Australian universities face a ‘catastrophic China problem’

Certain Australian universities are over-reliant on revenue generated from Chinese students

Nine factors could lead to a “sudden and severe fall” in Chinese enrolments

Major universities are ‘too big to fail’, so the government may step in in the event of a crisis – but taxpayers might end up footing the bill

An academic has sounded the alarm on “massive financial risks” that Australian universities face due to their over-reliance on Chinese students.

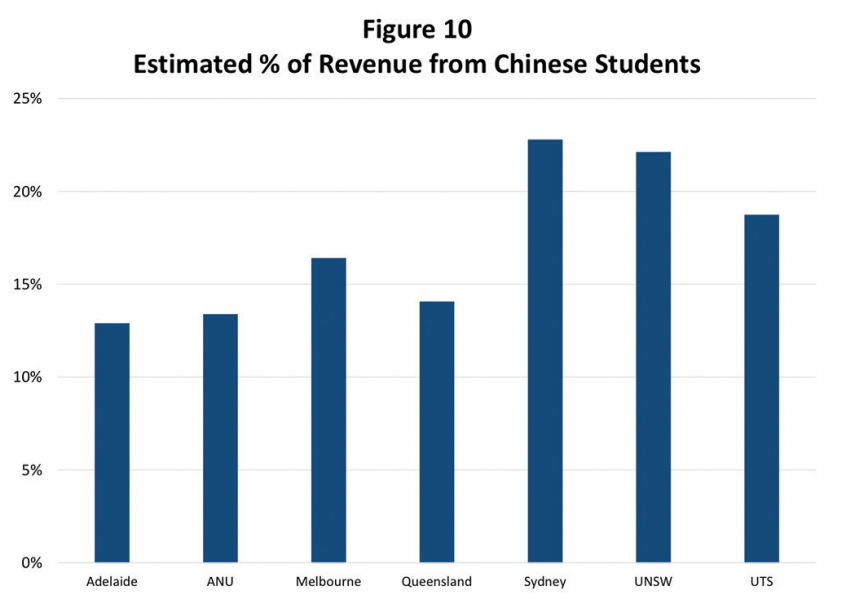

In a paper released today, the Centre for Independent Studies’ adjunct fellow Salvatore Babones said the prosperity of Australian universities was based on “a flood of international student money — Chinese money in particular”.

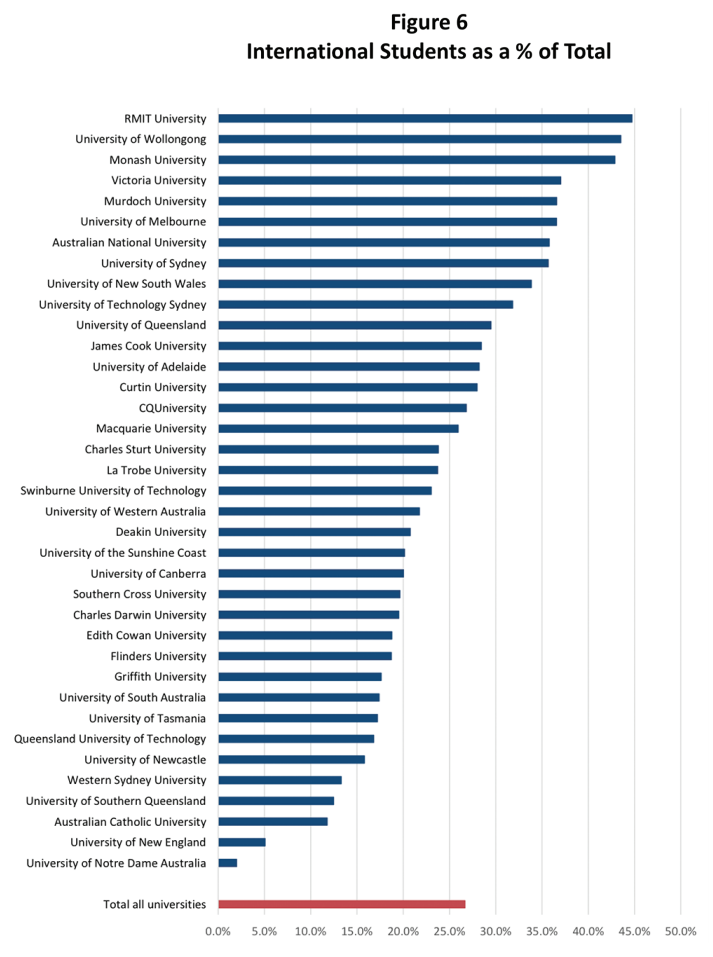

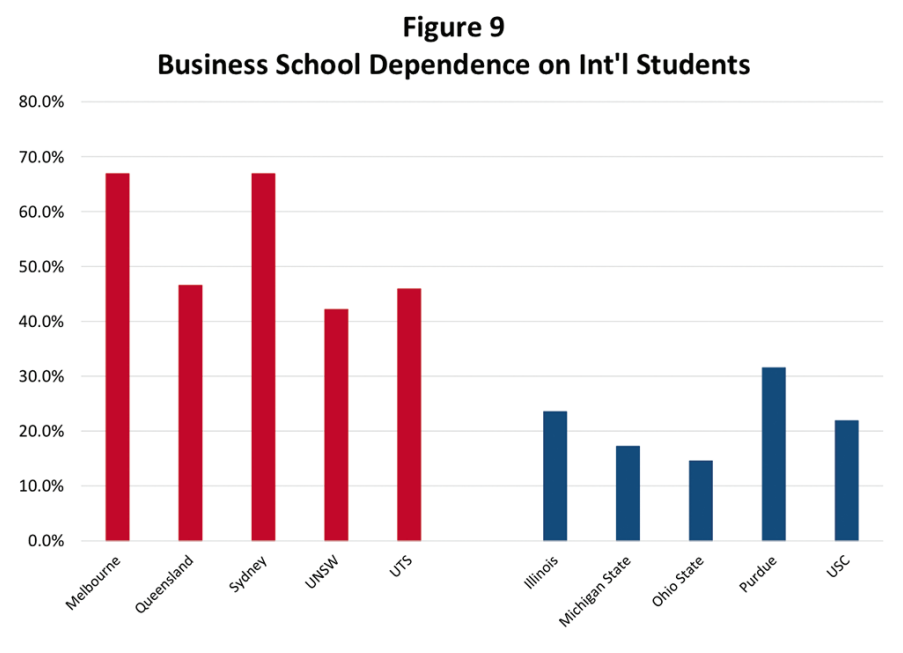

He pointed out that five leading Australian universities – Melbourne, the Australian National University, the University of Sydney, the University of New South Wales, and the University of Technology, Sydney – had an “extraordinary” number of Chinese students enrolled, with international enrolments at these institutions exceeding 30 per cent of the total student body.

Financial risk would be ‘catastrophic’

But such “over-reliance on international students” poses a “profound” and “serious” financial risk.

“At these levels of exposure, even small percentage declines in Chinese student numbers could induce significant financial hardship as universities struggle to meet the fixed costs of infrastructure and permanent staff salaries in the midst of a revenue shortfall,” Babones said.

Related story: These 6 Australia universities are among the top 100 in the world

Related story: Uni or TAFE? Here's which will get you a higher salary

Related story: 6 new university degrees to prepare Aussies for next-gen jobs

High percentage declines could be “catastrophic”, he added: a 25 per cent fall in Chinese student enrolments would hit the annual revenues of USYD, UNSW and probably Melbourne by more than $100 million at each institution.

“A 50 per cent fall — which is plausible if the Chinese government were to impose strict currency controls — would yield a billion-dollar revenue hit.”

Melbourne University, ANU, USYD, UNSW, UTS, Adelaide University and the University of Queensland “may have a ‘China problem’ lurking in fiscal over-reliance on Chinese international students.”

Of the nine factors that could drive a slide in the number of Chinese enrolments, Babones pointed out that the macroeconomic factors had the highest likelihood of prompting a “severe” and “sudden fall”.

The slowdown of China’s economic growth, as well as movements in both the Chinese and Australian currency could all create a sharp drop in Chinese student numbers – and this was a reality that was “no longer located in some remote future”.

“It is now an immediate (though not necessarily imminent) threat that should be addressed sooner rather than later.”

Who’s going to pay?

Babones compared Australian universities overly reliant on Chinese student enrolments with big banks just before the global financial crisis as “probably ‘too big to fail’”.

“As public and publicly accountable institutions, they enjoy an implicit guarantee that if things go wrong, the government will come to the rescue,” he said.

But these leading universities have already borrowed huge sums in anticipation of future revenue.

“Thus, like the CEOs of the big banks in 2008, the vice chancellors of Australia’s big universities are, in effect, betting with other people’s money,” the American sociologist said.

“If their bets on the international student market pay off, they will reap the accolades and justify their outsized pay packages.

“If their bets go sour, Australian taxpayers may in all likelihood pick up the tab.”

And that day may come sooner rather than later, Babones warned.

“Australia’s taxpayers would be well-advised to take note now, and force a change of course before it is too late.”

“[Australian universities] should act now to mitigate the risk of a sudden revenue collapse by raising admissions standards and reducing international student enrolments.”

However, universities have rejected criticism that they were overexposed to Chinese students.

Universities Australia chair Deborah Terry told the ABC that the majority of Australian universities had been assessed by regulators as being in a low-risk financial position.

"As not-for-profit public education institutions, our universities prudently manage taxpayer funds — and have extensive expertise in doing so," Terry said.

"Universities give constant and careful attention to future trends in student recruitment, and nurture diversity within and across regions, as part of their business planning.

"Australian universities maintain very high admissions standards and strong academic rigour — and those high academic standards safeguard quality and attract international students."

Anthony McClaran, the CEO of Australia’s university regulator TEQSA, said they “do occasionally see patterns of over-concentration” of either international students or students from one country.

“In those circumstances we would always recommend diversification where possible,” he told ABC.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance