Australia’s most affordable suburbs: Revealed

Australia’s record-low interest rates means there are opportunities to buy affordable homes across all cities, a property expert has said.

The Reserve Bank of Australia cut interest rates to its historical low of 0.25 per cent in March, and there are now signs the central bank will take them to 0.10 per cent in November.

Also read: Will interest rates go up in a recession?

Also read: Get ready for years and years of low interest rates

And according to the co-founder of BuyersBuyers.com.au, Pete Wargent, this is a good thing for buyers who have a “reasonable buffer and a level of employment security”.

“With first homebuyer incentives now in play we expect affordable suburbs to be sharply in focus,” Wargent said.

The CEO of property analytics firm RiskWise, Doron Peleg, agreed, saying that even in cities like Sydney, there are opportunities to be had.

“If you have a long-term strategy you can expect solid capital growth over the next few years,” he said.

“There are many opportunities for buyers looking for houses with high land value as a proportion of the property, and a strong component of scarcity, especially if they intended to hold on to the property for several years or longer.

“In addition, the current ultra-low interest rates have created a unique environment where buying a house in many areas was cheaper than paying rent on one.”

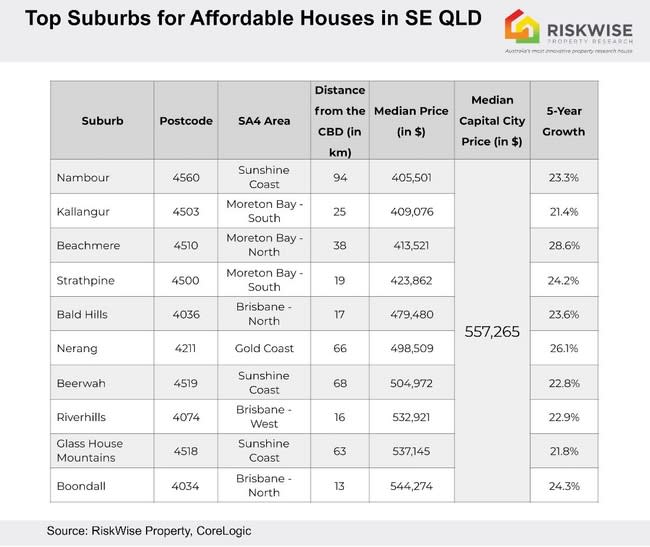

RiskWise analysed CoreLogic data to identify the top suburbs for affordable houses in Australia, based on suburbs that are around 70 per cent of the capital city’s median price with at least 1,000 homes in existing stock.

The property firm also told buyers to be aware that homes on the lower end of the market carry different types of risks.

NSW

In NSW, the Illawarra, Central Coast region and Sydney’s outer west regions offer opportunities, Peleg said, with homes in those regions coming in between $700,000 and $800,000. That’s compared to Sydney’s median house price of $1.01 million.

Peleg said Horningsea Park in Sydney’s south west in particular offers good value, with a median value of $800,000 and 20 per cent price growth over the last five years.

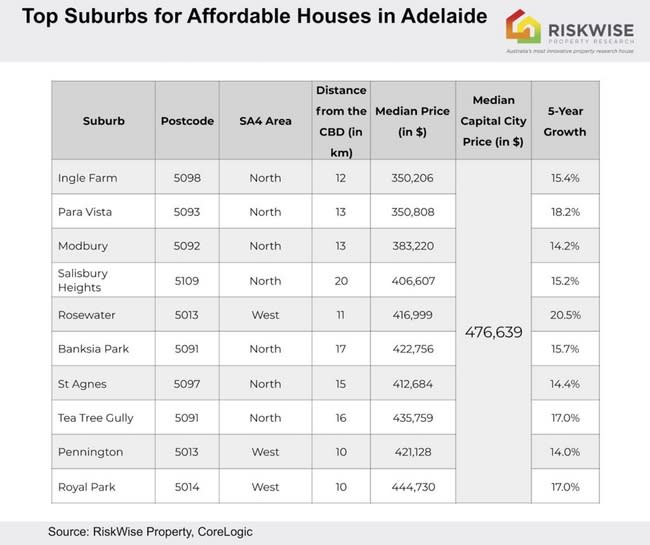

Adelaide

In South Australia, Adelaide North had the highest proportion of affordable homes, with Peleg highlighting the suburb of Willaston.

Willaston has seen five-year capital growth of 10 per cent and has a median price of $330,000 compared to Greater Adelaide’s median price of $476,600.

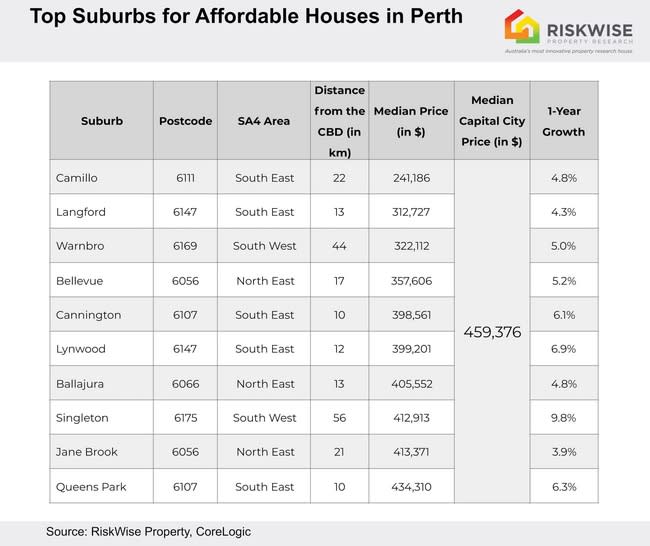

Perth

In Perth, there are 10 suburbs within less than an hour’s drive of the city that have house prices well below the median. Peleg highlighted Camillo, where it is nearly $220,000 cheaper to buy a home, and is located 22km from the city centre.

However, he added: “The Perth market is very much geared towards buyers who want to live there and are prepared to weather low prices due to the slump in the economy.”

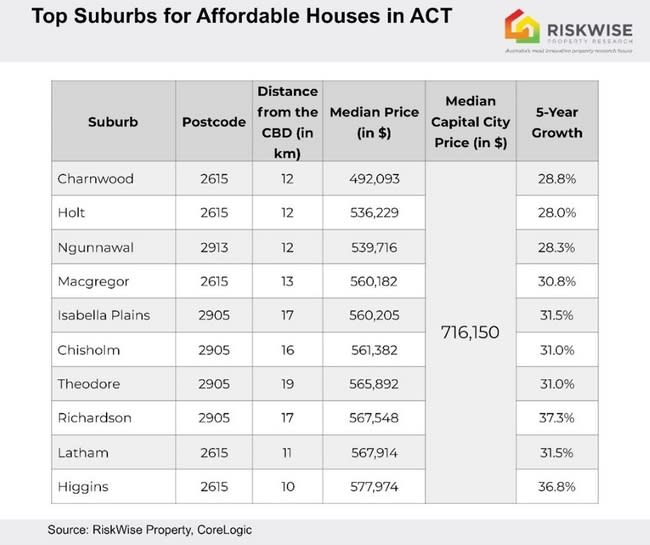

ACT

Canberra’s Charnwood is 12km from the capital city and has posted five-year growth of 28.8 per cent, while offering a median price of $492,093 - significantly lower than Canberra’s median value of $716,150.

“Despite COVID-19, in the ACT, with a median price of $716,000, houses performed strongly,” Peleg said.

“The territory is almost bullet proof for major shocks largely thanks to an extremely robust job market, with most employment linked in some way to the government, and strong economic growth.

“In addition, however, many of these affordable areas achieved between 28 and 37 per cent capital growth over the last five years.”

Hobart

Homes in the Tasmanian capital have seen roaring growth in recent years, but some suburbs still have solid bargains, Peleg said. He pointed to Glenorchy which has seen 74 per cent capital growth in the last five years, while offering a median price of $413,000 - more than $100,000 less than Hobart’s median price.

“Covid-19 has also helped strengthen ‘work from home’ opportunities, meaning owner-occupiers can take advantage of ‘lifestyle’ prospects instead of being tied to employment hubs,” he said.

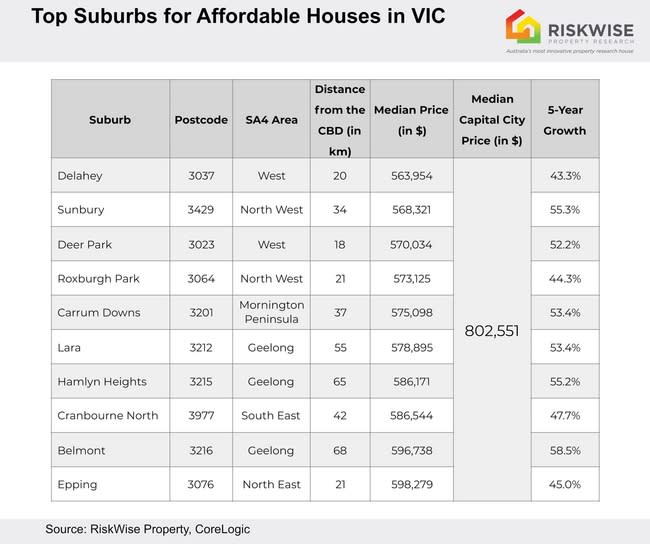

Victoria

In Victoria, there are some small signs of improvement as Melbourne slowly reopens, while the outskirts of the city offer strong value, Peleg said.

“Greater Melbourne has a median price of just over $802,500 and when you compare that to affordable suburbs on the Mornington Peninsula with median house prices in the high $500,000s and that have seen solid capital growth in the past five years (Carrum Downs had 53.4 per cent) and are only 60km or so from the city, you can see the attraction,” he said.

“In fact, both the Morning Peninsula and Geelong are within easy reach of the city and have enjoyed solid capital growth of, on average, around 50 per cent over the last five years. And the Peninsula, in particular, is a drawcard to homebuyers seeking lifestyle options, especially as more people are able to work remotely.”

South-east Queensland

The pandemic increased unemployment in Queensland’s south east amid prolonged border closures. However, Peleg said the associated weaker property market is good news for buyers.

He said buyers should consider Boondall, Bald Hills, Riverhills and Strathpine as affordable suburbs given they have all seen price growth of more than 20 per cent in the last five years and are all located within 20km of the CBD.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance