Aussies hit with $1,863 each in debt

After the Christmas gifts are bought and unwrapped, the lunches eaten and parties thrown, here’s the harsh reality: the silly season has left Aussies a staggering $30 billion in debt.

The nation borrowed approximately $29.7 billion on credit cards in the month of December alone, according to analysis by Finder.com.au of Reserve Bank of Australia data.

Per person, that is $1,863 in purchases put on the credit card.

Australia’s personal debt is one of the largest in the world.

What’s more, our spending is increasing. We spent $1.8 billion more last month than we did in December 2017 ($27.9 billion), and five years ago we spent under $25 billion.

Our spending has consequences: the near-$30 billion debt will cost us $237 million in interest alone, based on an average 55-day interest-free period.

Finder.com.au insights manager Graham Cooke said December was the biggest month of credit card spending for Aussies than any other month.

“This over-reliance on credit cards in December means the cost of Christmas is carried well into the new year and could take a toll on household budgets throughout 2019,” he said.

Furthermore, our spending is driving a lot of us to mental health issues and putting stress on financial counsellors. But the problem is, too many of us are in debt – and the counsellor services aren’t coping.

How do we fix this $30 billion hole?

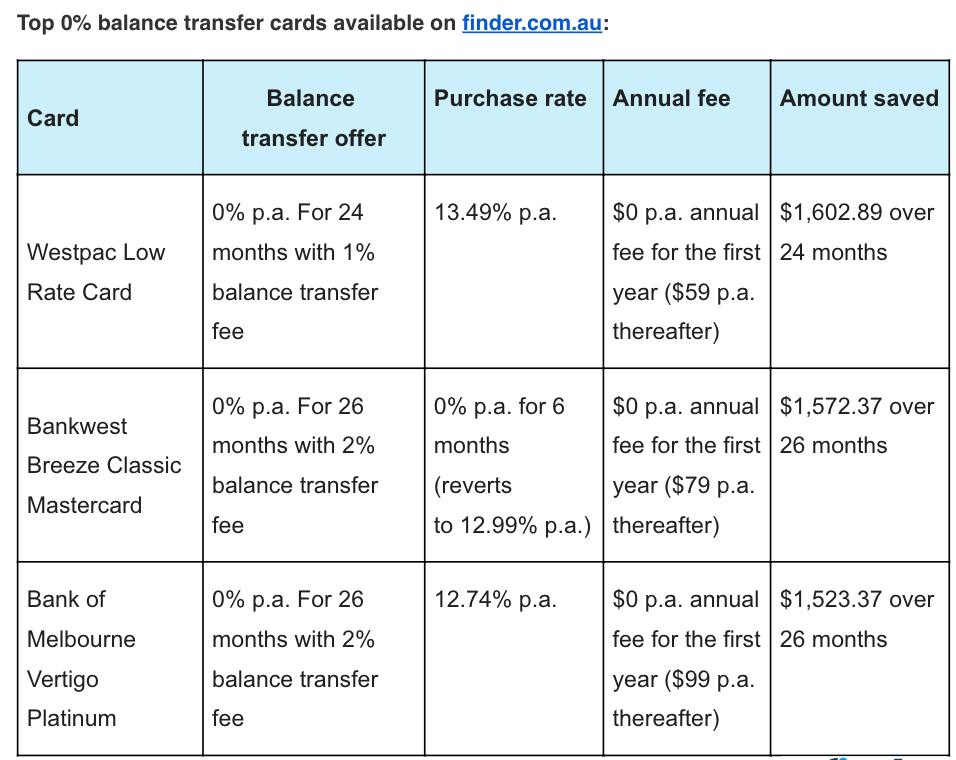

If you’re not quite ready yet to completely ditch your credit card, Cooke recommends switching to a zero per cent balance transfer card in order to minimise the damage.

“There are currently over one hundred balance transfer cards offering zero per cent introductory rates on transfers, and most banks offer a product with this feature,” he said.

“The interest free period varies, but more than half of the balance transfer cards on the market will give you a whole year or more interest free if you transfer your balance.”

But this isn’t an excuse to ignore your debt, Cooke warned: the flipside to zero per cent balance transfer cards is that they often have higher purchase rates than other cards.

“So it’s important that you commit to paying off all your debt in the interest-free period, and resist the urge to spend beyond your means.”

These are Finder.com.au’s top three zero per cent balance transfer cards:

But it’s not all bad news – there are signs we’re getting better at paying off our debt. The average credit card balance has fallen from $2,470 more than six years ago to $1,984 at the end of 2018.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Read next: Caught in a debt trap? Here’s 8 things you can do

Yahoo Finance

Yahoo Finance