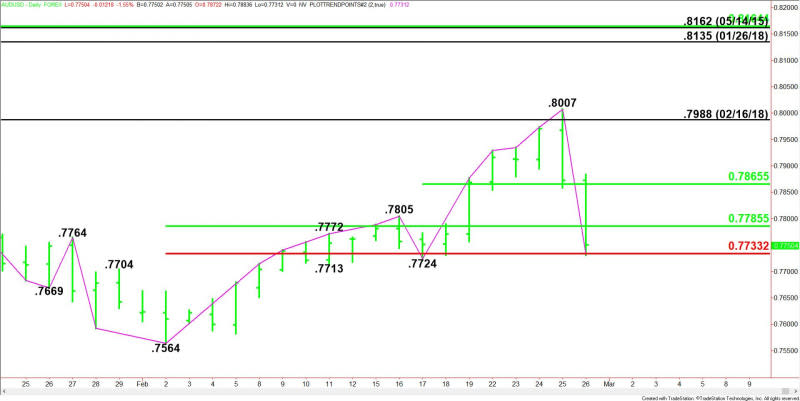

AUD/USD Forex Technical Analysis – Strengthens Over .7786, Weakens Under .7733

The Australian Dollar continued to retreat on Friday after topping .8000 the previous session for the first time since February 2018 as the U.S. Dollar sharply, lifted by an increase in U.S. bond yields overnight.

Government bonds, and particularly U.S. Treasuries, have become the focal point of markets globally. Traders are moving aggressively out of higher risk currencies that have benefited from a low-interest rate environment, as they price in earlier monetary tightening than the Federal Reserve and other central banks have signaled.

At 12:21 GMT, the AUD/USD is trading .7750, down .0122 or -1.55%.

Daily Swing Chart Technical Analysis

The main trend is up according to the daily swing chart, however, momentum shifted to the downside on Thursday with the formation of a closing price reversal top. A trade through .7724 will change the main trend to down. A move through .8007 will reaffirm the uptrend.

The minor range is .7724 to .8007. Its 50% level at .7866 is resistance. Trading on the weak side of this level is helping to generate the downside bias.

The short-term range is .7564 to .8007. The AUD/USD is currently testing its retracement zone at .7786 to .7733. Since the main trend is up, buyers could come in on a test of this area.

Daily Swing Chart Technical Forecast

The direction on Friday is likely to be determined by trader reaction to the 50% level at .7786 and the 61.8% level at .7733.

Bullish Scenario

A sustained move over .7786 will indicate the presence of buyers. If this move generates enough upside momentum then look for the rally to possibly extend into .7766.

Bearish Scenario

A sustained move under .7733 will signal the presence of sellers. This is followed by a main bottom at .7724 and a minor bottom at .7713. Taking out the minor bottom could trigger an acceleration to the downside. The daily chart indicates there is plenty of room to break with .7564 the next major target.

Side Notes

The AUD/USD formed a closing price reversal top on Thursday. The potentially bearish chart pattern was confirmed early Friday. This could trigger the start of a 2 to 3 day correction.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance