AUDNZD Scalps Targets Key Inflection Range - 1.1020 Critical Support

DailyFX.com -

Talking Points

AUDNZD weekly opening range takes shape above key support

Major inflection zone at 1.1020/35

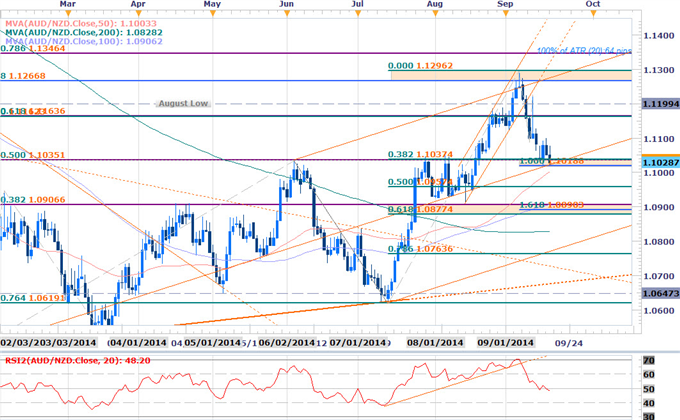

AUD/NZD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

AUDNZD at key support zone 1.1020/35- bullish invalidation

Support break targets objectives at 1.0957, 1.0878-1.0906, 1.0826

Resistance at weekly opening range high / Fibonacci confluence 1.1100

Breach targets 1.1160, 1.1200, 1.1267/96- bearish invalidation

Daily RSI straddling 50- neutral

Look for momentum rebound ahead of 40 to remain constructive

Limited event risk heading into weekend.

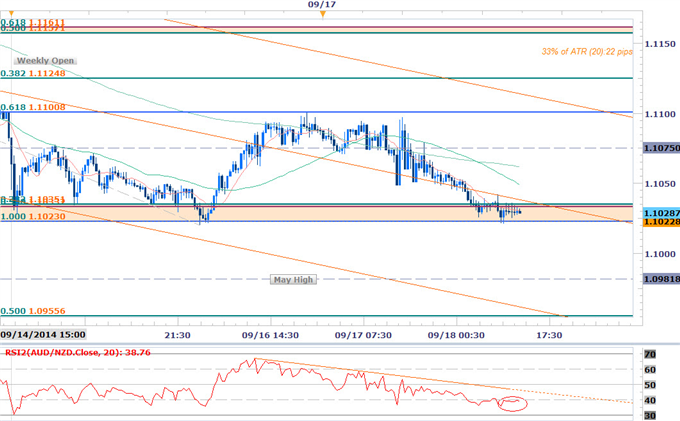

AUD/NZD 30min Chart

Notes: The AUDNZD has been trading within a well-defined Andrew’s Pitchfork off the September high with the weekly opening range taking shape just above a key infection region at 1.2023/35. Note that within this support zone rests the bisector of a broader ascending pitchfork formation off the 2014 low and as such, we will reserve this threshold as our near-term bullish invalidation level. The Sunday gap-open has been filled and the play here is a break out of the gap-range which is define by 1.1022 – 1.1100.

Bottom line: looking for a break of the weekly opening range with our near-term bias favoring buying dips while above 1.1022/35 with a breach above 1.11 offering further conviction for long-side exposure. Note that the average true range has remained rather tight here so we’ll increase the profit targets to 1/3 of the daily ATR- this puts us at approximately 22pips per scalp.Event risk is limited heading into the weekend and we’ll look for broader market sentiment for guidance. Follow the progress of this trade setup and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

Entry/Exit Targets | Timeframe | Level | Technical Relevance |

Resistance Target 1 | 30min | 1.1075 | Soft Resistance / Pivot |

Bearish Invalidation | Daily / 30min | 1.1100 | Weekly ORH / 61.8% Ext |

Break Target 1 | 30min | 1.1125 | 38.2% Retracement |

Break Target 2 | Daily / 30min | 1.1157/63 | 100% Ext / 50% & 61.8% Retracement(s) |

Break Target 3 | Daily / 30min | 1.1190/99 | August Low / 61.8% Retracement |

Break Target 4 | 30min | 1.1235 | 78.6% Retracement |

Break Target 5 | Daily / 30min | 1.1263/66 | 1.618% Ext / 88.6% Retracement |

Bullish Invalidation | Daily / 30min | 1.1023/35 | 100% Ext / 38.2% & 50% Retracement(s) |

Break Target 1 | Daily / 30min | 1.10 | S1 Monthly / 50DMA |

Break Target 2 | 30min | 1.0982 | May High / Soft Support |

Break Target 3 | Daily / 30min | 1.0955/57 | 50% Retracement |

Break Target 4 | 30min | 1.0925 | August Close Low / S2 Monthly |

Break Target 5 | Daily | 1.0878- 1.0906 | 38.2% & 61.8% Retrace(s) / 1.618% Ext / 100DMA |

Daily (20) | 64 | Profit Targets 19-22pips | |

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

AUDJPY Outside Reversal Day- Scalps Favor Buying Dips Above 96.38

EURUSD Short Bias at Risk Ahead of FOMC- 1.29 Bullish Invalidation

AUDCHF Monthly Opening Range Setup- Scalps Target Key Support

AUDUSD Scalps Target Head and Shoulders Break- Bearish Sub 9236

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars next week Tuesday – Thursday on DailyFX Plus (Exclusive of Live Clients) at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance