Australia, we’re in an ‘income recession’: Here’s what that means

Australia, we have a problem – and it’s time to face the music.

We’ve avoided a recession for three decades – but what we have to show for it is “anaemic” wages growth while costs of living have soared, according to a new report by the Australian Council of Trade Unions (ACTU).

“Workers have been trying to stretch a static pay packet to cover rising energy bills, childcare costs, medical expenses and other necessities of life,” the report said.

“The battle to make-ends-meet has become an ongoing nightmare for most working families.”

One-two punch

Weak wages growth has delivered a heavy one-two punch.

In the three months to December, ABS statistics show Australian wages grew at a dreary 0.5 per cent, which fell slightly below expectations of 0.6 per cent.

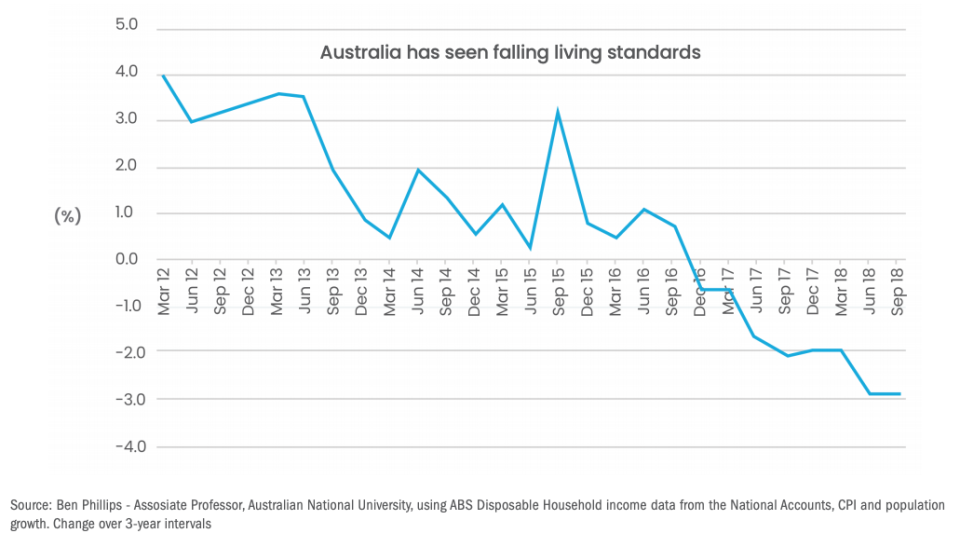

Meanwhile, living costs outstripped household incomes by 2.9 per cent across the last three years, which has sent us into the “biggest fall” in standards of living we’ve seen in thirty years.

Put another way, our standards of living are now so bad that it’s worse than the 1991-92 recession.

According to the ACTU, we’ve now found ourselves in an “income recession”.

“Using wages and salaries data from the national accounts we can see that this has been slowest and most sustained period for most of Australia’s post second world war history.”

An easy ride – for some

However, in 2016-17 alone, the number of billionaires in Australia increased by 26 percent to 43.

And at the same time, the plump paypackets of corporate executives and company CEOs have proven themselves unwarranted and not earned by merit, if the revelations of the banking Royal Commission have been anything to go by.

To illustrate the widening income inequality gap, the report pointed out that the average ASX200 CEO was paid the salary of an average worker every 4.6 days.

“In many cases extremely high executive salaries and bonus do not reflect the higher intelligence, greater productivity or hard work of the beneficiaries but rather their ability to manipulate people and extract rents. Sometimes through extremely corrupt practices,” the report said.

Scandals throughout corporate Australia

And these scandals are by no means limited to the finance sector – they’re rife throughout corporate Australia, and Aussies have become discouraged.

“They realise that no matter how hard, or how long, they work they will not get ahead.”

“Unfortunately, Australia is increasingly becoming a country in which it is ‘who you know and not what you know’ that determines your salary and standard of living.”

ACTU secretary Sally McManus said working Aussies needed “fair pay” and “good, secure jobs” to maintain good standards of living.

“Right now people are struggling to maintain their living standards while corporations make bumper profits and CEOs take sickeningly large salaries and bonuses.

“We need to re-balance our system so that people can negotiate fair pay rises and get a fair share of the wealth their work produces,” she said.

Yahoo Finance

Yahoo Finance