These Australian property markets will 'boom' in 2019

The property market in Australian regional cities like Launceston could approach “boom conditions” in 2019, provided favourable credit conditions return.

Head of research at property research firm Propertyology, Simon Pressley said Tasmania’s cities and several other regional hubs around the country are set for strong and possibly even double-digit growth in coming years.

But these results won’t be achieved without changes to the current tight credit conditions, he added.

Where should I be looking?

He said there are five capital cities and several major regional hubs with a sunny outlook for 2019, thanks to a combination of market and economic factors.

Adelaide, Canberra, Brisbane, Perth and Hobart could achieve double-digit growth, with Hobart particularly well-placed for property growth.

“Hobart is again a no-brainer as the capital city expected to perform the strongest in 2019,” Pressley said.

“The Tasmanian economy is a remarkable success story that has now spread right across the state. Launceston has the potential to be Australia’s property premier in 2019 while Burnie and Devonport also will perform strongly,” he continued.

“Don’t be fooled by the 2018 price fall of two per cent in Perth because a large proportion of its former oversupply has been absorbed, vacancy rates have reduced from 6.9 per cent to 3.3 per cent over the last two years, and expectations for new job creation is now high.”

In fact, Pressley said Perth could be Australia’s strongest capital city within three years.

But this success depends on a change in credit conditions

Calling on the prudential regulator, APRA and the major banks to bury the hatchet, Pressley said overzealous credit conditions have dragged property prices down 5 – 7 per cent in 2018.

APRA introduced a series of reforms designed to curb excessive investor and interest-only lending over the last four years, as it considered these loans particularly risky.

However limits on the percentage of interest-only and investor loans banks could write were both lifted in 2018, with APRA considering the limits to have served their purpose.

Banks have also been asked to build up their cash reserves to protect against mass defaults or economic challenges.

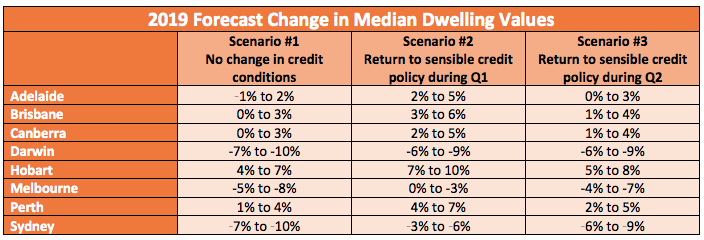

Propertyology considers the policies unnecessarily harmful and warned today that Sydney prices could plummet up to 10 per cent this year if the policies aren’t reconsidered.

Conversely, a return to “sensible credit policy” by the end of March would limit the damage to 6 per cent.

Break it down for me

Pressley said a return to “sensible credit policy” would push Adelaide, Brisbane, Canberra, Hobart and Perth to positive growth and even double-digit results over 2019.

Brisbane and Adelaide could also achieve double-digit annual price growth within three years if credit conditions softened.

“The best opportunities for the foreseeable future are in locations outside of capital cities where housing is more affordable, annual cash flows are stronger, housing supply is tight, and economic conditions are good,” he said.

“As we’ve already seen during the last couple of years, double-digit price growth will occur again in 2019 and beyond in many regional locations.”

What’s happening outside the capital cities?

Western Australia and Queensland could produce the best regional markets in the foreseeable future, thanks to their strong fundamentals.

“We believe that Cairns and the Sunshine Coast have the best fundamentals in Queensland for 2019 but expect big improvement over the next few years from Mackay, Rockhampton, Townsville and Toowoomba,” Pressley said.

Over in WA, Albany, Busselton and Margaret River have the potential to outperform Perth.

And in Victoria, Shepparton, Warrnambool, Bendigo, Ballarat and Bairnsdale show promise.

Why the long face?

Figures from property research group Corelogic revealed yesterday that property values across the country softened 4.8 per cent in 2018.

However, that doesn’t mean markets are in the doldrums, Pressley argued.

“The consensus view is also based on the here-and-now and with an apparent lack of understanding of how underlying fundamentals might shape things just over the horizon,” he said.

“History is littered with masses of people following the consensus when making important property decisions only to subsequently realise that things looked a lot different a year or two later.”

He said there are some clear signs of potential booms as long as people know how and where to look.

These include the national economy performing at its best in years, and an unemployment rate hovering at 5.1 per cent.

Then there’s Treasurer Josh Frydenberg’s promise to return the Federal Budget to surplus this year, and a national population set to grow by more than 350,000 this year.

“There is a long list of big-picture, positive stuff, which collectively paints a very bright future,” Pressley said.

“Believe the doom and gloom reporting if you wish, but I’m telling you that there will be locations that experience a property boom over the next few years.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: 5 reasons why you shouldn’t worry about the property market

Now read: Here’s how your property value changed last year

Now read: 17 things we learnt about the Aussie property market in 2018

Yahoo Finance

Yahoo Finance