Aussie economy downcast while the US is set to surge

While economic news from the US is bringing Christmas cheer to investors, the story in Australia isn’t looking so positive.

“Despite a rather rocky year, the US looks like it is going to finish the year on a relative high,” says David Bryant, chief investment officer at Australian Unity Wealth.

“The fact that the Federal Reserve raised interest rates is a sign of ongoing confidence and strength in their economy, it’s the forward projections that are of most interest.

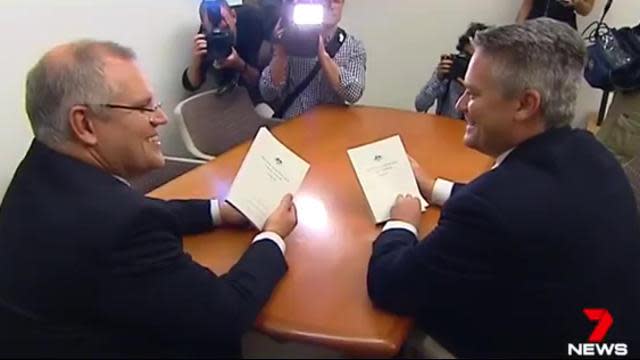

Also read: Zombies, but no horror in budget update

“It’s now likely that there will be three rate rises in the US in 2017, which should help stimulate the economy and boost consumer and business confidence.

“Investors in the US and global assets will be well-placed to benefit from this.

The rate rises will also affect the Australian dollar which will bring mixed blessings for local businesses and investors, as higher US rates mean a lower AUD, so capital will flow to the US, Bryant points out.

“Imports will be more expensive, and inflation higher, but our exports will be more competitive.”

In fact, in terms of the local economy, Australia certainly needs a lot more good news.

“There hasn’t been a lot of good tidings domestically this Christmas season. The GDP numbers last week were very poor at minus 0.5 percent and broadly weak,” he said.

“The unemployment figures are also sobering, seemingly stuck in the high five percent range, while consumer confidence has fallen almost four percent in the last quarter.”

And if that isn’t bad enough, there is even concern that the country’s prized triple-A credit rating is under threat, which would mean higher borrowing costs for Australia – and Australians.

“We’re already starting to see this come through in interest rates, with many banks already starting to increase their rates, as funding costs for overseas capital start to increase,” Bryant said.

“Rates are now out of the hands of the Reserve Bank of Australia - it has lowered rates about as far as it realistically can, without having the desired result, and there is little room to manoeuvre from here.”

Silver lining ahead?

But despite all this doom and gloom, there does look to be some positive news ahead for the Aussie economy.

“The fact that the US - still a key driver of global growth - is strengthening and building confidence, it will ultimately have a knock-on effect in Australia,” Bryant said.

Also read: MYEFO 'underwhelming': Vic treasurer

“I would expect that during 2017, we may see improved conditions domestically but investors should remain focused on their long term investment strategy and not become distracted by market noise.”

“A sensible strategy right now is to ensure good diversification with a mix of currently low returning but secure fixed interest investments with higher yielding investments in other asset classes, including domestic and international shares, and property,” Bryant said.

Yahoo Finance

Yahoo Finance