Australia has a 'once in a generation opportunity' to become a major battery hub

Booming global demand for lithium-ion batteries gives Australia a “once in a generation” opportunity to become a major battery processing, manufacturing and trading hub – but it needs to get a move on.

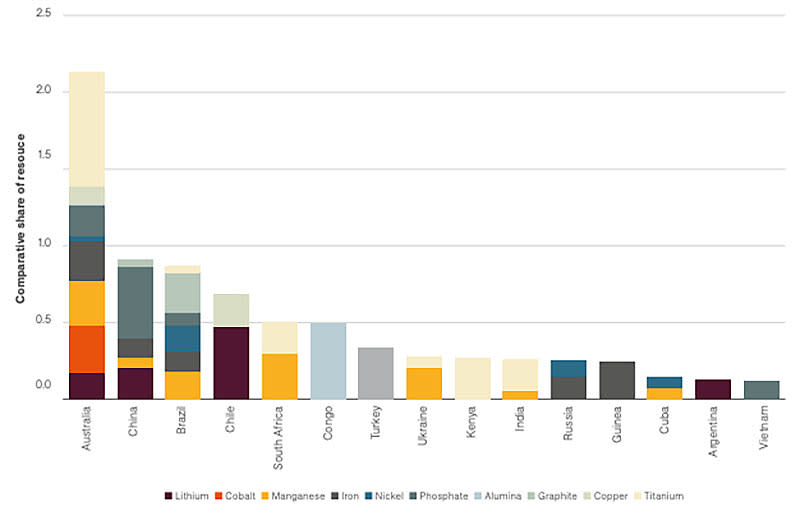

A new Australian Trade and Investment Commission (Austrade) report adds to the growing stack of analysis which shows Australia has all the raw materials needed to produce batteries.

This potentially gives the country “significant global supply-chain advantages”, the report says.

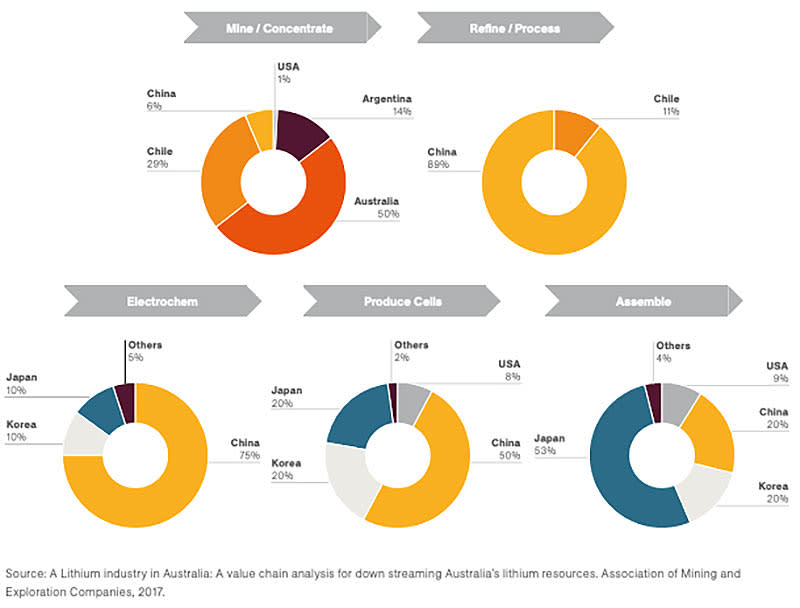

According to Future Smart Strategies, Australia earns only $1.13 billion, or 0.53 per cent of ultimate value of its exported lithium ore.

An estimated $213 billion of value is added overseas through electro-chemical processing, battery cell production, and product assembly.

The Austrade report says critical components in advanced battery production — precursor, anode, cathode, electrolyte — can be made here.

But the critical gap in the supply chain is Australia’s lack of battery manufacturing technology – which is why we need one of the world’s big battery cell manufacturers to set up shop Down Under.

AMEC chief Warren Pearce says Austrade will play a crucial role in attracting international companies with battery technology in order to support a move down the battery minerals value chain.

“If we were to realise this opportunity it could reshape the entire Australian economy, providing jobs, economic diversification and leadership in a critical future technology,” he says.

“It is a timely report and a call to action for Australia. It clearly spells out the opportunity and Australia can seize it.”

Attracting investment from the big battery makers

Austrade believes Australia needs to attract investment and technology transfer from existing lithium-ion battery manufacturers to develop “the required level of capability”.

It reckons we need to do this through incentives.

South Korean, Japanese, and now Chinese companies – such as Panasonic, BYD, LG Chem, and Samsung SDI — dominate the lithium-ion battery manufacturing space.

The US and several European countries have recently started to upscale their lithium-ion battery manufacturing capacity in response to increased demand for EVs.

Austrade says the Tesla/Panasonic integrated ‘Gigafactory’ in Reno, Nevada was secured in 2014 through incentives worth $US1.3 billion.

These included multi-year exemptions on various taxes, transferable tax credits up to $US195 million, discounts on power, and infrastructure support.

This article first appeared at Stockhead, Australia’s leading news source for emerging ASX-listed companies. Read the original article here. Follow Stockhead on Facebook or Twitter.

Yahoo Finance

Yahoo Finance