents per share on revenues of $32.59 billion.

General Motors’ SUVs and crossover vehicles, which account for majority of its sales volumes, are becoming popular on low interest rates and gas prices. However, the company is expected to have witnessed a decline in sales volumes amid industry headwinds. General Motors’ customer deliveries in the United States in the quarter under review decreased 7% from the prior-year period to 618,335 deliveries, as the coronavirus outbreak marred demand for vehicles. Furthermore, the company’s inflated product-launch costs, R&D expenses and capital expenditure are expected to have clipped margins during the first quarter. (What's in Store for General Motors This Earnings Season?)

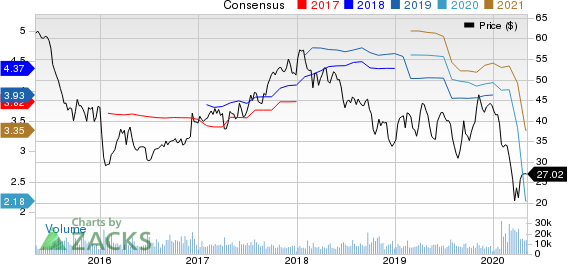

Genuine Parts Company GPC: Genuine Parts delivered stellar results in the fourth quarter of 2019 on a solid Automotive segment. Over the preceding four quarters, the company beat estimates on two occasions for as many misses, the average negative surprise being 0.80%.

Genuine Parts Company Price and Consensus

Genuine Parts Company price-consensus-chart | Genuine Parts Company Quote

Genuine Parts has an Earnings ESP of -7.99% and currently carries a Zacks Rank of 4. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for the quarter’s earnings is pegged at $1.15 a share on revenues of $4.61 billion.

Genuine Parts’ quarterly results will likely reflect positive impact of the company’s acquisitions to improve product offerings and expand its geographical footprint. The acquisitions of PartsPoint and Inenco are likely to have contributed to the company’s operating margin, and consequently, the bottom line. However, heightening coronavirus fears, especially in March, are likely to have thwarted vehicle demand, in turn dampening demand for replacement parts and materials, and business products that are required to repair and maintain vehicles. Genuine Parts also withdrew its full-year guidance and suspended stock buybacks during the January-March quarter. Further, the coronavirus crisis is expected to have hurt the company’s sales due to factory closures and production shutdowns in the United States, the U.K., Europe and Canada. (Genuine Parts to Post Q1 Earnings: What's in Store?)

BorgWarner BWA: The automotive equipment supplier posted solid results in the last reported quarter, mainly on robust performance of the Drivetrain and Engine segments. BorgWarner surpassed estimates in all of the past four quarters, the average positive surprise being 5.95%.

BorgWarner Inc. Price and Consensus

BorgWarner Inc. price-consensus-chart | BorgWarner Inc. Quote

BorgWarner currently carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 49 cents per share on revenues of $2.01 billion.

Borgwarner’s expansion efforts, product launches, strategic collaborations and strong backlog are likely to have aided its first-quarter performance. Nevertheless, the Zacks Consensus Estimate for the Engine segment’s quarterly net sales is pegged at $1,411 million, down from the year-ago quarter’s $1,598 million. In addition, the consensus estimate for its Drivetrain segment’s quarterly net sales is pegged at $891 million, reflecting a decrease from the year-ago quarter’s $982 million. Decline in light-vehicle production across all major markets served, along with supply-chain inefficiencies and higher research and development costs, are likely to have dented its margins to some extent.

CNH Industrial N.V. CNHI: CNH Industrial’s earnings came in line with estimates in the December-end quarter, primarily on solid performance of the Financial Services segment. The company outpaced estimates in each of the trailing four quarters, the average positive surprise being 6.73%.

CNH Industrial N.V. Price and Consensus

CNH Industrial N.V. price-consensus-chart | CNH Industrial N.V. Quote

However, per our model, the stock is unlikely to maintain its earnings beat streak in the quarter to be reported, as it currently carries a Zacks Rank of 3 and has an Earnings ESP of -11.77%. The Zacks Consensus Estimate for the quarter’s earnings is pegged at 7 cents per share on revenues of $5.75 billion.

CNH Industrial’s results are expected to reflect year-over-year revenue declines across all its industrial activities in the quarter. The consensus mark for revenues from Agricultural Equipment and Commercial and Specialty vehicles is pegged at $2,322 million and $2,198 million, calling for a year-over-year decrease of 6.7% and 8.9%, respectively. Notably, the Zacks Consensus Estimate for sales from the Construction Equipment and Powertrain segment is pegged at $522 million and $899 million, suggesting a year-over-year fall of 18.4% and 13.2%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

CNH Industrial N.V. (CNHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance