Here's when Aussie property could reach new record highs

Australia’s housing market could hit new record highs in just six months if current rates of growth continue, a property research firm has revealed.

Related story: Sydney homes are worth $448 more every day in new boom

Related story: Property expert’s top 20 suburbs

Related story: Interest rate decision: Reserve Bank of Australia delivers verdict

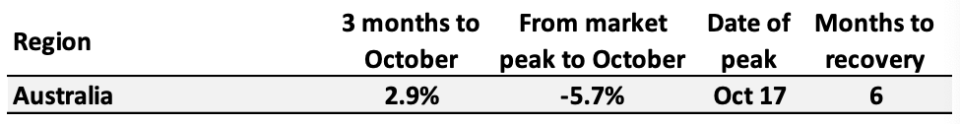

As it stands, national dwelling values are 5.7 per cent below their peak as of the end of October, but with prices rising by 2.9 per cent over the last quarter, it would only take another six months for prices to eclipse previous records, CoreLogic analysis has confirmed.

“A recovery in the housing market should help to provide some support for Australian economic conditions, boosting household wealth which will potentially lead to improved confidence and a greater willingness from households to spend, while also supporting the residential building and development sector where dwelling approvals have tanked,” CoreLogic head of research Tim Lawless said.

“On the flipside, for non-home owners, a recovery in housing values implies the affordability dividends provided by the recent housing downturn are now a thing of the past.

“With housing values rising rapidly in some areas, we could see less first home buyer participation in the market as affordability pressures start to dampen activity across this important sector of the market.”

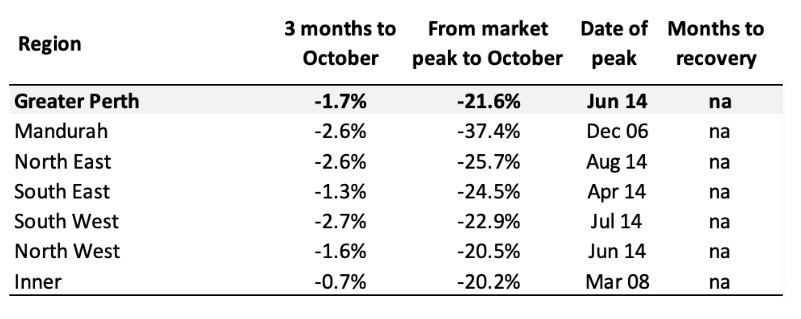

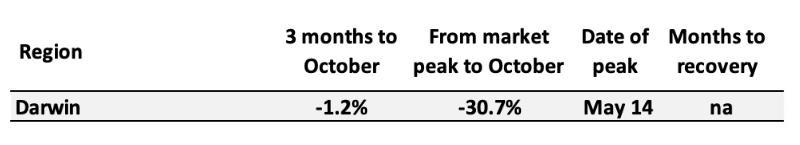

In the last quarter, all capital cities bar Perth and Darwin saw positive growth. Hobart and Canberra are also in a strong position, with both having recorded only slight corrections of 1.3 per cent and 1.5 per cent.

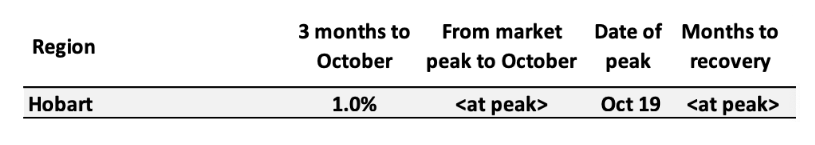

Hobart reached its record high in October 2019, while Canberra has continued moving to new records since September 2019.

Melbourne to reach new record first

At its current rate of growth, Melbourne’s housing market could reach a new peak by January 2020.

“During the correction, Melbourne housing values fell by 11.1 per cent from peak to trough and remained 5.8 per cent below their peak in October. Dwelling values across Melbourne’s Inner precinct were only 1.5 per cent below their peak in October, and this subregion is on track to set a new valuation benchmark by the end of November; the earliest of any of Melbourne’s sub-regions,” Lawless said.

But on the other end of the spectrum, Melbourne’s Mornington Peninsula region will take another 12 months to reach a new peak.

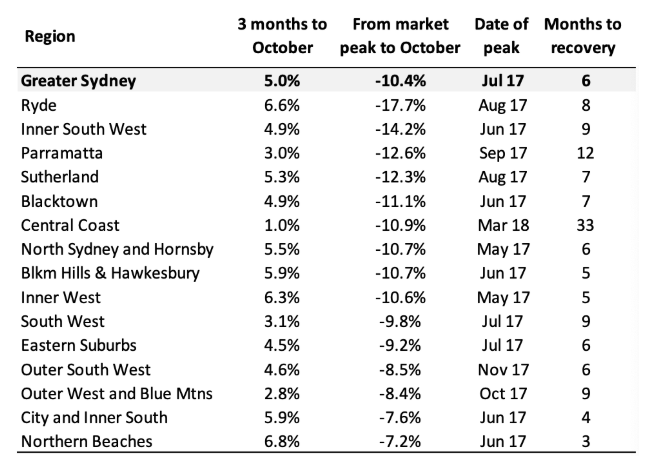

Sydney will take six months

Sydney’s market is “on track” for a full recovery in six months.

“Housing values are trending higher rapidly, up 5.0 per cent over the past three months, however the correction was more substantial across Sydney, with housing values falling by 14.9 per cent from peak to trough. Sydney dwelling values remained 10.4 per cent below their 2017 peak at the end of last month.”

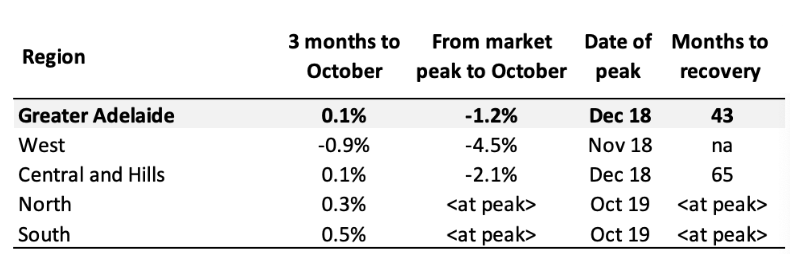

But Adelaide will need 43 months to recover

Adelaide house values are growing at just 0.1 per cent per quarter, with prices down 1.2 per cent since their last peak.

“Such a sluggish rate of appreciation is likely to see a prolonged recovery phase,” Lawless said.

“Despite what looks to be a long recovery period, two of Adelaide’s sub-regions have already reached new record housing values. Both the North and South of Adelaide posted a new record high for housing values in October this year.”

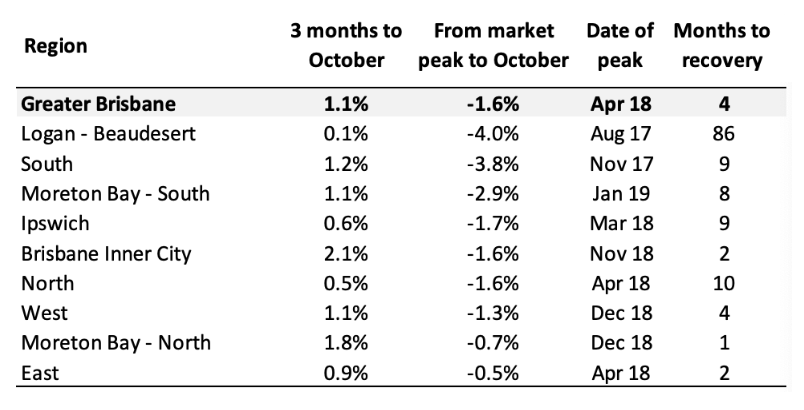

Brisbane only needs four months

Up north, Brisbane values will take only four months due to the shallow correction.

There, values fell 2.9 per cent from peak to trough, and in the last quarter grew 1.1 per cent.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance