AUD/USD Forex Technical Analysis – .6706 – .6718 Upside Target Ahead of Employment Reports

The Australian Dollar is edging higher on Wednesday on short-covering amid signs China was looking to fend off economic threats from the coronavirus, which supported investor confidence as the outbreak’s spread appeared to slow.

China posted the lowest daily rise in new infections since January 29, seen by some investors as an indication containment efforts were working, Reuters reported.

Meanwhile, a Bloomberg report, citing sources, that China is considering cash injections or mergers to bail out airlines hit by the virus also supported for risk.

Helping to put a lid on the Aussie is a weaker Chinese Yuan. It touched a two-week low after the central bank fixed a softer-than-expected trading band, and as investors expected further monetary easing.

At 09:08 GMT, the AUD/USD is trading .6702, up 0.0014 or +0.21%.

Daily Technical Analysis

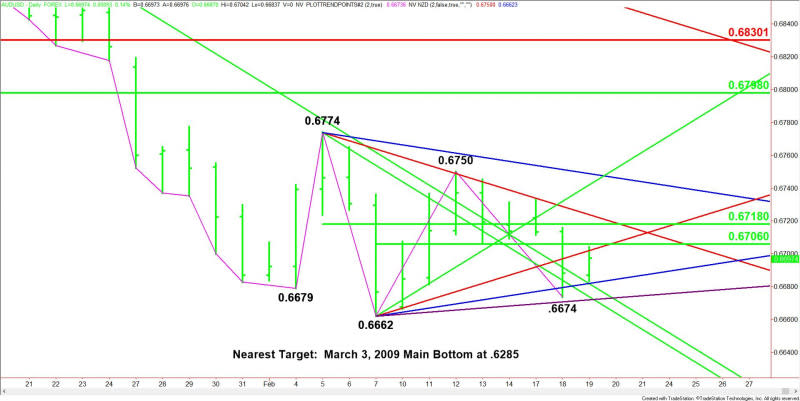

The main trend is down according to the daily swing chart. The main trend will change to up on a trade through .6750. A move through .6674 will indicate the selling is getting stronger. Taking out .6662 will signal a resumption of the downtrend.

The first minor range is .6662 to .6750. Its 50% level at .6706 is the first upside target.

The short-term range is .6774 to .6662. Its 50% level at .6718 is a second upside target.

Daily Technical Forecast

Based on the early price action and the current price at .6702, the direction of the AUD/USD the rest of the session on Wednesday is likely to be determined by trader reaction to the pivot at .6706 and an uptrending Gann angle at .6702.

Bullish Scenario

A sustained move over .6706 will indicate the buying is getting stronger. This could trigger a rally into the second 50% level at .6718 and a downtrending Gann angle at .6724. The latter is a potential trigger point for an acceleration to the upside.

Bearish Scenario

A sustained move under .6702 will signal the presence of sellers. This could lead to a retest of the uptrending Gann angle at .6682.

Side Notes

Traders could tighten up later in the session ahead of Thursday’s release of the Australian Employment Change and Unemployment Rate reports. The Employment Change report is expected to show the economy added 10K jobs in January. The Unemployment Rate is expected to inch up to 5.2%.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance