Auto Roundup: KMX's Quarterly Show, Ford's C$1.8B Investment & More

Last week, China Association of Automobile Manufacturers (CAAM) released vehicle sales data for March. Vehicle sales in China rose 9.7% year over year to 2.45 million units last month. Meanwhile, sales for the first three months of 2023 contracted 6.7% year on year. Sales of new energy vehicles (NEVs) soared around 34.8% year over year to 653,000 units in March. Sales of NEVs for the first three months of 2023 totaled 1,586,000 units, up 26.2% on a year-over-year basis.

In a bid to tackle the climate crisis and reduce pollution levels, the U.S. Environmental Protection Agency (EPA) has proposed the strictest-ever vehicle emissions standards. The EPA’s ambitious pollution technology standards pave the way for a swifter transition to clean mobility and are set to boost electric vehicle (EV) sales in the United States. EPA’s new proposal seeks to prevent 10 billion tons of CO2 emissions through 2055, which is twice the amount emitted by vehicles in the United States in 2022.

On the news front, used vehicle retailer CarMax Inc. KMX posted quarterly results last week. U.S. legacy automaker Ford F plans to invest C$1.8 billion to transform Oakville Assembly Complex into an EV manufacturing hub. EV charging stock Blink Charging BLNK also made news as it partnered with Catalyst Power and also signed a deal with APCOA. Last but not the least, China’s EV maker XPeng Inc. XPEV hit the headlines as it unveiled its innovative technology, SEPA2.0.

XPEV, BLNK, KMX currently carry a Zacks Rank #3 (Hold), while F is #4 Ranked (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Last Week’s Top Stories

CarMax reported fourth-quarter fiscal 2023 (ended Feb 28, 2023) net earnings per share of 44 cents, topping the Zacks Consensus Estimate of 22 cents on higher-than-anticipated gross profit per unit in the used and wholesale vehicle segments. But the bottom line fell from 98 cents per share recorded in the year-ago period. The auto retailer registered revenues of $5,722.5 million for the quarter ended February. Revenues fell short of the Zacks Consensus Estimate of $5,829 million. The top line also contracted by 25.6% year over year.

CarMax’s used-vehicle net sales totaled $4,531.1 million for the reported quarter, down 21.1% year over year, owing to a decline in units sold. For the fiscal fourth quarter, wholesale vehicle revenues tanked 41.6% from the year-ago level to $1,030.7 million. Other sales and revenues contracted 11.4% year over year to $160.6 million for the fiscal fourth quarter, missing the consensus mark of $168 million. CarMax Auto Finance witnessed a 36.1% year-over-year decline in income to $123.9 million in the quarter that ended February.

The firm had cash/cash equivalents and long-term debt of $314.8 million and $1,909.3 million, respectively, as of Feb 28, 2023. CarMax envisions fiscal 2024 capex at around $450 million. During the fiscal fourth quarter, CarMax did not buy back shares of common stock under the share repurchase program. As of Feb 28, 2023, it had $2.45 billion remaining under the share repurchase authorization. The company opened five new stores in the fiscal fourth quarter. KMX currently operates more than 240 used car stores. In fiscal 2024, it targets to open five stores.

Ford will invest C$1.8 billion in its Oakville, Ontario, manufacturing site to transform it into a high-volume EV manufacturing hub. The core part of the plan is to ramp up the production of electric vehicles and make them widely available. The site will be renamed Oakville Electric Vehicle Complex, and its retooling and transformation will begin in the second quarter of 2024. The on-site production of next-generation EVs will start in 2025. Ford is the first full-line automaker that plans to manufacture EVs in Canada for the North America market. The investment supports Ford’s target of producing 2 million EVs per year by late 2026.

With this investment, Ford will transform its existing site into a state-of-the-art facility that will leverage Ford of Canada’s experienced and skilled workforce. The existing 487-acre Oakville site has one paint building, three body shops and one assembly building. After the transformation, it will have a new 407,000-square-foot on-site battery plant that will utilize components from the BlueOval SK Battery Park in Kentucky. The workers in Oakville will assemble those components to build battery packs that will be installed in EVs.

Apart from the Oakville Electric Vehicle Complex, the auto giant is building BlueOval City, an EV manufacturing ecosystem in West Tennessee and a lithium iron phosphate battery plant in Marshall, MI. Ford is modernizing its vehicle assembly campus in Cologne, Germany, to produce Ford Explorer for European customers and building one of the largest commercial EV battery cell production facilities in Europe. The company is scaling the production of F-150 Lightning at the Rouge Electric Vehicle Centre in Dearborn and the Mustang Mach-E at its Cuautitlan facility in Mexico.

Blink Charging’s subsidiary Blue Corner, a pioneer of EV charging in Europe, signed a four-year agreement with APCOA Parking, Europe’s full-service parking management company, to deploy and maintain its chargers in premium parking sites of APCOA throughout Belgium. APCOA manages more than 1,800,000 parking spaces across 13 countries in different sectors. It also connects parking lots with consumers and their vehicles through its digital platform, APCOA FLOW.

Per the agreement, APCOA will implement a turnkey solution and provide services related to installation, operation, maintenance and customer service. Then again, Blue Corner will provide necessary training, and other logistical and maintenance services to support the availability of its EV charging stations at APCOA parking sites. Olivier Van Schap, MD at Blue Corner, said that the inclusion of EV charging stations in public parking facilities is crucial because it would provide a valuable service to EV drivers at the most desirable places.

In another development, Blink Charging announced a partnership with Catalyst Power Holdings LLC, an integrated provider of cleaner energy solutions for the commercial and industrial sectors. This collaboration aims to offer EV charging services to businesses in the Northeast and Mid-Atlantic regions, expanding Catalyst's existing suite of clean energy solutions. This collaboration positions Blink Charging to capitalize on this burgeoning market, potentially leading to increased revenues and a positive impact on its stock performance.

XPeng introduced its cutting-edge integrated technology architecture, SEPA2.0 (Smart Electric Platform Architecture). This new platform lays the groundwork for the production of future models and is expected to significantly streamline R&D efficiency while catering to diverse customer needs at optimized costs. SEPA2.0-based R&D platform will boost the efficiency of XPeng's in-house full-scenario Advanced Driver Assistance System (ADAS), XNGP, by 30%. At the same time, it will reduce ADAS software model adaptation costs by 70%.

XPeng's Chairman and CEO, He Xiaopeng, envisions that the revolutionary intelligent architecture will lead smart EV technology development for the next three years. This will provide customers with rapid advancements in technology, faster software upgrades, significant cost savings, and an elevated product experience. SEPA2.0 will architecturally empower XPeng in its ongoing quest to redefine the mobility experience with compelling value, superb comfort and rich infotainment.

The versatility of the SEPA2.0 platform will enable XPeng to cater to a wider range of customers with varying needs and preferences. This adaptability is crucial for the company to stay ahead in the rapidly evolving electric vehicle industry. With faster R&D cycles and significant cost savings, XPeng can offer customers more advanced technology at competitive prices, making their vehicles more appealing to a broader market.

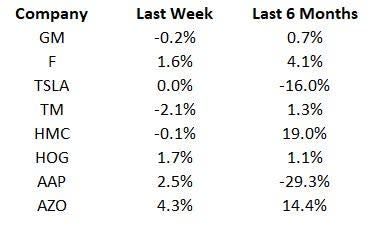

Price Performance

The following table shows the price movement of some of the major auto players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Auto Space?

The first-quarter 2023 earnings season for the auto sector kicks off this week. Investors are keenly awaiting Tesla’s results, set to be released on Wednesday. Other auto stocks like Lithia Motors, Genuine Parts, Autoliv and AutoNation will be reporting this week. Also, industry watchers will keep a tab on March 2023 passenger vehicle registrations to be released by the European Automobile Manufacturers Association soon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

CarMax, Inc. (KMX) : Free Stock Analysis Report

Blink Charging Co. (BLNK) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance