Auto Stock Earnings Due on Jul 31: ALSN, FOXF, DAN, MTOR

Several important companies in the Auto sector such as Ford Motor Company F, Tesla, Inc. TSLA, LKQ Corporation LKQ have reported their quarterly numbers for the quarter ending Jun 30, 2019.

While Ford reported earnings and revenues beat for the quarter under review, Tesla lagged estimates for both. LKQ’s quarterly earnings surpassed estimates while revenues missed the same.

Per the latest Earnings Preview, the auto sector’s earnings and revenues for the quarter under review are expected to decline 6.7% and 0.2%, respectively, on a year-over-year basis.

Automakers recently reported U.S. sales for June. The overall auto sales performance was mixed for the month as well as for the quarter under review. However, the auto space witnessed fairly strong demand for SUVs and pickup trucks while the same for passenger cars declined.

U.S. auto sales are witnessing a slowdown and the overall domestic new-vehicle sales are expected to decline this year. This can be attributed to rising interest rates and competition from off-lease vehicles and is likely to affect the to-be-reported quarter’s results.

Now, let’s assess a few important automakers, namely, Allison Transmission Holdings, Inc. ALSN, Fox Factory Holding Corp. FOXF, Dana Incorporated DAN and Meritor, Inc. MTOR which are slated to announce their quarterly numbers on Jul 31.

The Zacks methodology helps to find stocks with better prospect by combining a Zacks Rank #1 (Strong Buy) or 2 (Buy) or 3 (Hold) with a positive Earnings ESP.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. Research shows that for stocks, with the combination of a favorable Zacks Rank and Earnings ESP, chances of a positive surprise are as high as 70%.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Headquartered in Indianapolis, IN, Allison Transmission is a designer and manufacturer of fully-automatic transmissions for medium and heavy-duty commercial, and heavy-tactical U.S. defense vehicles.

Our proven model does not conclusively predict an earnings beat for the company in second-quarter 2019. This is because it currently has an Earnings ESP of -1.73% and a Zacks Rank of 3.

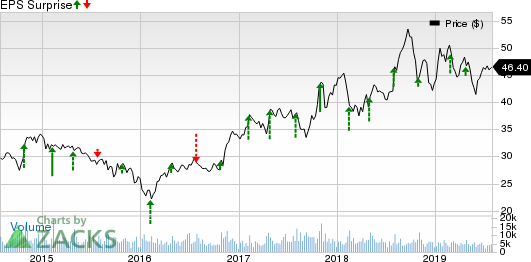

Allison Transmission Holdings, Inc. Price and EPS Surprise

Allison Transmission Holdings, Inc. price-eps-surprise | Allison Transmission Holdings, Inc. Quote

California-based Fox Factory is a designer, manufacturer and marketer of suspension products, used primarily on mountain bikes, side-by-side vehicles, on-road vehicles, off-road vehicles, all-terrain vehicles, snowmobiles, specialty vehicles, and applications and motorcycles.

Our proven model does not conclusively predict an earnings beat for the company in second-quarter 2019. This is because it presently has an Earnings ESP of 0.00% and a Zacks Rank of 3.

Fox Factory Holding Corp. Price and EPS Surprise

Fox Factory Holding Corp. price-eps-surprise | Fox Factory Holding Corp. Quote

Maumee, Ohio-based Dana is a provider of technology driveline, sealing and thermal-management products.

Per our proven model, the company is likely to post an earnings beat in the second-quarter 2019 results as it currently has an Earnings ESP of +0.45% and a Zacks Rank of 3.

Dana Incorporated Price and EPS Surprise

Dana Incorporated price-eps-surprise | Dana Incorporated Quote

Meritor, headquartered in Troy, MI, is a global automotive parts manufacturer and supplier.

Our proven model does not conclusively predict an earnings beat for the company in third-quarter 2019. This is because it has an Earnings ESP of 0.00% and a Zacks Rank of 3 at present.

Meritor, Inc. Price and EPS Surprise

Meritor, Inc. price-eps-surprise | Meritor, Inc. Quote

Today’s Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fox Factory Holding Corp. (FOXF) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Meritor, Inc. (MTOR) : Free Stock Analysis Report

Dana Incorporated (DAN) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance