Australian Dollar at Standstill as Consumer Sentiment Ebb in Force

THE TAKEWAY: Inflation expectations increased, but at lesser pace > Consumer sentiment appears to have ebb like quality as Europe, China pose risks > Markets quiet, Australian Dollar unchanged

The Australian Dollar was little changed versus the U.S. Dollar as Australian consumers anticipate inflation to ease. The Melbourne Institute reported consumers’ expectations for rising prices increased by 2.4% in August, down from 3.3% rise in expectations in July. Although consumers do expect prices to elevate, the rate of expected increase declined indicating a potential downward shift in sentiment. Furthermore, consumer confidence recently registered declines even as workers earned more. The threat of a potential financial shock in Europe and slowdown in China pose significant risk to Aussie prosperity and appears to be a likely catalyst behind the ebbing change in sentiment.

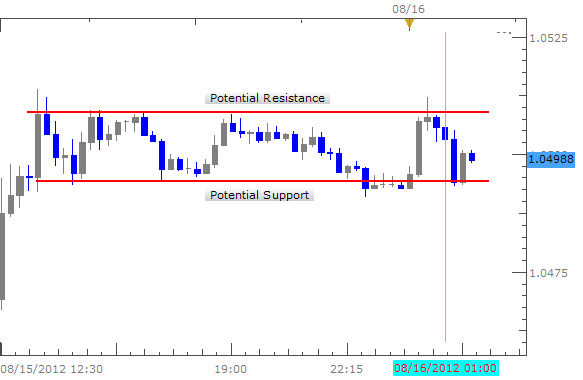

The current market conditions have been extremely quiet this month as average daily ranges, volume and volatility are at yearly and by some measures pre-2008 crisis levels. The Australian Dollar is a high yielding and thus high risk investment. Often, when markets become volatile investors prefer to hold more liquid, low risk investments like the U.S. Dollar.

AUD/USD, 15 Minute Chart

Yahoo Finance

Yahoo Finance