Hoping for a quick property recovery? Get used to disappointment

Australia’s property market continues to stabilise, with the latest monthly figures revealing only three capital cities falling in value.

But while these are positive signs, any Australians hoping for the market to recover as quickly as it fell shouldn’t hold their breath, CoreLogic head of research Tim Lawless said.

Related story: 11 tips to make a fortune in the property market

Related story: These homes were hit hardest in the recent property downturn

Related story: Capital city suburbs where prices are tipped to soar 25% in three years

“There is no sign of a ‘v-shaped’ recovery,” Lawless said.

A combination of tighter housing credit policies and comprehensive credit reporting will offset any improvement in credit availability, Lawless said.

“The ongoing tightness in housing credit is expected to keep a rapid rebound in housing values at bay, despite the lowest mortgage rates since the 1950s.

“No doubt policy makers will be keeping a close eye for signs of investor exuberance, or a more rapid acceleration in the recovery trend.

“If values were to start appreciating rapidly, there could be a renewed round of policy responses aimed at keeping a lid on housing prices whilst at the same time, allowing low interest rates to stimulate the economy more broadly.”

What happened to Australian property in July?

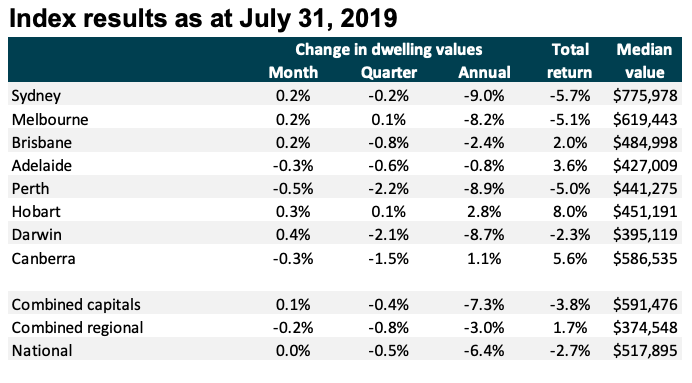

Sydney values increased by 0.2 per cent, following its first increase in months in June. The same occurred in Melbourne, where prices grew by 0.2 per cent.

Brisbane, Hobart and Darwin also recorded slight increases in property values, up 0.2 per cent, 0.3 per cent and 0.4 per cent respectively.

“The stabilisation in housing values is becoming more broadly based, with five of the eight capital cities recording a subtle rise in values over the month, while the regional areas of South Australia, Tasmania and Northern Territory also recorded a lift in housing values in July,” Lawless said, pointing to successive interest rate cuts and improved housing market confidence in the wake of the federal election as factors.

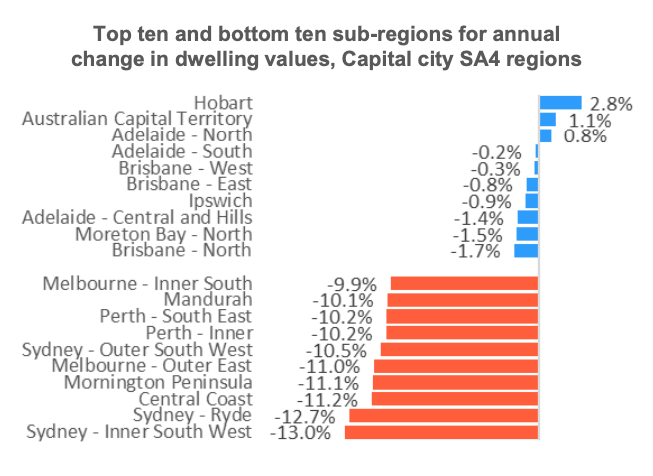

Looking more closely at the capital city sub-regions, only Hobart, the ACT and north Adelaide recorded positive value increases in the year to date, meaning seven of the top 10 performing city sub-regions are recording negative growth.

Inner south-west Sydney and Ryde are the worst-performing city sub-regions, down 13.0 per cent and 12.7 per cent respectively.

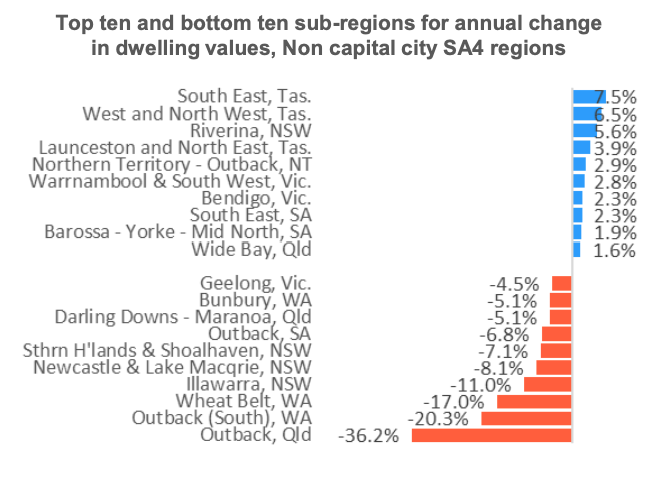

Outside of the capital cities, south east Tasmania is leading the growth, up 7.5 per cent in the year to date, followed by the west and north west Tasmanian regions, where prices are up 5.6 per cent.

At the other end of the spectrum, homeowners in the southern outback region in Western Australian and in outback Queensland have seen the worst property changes, down 20.3 per cent and 36.2 per cent respectively.

By and large, however, the results show that the housing market is responding positively to the two recent interest rate cuts, Lawless said.

“However, the response to-date has been relatively mild.”

The Reserve Bank of Australia will deliver its interest rate verdict for August coming Tuesday 6 August.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance