Aussie tech firm’s crash ‘one of the worst’

A Melbourne tech firm in the midst of investigating where a missing $30mn went has resumed trading from a six-week hiatus to plummet to its lowest share price in 10 years.

Cloud-based telco call recording firm Dubber has been rocked in recent months, as its co-founder and chief executive was stood down and then sacked after $30m in a third-party term deposit went missing.

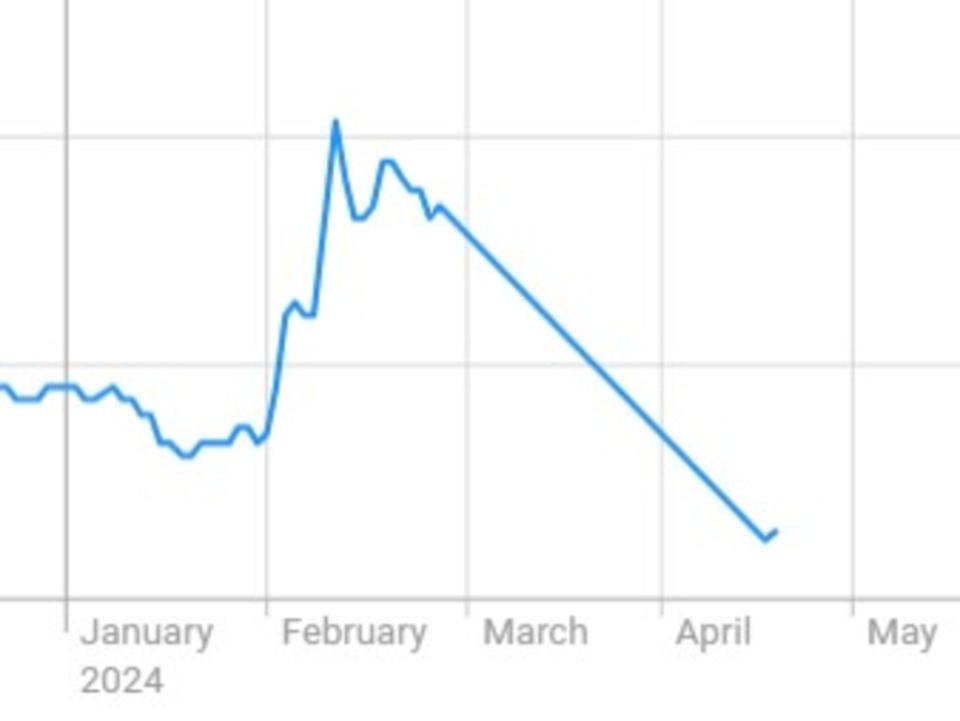

The company went into a trading halt in late February at $0.135. The stock resumed trading on Wednesday but closed at $0.061.

The drop represents about $42.3m being wiped from the company’s value.

Sky News business editor Ross Greenwood called it “one of the worst share price falls in the history of the ASX”.

Issues at Dubber emerged when an audit found $30m supposedly being held by Christopher William Legal in a term deposit was missing. Dubber chief executive and co-founder Steve McGovern was then suspended.

Last month, Dubber told the ASX that about $3.4m had been recovered, with $26.6m outstanding.

“From the investigation conducted to date, it is alleged that Mr McGovern and the trustee were likely involved in the unauthorised use of those funds, including for purposes which were not for the company’s benefit,” the company announced last week as it sacked Mr McGovern.

ASIC and Dubber are running their own investigations.

The financial regulator sought, and the courts granted, a ban on Mr McGovern and Christopher William Legal principal Mark Madafferi from leaving the country.

Mr Madafferi’s legal representatives declined to comment. Mr McGovern’s counsel did not respond.

Dubber’s share price had risen about 13 per cent to $0.069 halfway through trading on Thursday.

Yahoo Finance

Yahoo Finance