Australian Dollar Likely to Decline until this Changes

DailyFX.com -

View Real-Time SSI Updates via the FXCM Trading Station Desktop

See a video on why we use the Speculative Sentiment Index as a contrarian indicator in our trading

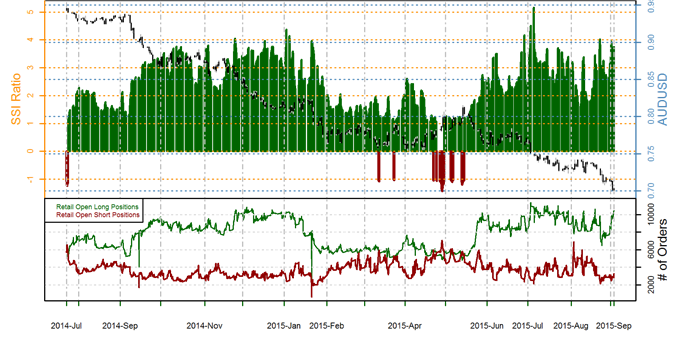

AUDUSD – Aggressively one-sided retail forex trader sentiment warns that the Australian Dollar may continue onto fresh lows versus its US namesake. Indeed our trader sample shows that total open long orders outnumber those short by 3 to 1, and a contrarian view of crowd sentiment leaves us firmly in favor of selling into AUD losses.

Positioning most recently turned net-long the Australian Dollar as the pair crossed below the $0.80 mark in May. As long as that remains the case we see little reason to shift from our long-standing bearish trading bias.

See next currency section:NZDUSD - New Zealand Dollar Forecast to Decline Further

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance