Australian Dollar Steady as Producer Prices Tick Upward

DailyFX.com -

Talking points

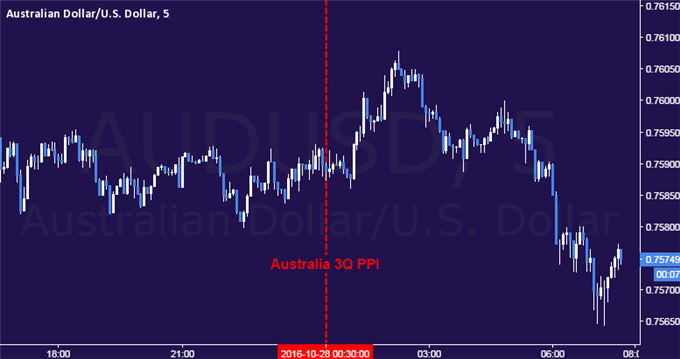

Aussie Dollar unmoved as producer prices post 3rd-quarter gain

PPI rose 0.3% q/q in 3Q versus 0.1% in the three months to June

Already-released CPI numbers have reduced RBA ratecut bets

The Australian Dollar was steady on Friday after the release of official producer price index data for the year’s third quarter.

The PPI increase picked up on the quarter, but annual inflation slowed sharply.

The producer price index (PPI) advanced 0.3% on the quarter, following a 0.1% increase in April-June.

However, on an annualized basis, producer prices rose just 0.5%, compared to 1% in the second quarter.

The increase was mainly thanks to an 11.9% increase in agricultural prices. This offset declines in the prices received for manufacturing products.

The Aussie was unmoved after the release. It bought US$0.75905, exactly as it had shortly before.

Producer price data don’t have the market “glamour appeal” of their consumer price equivalent, as they are usually nowhere near as closely linked to central bank policy setting.

The Australian central bank last cut its key interest rate in August. That took the benchmark lending rate to a record low of 1.5%.

Surprise weakness in the latest Australian employment data spurred an increase in bets that rates could go lower this year.

However the consumer price data released earlier saw those expectations pared back again.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance