Auto Roundup: LKQ's Big Buyout & STLA's Electrification Push Grab Eyeballs

Last week, many auto biggies released U.S. vehicle sales data for February 2023. Among the automakers that revealed monthly sales numbers, Ford, Mazda, Hyundai, Kia, Subaru and Volvo registered year-over-year gains, while Toyota and Honda posted a decline in sales. Per Motor Intelligence, the seasonally adjusted annualized rate of sales reached 15.19 million last month, down from January’s 16.21 reading. Per LMC Automotive, U.S. light vehicle sales totaled 1.14 million units in February, up 9.5% year over year, in a sign that the demand for vehicles has not yet been hit by economic uncertainty.

On the news front, LKQ Corp LKQ made big headlines with its decision to acquire Uni-Select Inc. In a bid to bolster its global automotive vehicle parts distribution business. AutoZone Inc. AZO put up an impressive show in its latest quarterly release. Besides pulling off a comprehensive beat, the company's earnings and revenues increased almost 10% each year over year. Close peer Advance Auto Parts, Inc. AAP also beat both top and bottom-line estimates. Meanwhile, Stellantis STLA announced an investment in McEwen Copper to secure copper demand and to support electrification goals in three Indiana plants in North America. Ford F also made it to the top stories as it announced plans to resume production of the F-150 Lightning pickup truck on Mar 13, more than a month after the holding lot caught fire due to a battery issue

Last Week’s Top Stories

LKQ signed an agreement to acquire Uni-Select Inc. for C$2.8 billion ($2.1 billion). Uni-Select’s shareholders would receive C$48 per share. The purchase price represents a 19.2% premium to Uni-Select's closing share price on Feb 24. The all-cash deal is expected to close in the second half of 2023.The acquisition is likely to be accretive to LKQ’s EPS in the first year of its completion itself. LKQ plans to fund the acquisition through a combination of cash on hand and debt.

Uni-Select has a consolidated presence in North America, Canada and the USA through its FinishMaster segment, Canadian Automotive Group segment and GSF Car Parts segment, respectively. Uni-Select’s automotive refinish paint and mechanical parts distribution operations go well with LKQ’s existing footprint and would help LKQ distribute a wide variety of products to its customers. The acquisition will solidify LKQ’s pre-existing business operations in Quebec. By the third year, the strategic acquisition is expected to generate an annual run-rate cost synergy of $55 million. The transaction is expected to boost revenue growth and improve margins. (LKQ to Acquire Uni-Select for $2.1B to Strengthen Prospects)

AutoZone reported earnings of $24.64 per share for second-quarter fiscal 2023, up 10.5% year over year. Earnings surpassed the Zacks Consensus Estimate of $21.33 per share. Net sales grew 9.5% to $3,690.9 million. The top line beat the Zacks Consensus Estimate of $3,539 million. In the reported quarter, domestic commercial sales totaled $954.6 million, up from $843.8 million recorded in the year-ago period. Domestic same-store sales (sales at stores open at least for a year) rose 5.3%.

Gross profit increased to $1,930 million from the prior-year quarter’s figure of $1,785 million. Operating profit slipped 6.9% year over year to $670 million.As of Feb 11, 2023, AutoZone had cash and cash equivalents of $301.3 million, up from $239.4 million on Feb 12, 2022. The total debt amounted to $7,042.3 million as of Feb 11, marking an increase from $5,840.8 million on Feb 12, 2022. (AutoZone Maintains Its Beat Streak in Q2 Earnings)

Advance Auto reported adjusted earnings of $2.88 per share for fourth-quarter 2022, an increase of 39.1% from the year-ago quarter figure. The reported figure outpaced the Zacks Consensus Estimate of $2.41 a share. Advance Auto generated net revenues of $2,474 million, surpassing the Zacks Consensus Estimate of $2,422 million and increasing 3.2% from the year-ago reported figure. Comparable store sales increased 2.1%. Adjusted operating income increased 23.6% year over year to $218.5 million. Adjusted SG&A expenses totaled $942.5 million for fourth-quarter 2022, down 0.4% year over year.

Advance Auto estimates 2023 net sales in the band of $11.4-$11.6 billion. Comparable store sales are envisioned to range between 1% and 3%. Adjusted operating income margin is envisioned in the range of 7.8%-8.2%. Advance Auto expects its 2023 capex to be in the range of $300-$350 million. The company targets a minimum FCF of $400 million. EPS is forecast between $10.2 and $11.2. The company aims to open 60 to 80 new stores this year. (Advance Auto's Q4 Earnings Beat, Revenues Increase Y/Y)

Stellantis became McEwen Copper’s second-largest shareholder after acquiring an equity stake of 14.2% for $155 million in McEwen Mining’s subsidiary. McEwen Mining owns the Los Azules project in Argentina and the Elder Creek project in Nevada. Starting in 2027, Los Azules targets producing 100,000 tons per year of cathode copper.Los Azule is one of the top 10 international projects in the development of copper and by making this investment, Stellantis will be able to meet its projected copper demand starting 2027.

Stellantis also announced plans to invest $155 million in Indiana Transmission, Kokomo Transmission and Kokomo Casting Plants to localize the production of a new electric drive module. The electric drive module consists of three components combined into a single module to achieve improved performance at a low cost. The module will be integrated in more than 25 battery electric vehicles, scheduled for launch between now and 2030, designed on the STLA Frame and STLA Large platform. Due to its optimized efficiency, this module can help each platform achieve a driving range of 500 miles. (Stellantis to Invest $155M Each in Two New Projects)

Ford prepares to restart the production of the F-150 Lightning on Mar 13, 2023, after suspending its production in early February due to a potential battery-related issue. Ford’s battery supplier, SK On, started the production of battery cells again in its Georgia plant. The production timeline will allow SK to build up production of battery packs and deliver them to Ford’s Michigan-based truck production plant.

Ford, in a statement to CNBC, said, “In the weeks ahead, we will continue to apply our learnings and work with SK On’s team to ensure we continue delivering high-quality battery packs — down to the battery cells. As REVC ramps up production, we will continue holding already-produced vehicles while we work through engineering and parts updates.”Investors have been closely following the progress of F-150 Lightning since it is Ford’s first mainstream electric pickup truck and a major element in deciding the trajectory of the business going forward. (Ford to Resume Production of F-150 Lightning on Mar 13)

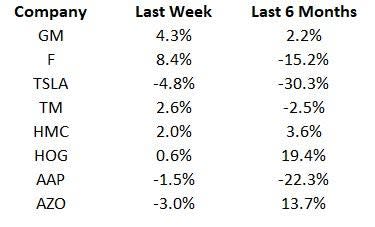

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

Industry watchers will track China vehicle sales data for February 2023, which will be released by the China Association of Automobile Manufacturers soon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance